Smash ES Plan | November 14, 2022

Daily and weekly one time framing up after last week's strong directional move. Unfinished business at both extremes on Friday's profile.

Recap & Plan

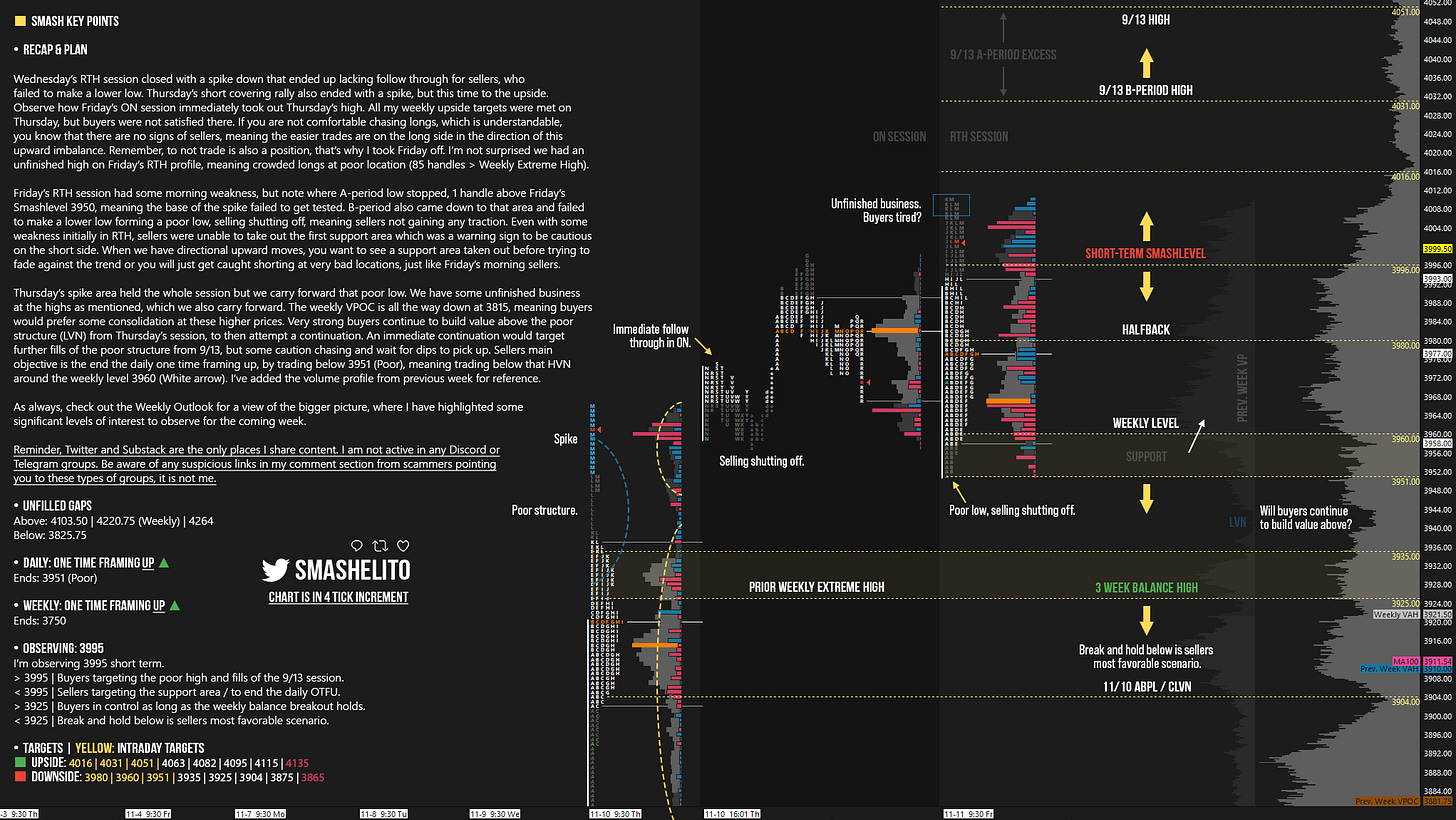

Wednesday’s RTH session closed with a spike down that ended up lacking follow through for sellers, who failed to make a lower low. Thursday’s short covering rally also ended with a spike, but this time to the upside. Observe how Friday’s ON session immediately took out Thursday’s high. All my weekly upside targets were met on Thursday, but buyers were not satisfied there. If you are not comfortable chasing longs, which is understandable, you know that there are no signs of sellers, meaning the easier trades are on the long side in the direction of this upward imbalance. Remember, to not trade is also a position, that’s why I took Friday off. I’m not surprised we had an unfinished high on Friday’s RTH profile, meaning crowded longs at poor location (85 handles > Weekly Extreme High).

Friday’s RTH session had some morning weakness, but note where A-period low stopped, 1 handle above Friday’s Smashlevel 3950, meaning the base of the spike failed to get tested. B-period also came down to that area and failed to make a lower low forming a poor low, selling shutting off, meaning sellers not gaining any traction. Even with some weakness initially in RTH, sellers were unable to take out the first support area which was a warning sign to be cautious on the short side. When we have directional upward moves, you want to see a support area taken out before trying to fade against the trend or you will just get caught shorting at very bad locations, just like Friday’s morning sellers.

Thursday’s spike area held the whole session, but we carry forward that poor low. We have some unfinished business at the highs as mentioned, which we also carry forward. The weekly VPOC is all the way down at 3815, meaning buyers would prefer some consolidation at these higher prices. Very strong buyers continue to build value above the poor structure (LVN) from Thursday’s session, to then attempt a continuation. An immediate continuation would target further fills of the poor structure from 9/13, but some caution chasing and wait for dips to pick up. Sellers main objective is the end the daily one time framing up, by trading below 3951 (Poor), meaning trading below that HVN around the weekly level 3960 (White arrow). I’ve added the volume profile from previous week for reference.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com