ES Daily Plan | January 9, 2023

On Friday, we saw a triple distribution trend day to the upside with two sets of single prints. I'm observing if we will get a follow through. Buyers not in any huge trouble as long as > 3875.

Recap & Plan

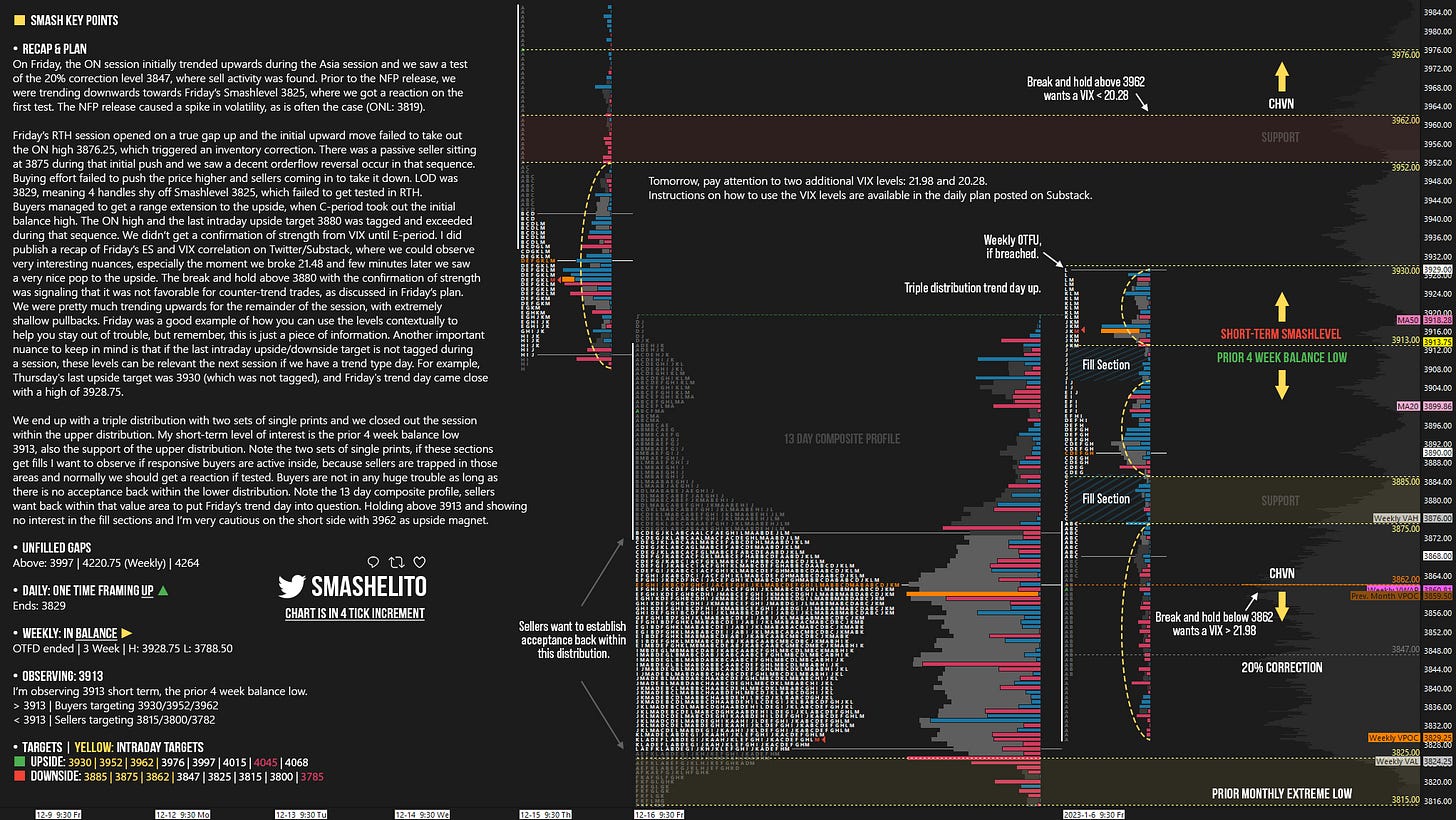

On Friday, the ON session initially trended upwards during the Asia session and we saw a test of the 20% correction level 3847, where sell activity was found. Prior to the NFP release, we were trending downwards towards Friday’s Smashlevel 3825, where we got a reaction on the first test. The NFP release caused a spike in volatility, as is often the case (ONL: 3819).

Friday’s RTH session opened on a true gap up and the initial upward move failed to take out the ON high 3876.25, which triggered an inventory correction. There was a passive seller sitting at 3875 during that initial push and we saw a decent orderflow reversal occur in that sequence. Buying effort failed to push the price higher and sellers coming in to take it down. LOD was 3829, meaning 4 handles shy off Smashlevel 3825, which failed to get tested in RTH. Buyers managed to get a range extension to the upside, when C-period took out the initial balance high. The ON high and the last intraday upside target 3880 was tagged and exceeded during that sequence. We didn’t get a confirmation of strength from VIX until E-period. I did publish a recap of Friday’s ES and VIX correlation on Twitter/Substack, where we could observe very interesting nuances, especially the moment we broke 21.48 and few minutes later we saw a very nice pop to the upside. The break and hold above 3880 with the confirmation of strength was signaling that it was not favorable for counter-trend trades, as discussed in Friday’s plan. We were pretty much trending upwards for the remainder of the session, with extremely shallow pullbacks. Friday was a good example of how you can use the levels contextually to help you stay out of trouble, but remember, this is just a piece of information. Another important nuance to keep in mind is that if the last intraday upside/downside target is not tagged during a session, these levels can be relevant the next session if we have a trend type day. For example, Thursday's last upside target was 3930 (which was not tagged), and Friday's trend day came close with a high of 3928.75.

We end up with a triple distribution with two sets of single prints and we closed out the session within the upper distribution. My short-term level of interest is the prior 4 week balance low 3913, also the support of the upper distribution. Note the two sets of single prints, if these sections get fills I want to observe if responsive buyers are active inside, because sellers are trapped in those areas and normally we should get a reaction if tested. Buyers are not in any huge trouble as long as there is no acceptance back within the lower distribution. Note the 13 day composite profile, sellers want back within that value area to put Friday’s trend day into question. Holding above 3913 and showing no interest in the fill sections and I’m very cautious on the short side with 3962 as upside magnet.

Tomorrow, pay attention to two additional VIX levels: 21.98 and 20.28. These levels can provide confirmation of strength or weakness. If we break and hold above 3962, a VIX below 20.28 would confirm strength. If we break and hold below 3862, a VIX above 21.98 would confirm weakness. Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Outlook, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Thank you Smash!

Damn VIX near the highs even when we were green most of today. Def not a lot of strength in the markets towards the upside