ES Daily Plan | January 6, 2023

Today's range was very tight with unfinished business at both extremes. Tomorrow we have the release of NFP, which has the potential to break us out of this major consolidation. Stay on your toes!

Recap & Plan

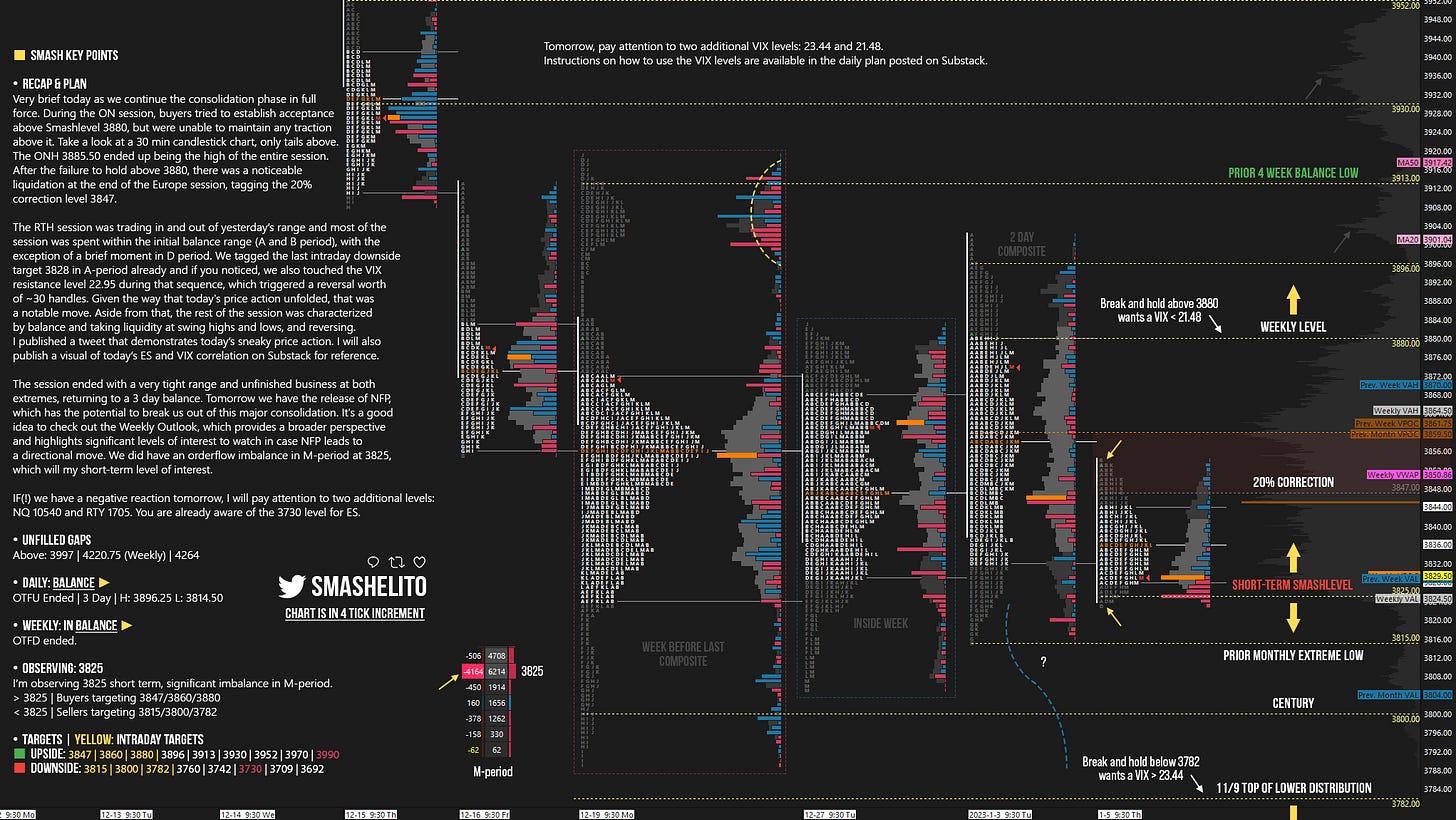

Very brief today as we continue the consolidation phase in full force. During the ON session, buyers tried to establish acceptance above Smashlevel 3880, but were unable to maintain any traction above it. Take a look at a 30 min candlestick chart, only tails above. The ONH 3885.50 ended up being the high of the entire session. After the failure to hold above 3880, there was a noticeable liquidation at the end of the Europe session, tagging the 20% correction level 3847.

The RTH session was trading in and out of yesterday’s range and most of the session was spent within the initial balance range (A and B period), with the exception of a brief moment in D period. We tagged the last intraday downside target 3828 in A-period already and if you noticed, we also touched the VIX resistance level 22.95 during that sequence, which triggered a reversal worth of ~30 handles. Given the way that today's price action unfolded, that was a notable move. Aside from that, the rest of the session was characterized by balance and taking liquidity at swing highs and lows, and reversing. I published a tweet that demonstrates today’s sneaky price action.

I will also publish a visual of today’s ES and VIX correlation on Substack for reference.

The session ended with a very tight range and unfinished business at both extremes, returning to a 3 day balance. Tomorrow we have the release of NFP, which has the potential to break us out of this major consolidation. It's a good idea to check out the Weekly Outlook, which provides a broader perspective and highlights significant levels of interest to watch in case NFP leads to a directional move. We did have an orderflow imbalance in M-period at 3825, which will my short-term level of interest.

IF(!) we have a negative reaction tomorrow, I will pay attention to two additional levels: NQ 10540 and RTY 1705. You are already aware of the 3730 level for ES.

Tomorrow, pay attention to two additional VIX levels: 23.44 and 21.48. These levels can provide confirmation of strength or weakness. If we break and hold above 3880, a VIX below 21.48 would confirm strength. If we break and hold below 3782, a VIX above 23.44 would confirm weakness. Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Ugh, had some weight ready to close on that 3930, so close!

Have a great weekend Smashelito(s)!

Thank you brother SmashElito , We absolutely love your work 👏👏 With the help on levels from your SmashPlan I am ready for one more successful day 👍