ES Daily Plan | January 10, 2023

The last intraday upside target was hit and we saw a significant reversal after buyers got crowded at the highs. Carry forward that unfinished business.

Friday's upper distribution is my battlefield of interest.

Recap & Plan

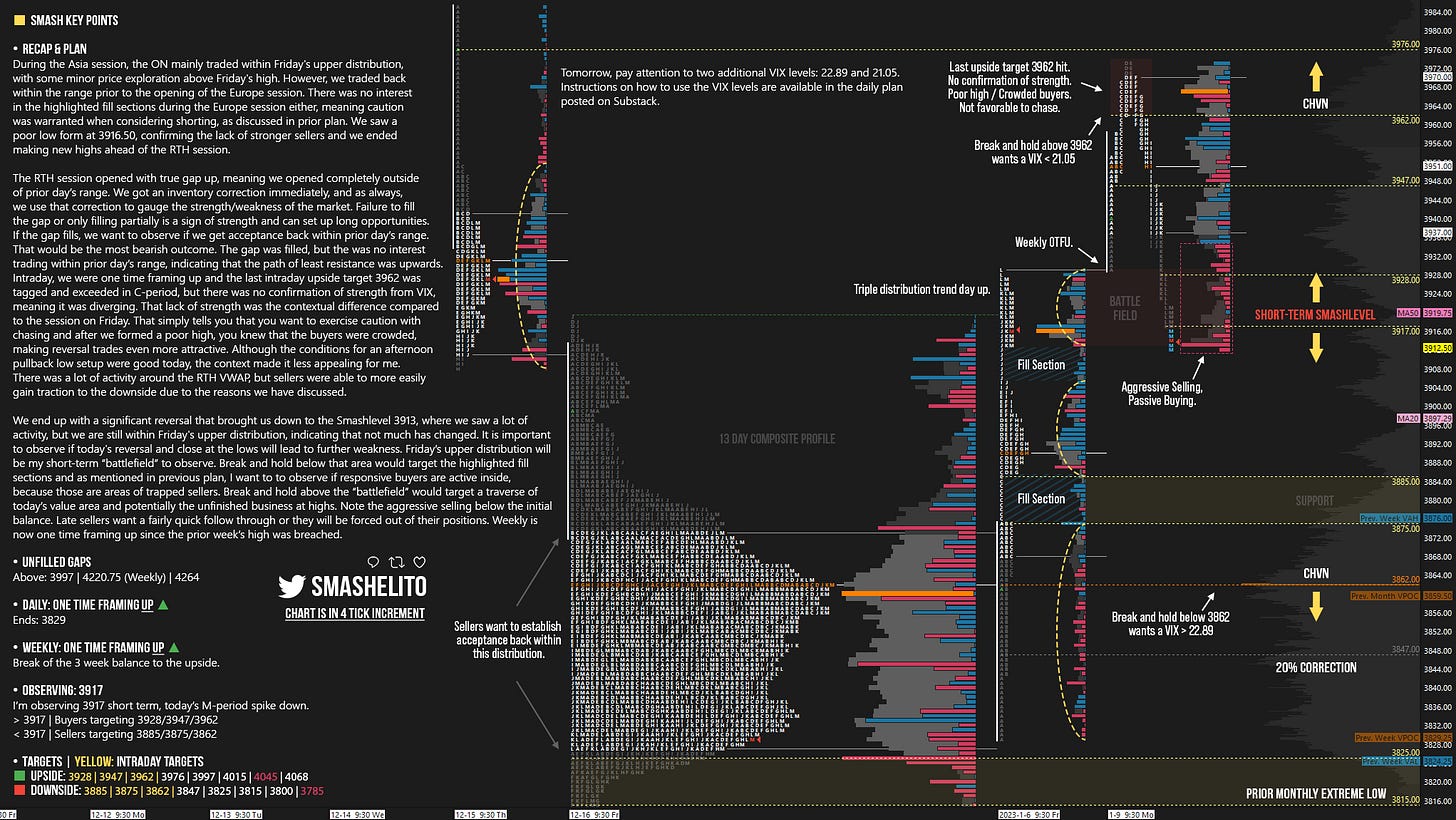

During the Asia session, the ON mainly traded within Friday's upper distribution, with some minor price exploration above Friday's high. However, we traded back within the range prior to the opening of the Europe session. There was no interest in the highlighted fill sections during the Europe session either, meaning caution was warranted when considering shorting, as discussed in prior plan. We saw a poor low form at 3916.50, confirming the lack of stronger sellers and we ended making new highs ahead of the RTH session.

The RTH session opened with true gap up, meaning we opened completely outside of prior day’s range. We got an inventory correction immediately, and as always, we use that correction to gauge the strength/weakness of the market. Failure to fill the gap or only filling partially is a sign of strength and can set up long opportunities. If the gap fills, we want to observe if we get acceptance back within prior day’s range. That would be the most bearish outcome. The gap was filled, but the was no interest trading within prior day’s range, indicating that the path of least resistance was upwards. Intraday, we were one time framing up and the last intraday upside target 3962 was tagged and exceeded in C-period, but there was no confirmation of strength from VIX, meaning it was diverging. That lack of strength was the contextual difference compared to the session on Friday. That simply tells you that you want to exercise caution with chasing and after we formed a poor high, you knew that the buyers were crowded, making reversal trades even more attractive. Although the conditions for an afternoon pullback low setup were good today, the context made it less appealing for me. There was a lot of activity around the RTH VWAP, but sellers were able to more easily gain traction to the downside due to the reasons we have discussed.

We end up with a significant reversal that brought us down to the Smashlevel 3913, where we saw a lot of activity, but we are still within Friday's upper distribution, indicating that not much has changed. It is important to observe if today's reversal and close at the lows will lead to further weakness. Friday’s upper distribution will be my short-term “battlefield” to observe. Break and hold below that area would target the highlighted fill sections and as mentioned in previous plan, I want to to observe if responsive buyers are active inside, because those are areas of trapped sellers. Break and hold above the “battlefield” would target a traverse of today’s value area and potentially the unfinished business at highs. Note the aggressive selling below the initial balance. Late sellers want a fairly quick follow through or they will be forced out of their positions. Weekly is now one time framing up since the prior week’s high was breached.

Tomorrow, pay attention to two additional VIX levels: 22.89 and 21.05. These levels can provide confirmation of strength or weakness. If we break and hold above 3962, a VIX below 21.05 would confirm strength. If we break and hold below 3862, a VIX above 22.89 would confirm weakness. Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Outlook, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Good stuff! Really enjoy it and learning a lot. Thanks

Thank you as always! I may have missed this, but do you have a chart study or Substack post on how you arrive at your VIX correlations? Just curious as I've been researching this for my own trade plans. Most appreciated!