Smash ES Plan | December 23, 2022

What a session! No follow through in the ON session for buyers attracted responsive selling. From a triple distribution to a full-on reversal in RTH.

I've observed 3856 the whole week and might as well continue to do so.

Recap & Plan

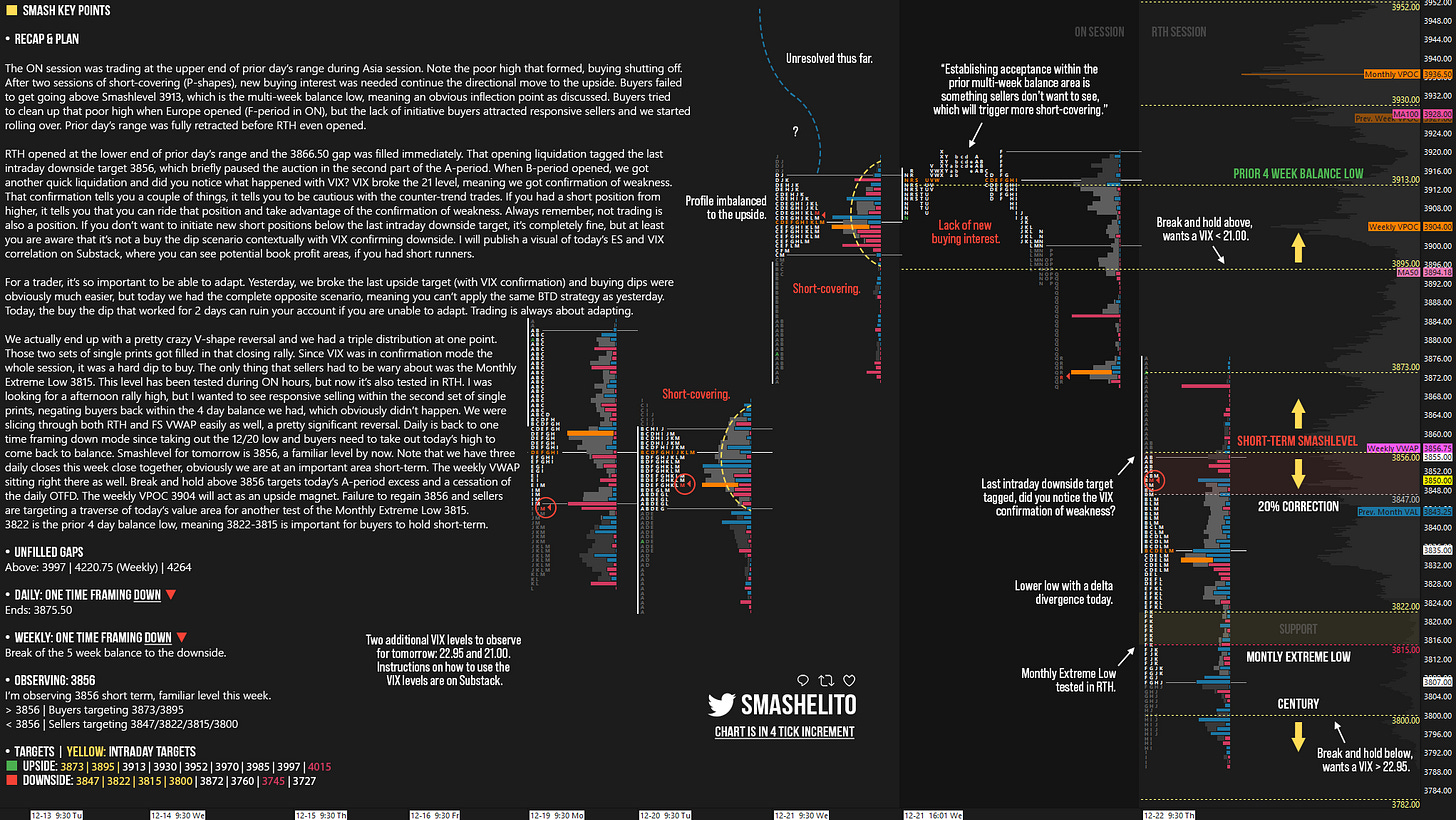

The ON session was trading at the upper end of prior day’s range during Asia session. Note the poor high that formed, buying shutting off. After two sessions of short-covering (P-shapes), new buying interest was needed continue the directional move to the upside. Buyers failed to get going above Smashlevel 3913, which is the multi-week balance low, meaning an obvious inflection point as discussed. Buyers tried to clean up that poor high when Europe opened (F-period in ON), but the lack of initiative buyers attracted responsive sellers and we started rolling over. Prior day’s range was fully retracted before RTH even opened.

RTH opened at the lower end of prior day’s range and the 3866.50 gap was filled immediately. That opening liquidation tagged the last intraday downside target 3856, which briefly paused the auction in the second part of the A-period. When B-period opened, we got another quick liquidation and did you notice what happened with VIX? VIX broke the 21 level, meaning we got confirmation of weakness. That confirmation tells you a couple of things, it tells you to be cautious with the counter-trend trades. If you had a short position from higher, it tells you that you can ride that position and take advantage of the confirmation of weakness. Always remember, not trading is also a position. If you don’t want to initiate new short positions below the last intraday downside target, it’s completely fine, but at least you are aware that it’s not a buy the dip scenario contextually with VIX confirming downside. I will publish a visual of today’s ES and VIX correlation on Substack, where you can see potential book profit areas, if you had short runners.

For a trader, it’s so important to be able to adapt. Yesterday, we broke the last upside target (with VIX confirmation) and buying dips were obviously much easier, but today we had the complete opposite scenario, meaning you can’t apply the same BTD strategy as yesterday. Today, the buy the dip that worked for 2 days can ruin your account if you are unable to adapt. Trading is always about adapting.

We actually end up with a pretty crazy V-shape reversal and we had a triple distribution at one point. Those two sets of single prints got filled in that closing rally. Since VIX was in confirmation mode the whole session, it was a hard dip to buy. The only thing that sellers had to be wary about was the Monthly Extreme Low 3815. This level has been tested during ON hours, but now it’s also tested in RTH. I was looking for a afternoon rally high, but I wanted to see responsive selling within the second set of single prints, negating buyers back within the 4 day balance we had, which obviously didn’t happen. We were slicing through both RTH and FS VWAP easily as well, a pretty significant reversal. Daily is back to one time framing down mode since taking out the 12/20 low and buyers need to take out today’s high to come back to balance. Smashlevel for tomorrow is 3856, a familiar level by now. Note that we have three daily closes this week close together, obviously we are at an important area short-term. The weekly VWAP sitting right there as well. Break and hold above 3856 targets today’s A-period excess and a cessation of the daily OTFD. The weekly VPOC 3904 will act as an upside magnet. Failure to regain 3856 and sellers are targeting a traverse of today’s value area for another test of the Monthly Extreme Low 3815. 3822 is the prior 4 day balance low, meaning 3822-3815 is important for buyers to hold short-term.

Two additional VIX levels to observe for tomorrow: 22.95 and 21.00. Use the levels as confirmation of strength/weakness. Should we break and hold above 3895, you want a see a VIX < 21.00 for confirmation of strength. Should we break and hold below 3800, you want a see a VIX > 22.95 for confirmation of weakness. In any case, one should be careful with chasing outside of the yellow levels. A non-cooperating VIX may suggest reversals (trade setups).

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

The addition of VIX has really been helpful! Thanks for all you do!

Hey Smash!! Do you have any recommendations for learning more about how to analyze the VIX? Any resources someone just starting to learn about it should check out? Thanks so so much for your work on the markets! I incorporate your analysis everyday to help prep me for my trading day - you're doing God's work! 😂 Please keep it up