Smash ES Plan | December 16, 2022

Sellers controlled the session after holding the true gap down with a cooperating VIX. We end up with a b-shape profile, indicative of long liquidation.

Full traverse of the prior weekly balance completed.

Recap & Plan

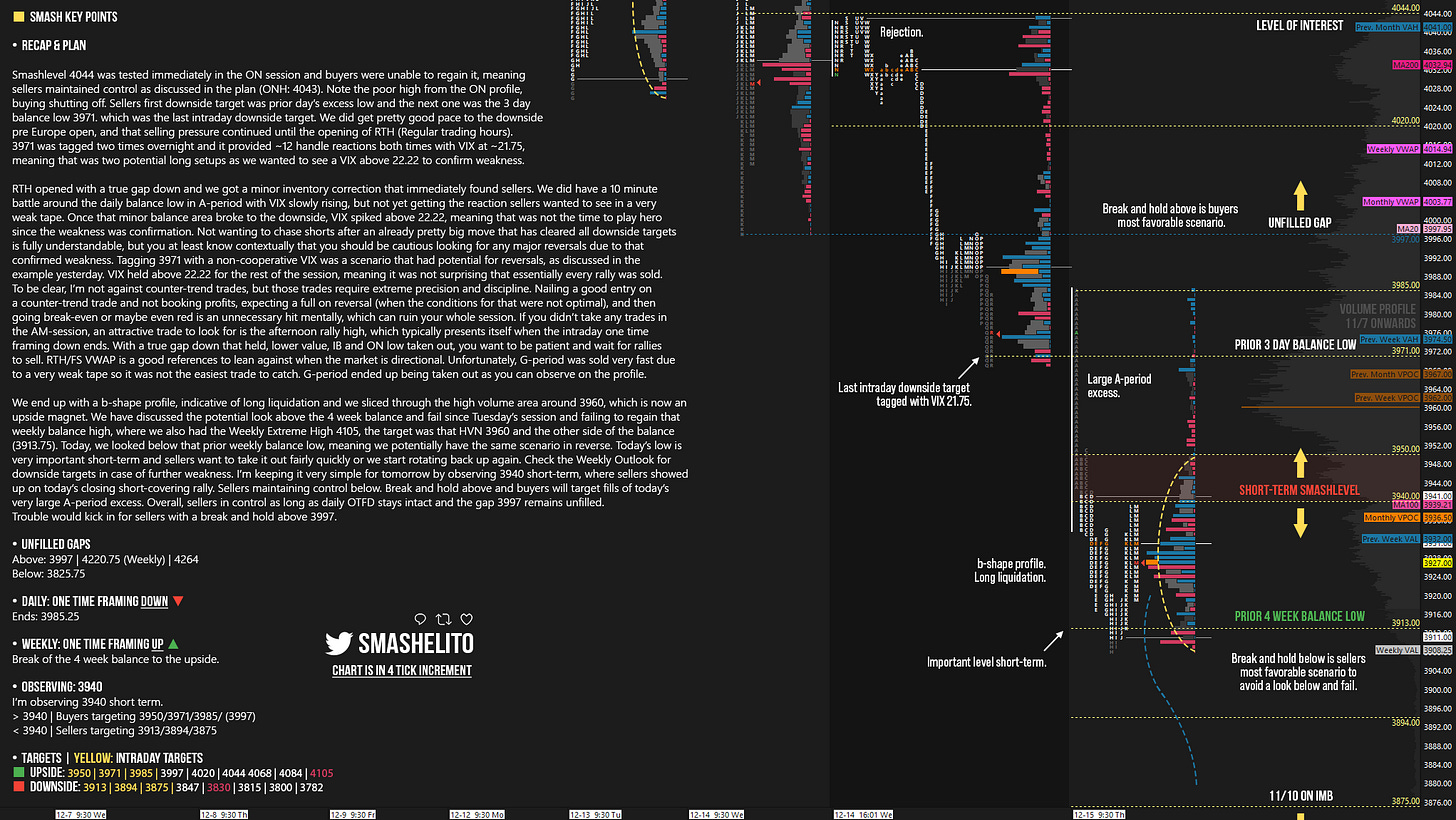

Smashlevel 4044 was tested immediately in the ON session and buyers were unable to regain it, meaning sellers maintained control as discussed in the plan (ONH: 4043). Note the poor high from the ON profile, buying shutting off. Sellers first downside target was prior day’s excess low and the next one was the 3 day balance low 3971. which was the last intraday downside target. We did get pretty good pace to the downside pre Europe open, and that selling pressure continued until the opening of RTH (Regular trading hours). 3971 was tagged two times overnight and it provided ~12 handle reactions both times with VIX at ~21.75, meaning that was two potential long setups as we wanted to see a VIX above 22.22 to confirm weakness.

RTH opened with a true gap down and we got a minor inventory correction that immediately found sellers. We did have a 10 minute battle around the daily balance low in A-period with VIX slowly rising, but not yet getting the reaction sellers wanted to see in a very weak tape. Once that minor balance area broke to the downside, VIX spiked above 22.22, meaning that was not the time to play hero since the weakness was confirmation. Not wanting to chase shorts after an already pretty big move that has cleared all downside targets is fully understandable, but you at least know contextually that you should be cautious looking for any major reversals due to that confirmed weakness. Tagging 3971 with a non-cooperative VIX was a scenario that had potential for reversals, as discussed in the example yesterday. VIX held above 22.22 for the rest of the session, meaning it was not surprising that essentially every rally was sold.

To be clear, I’m not against counter-trend trades, but those trades require extreme precision and discipline. Nailing a good entry on a counter-trend trade and not booking profits, expecting a full on reversal (when the conditions for that were not optimal), and then going break-even or maybe even red is an unnecessary hit mentally, which can ruin your whole session. If you didn’t take any trades in the AM-session, an attractive trade to look for is the afternoon rally high, which typically presents itself when the intraday one time framing down ends. With a true gap down that held, lower value, IB and ON low taken out, you want to be patient and wait for rallies to sell. RTH/FS VWAP is a good references to lean against when the market is directional. Unfortunately, G-period was sold very fast due to a very weak tape so it was not the easiest trade to catch. G-period ended up being taken out as you can observe on the profile.

We end up with a b-shape profile, indicative of long liquidation and we sliced through the high volume area around 3960, which is now an upside magnet. We have discussed the potential look above the 4 week balance and fail since Tuesday’s session and failing to regain that weekly balance high, where we also had the Weekly Extreme High 4105, the target was that HVN 3960 and the other side of the balance (3913.75). Today, we looked below that prior weekly balance low, meaning we potentially have the same scenario in reverse. Today’s low is very important short-term and sellers want to take it out fairly quickly or we start rotating back up again. Check the Weekly Outlook for downside targets in case of further weakness. I’m keeping it very simple for tomorrow by observing 3940 short-term, where sellers showed up on today’s closing short-covering rally. Sellers maintaining control below. Break and hold above and buyers will target fills of today’s very large A-period excess. Overall, sellers in control as long as daily OTFD stays intact and the gap 3997 remains unfilled. Trouble would kick in for sellers with a break and hold above 3997.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Brutal day. I thought 3960 HVN would provide support for a reversal. I unfortunately tried to catch that falling knife and got hurt. Luckily, I did manage a recovery by end of the day. Smash, can you please explain somewhere what the color coding means in your levels at bottom left? What do those red targets identify? ONL keeps making new lows below the chart. Thanks as always

Smash,

GREAT day! - your levels are magical!

The best things I have learned so far are... 1) the acceptance/rejection and 2) the OTFu/d and of course,,,, The tidbits that you have been dropping based on your experience. (I have been peeping them like a HAWK!) - priceless.

Please forgive me.. I do have a few questions

1_ how is balance, balance high and balance low determined? (I THINK i know how to calculate this - I am just not sure do i call it a 3 day balance or a 4 day balance - as we find the balance AFTER the OTFU/D ends)- just need some clarification I guess

2) what is "FS" VWAP? I am familar with VWAP - but I dont know what FS means

and

3) is is a b shaped profile if the bottom is a "V"?

As always thank you for your time and expertise.

Thank you seems so small to say for all that you do - I will have to find some other words.......