Smash ES Plan | December 13, 2022

Triple distribution with three sets of single prints. ES up, VIX up and CPI data tomorrow sets up an interesting upcoming session. Stay nimble.

Recap & Plan

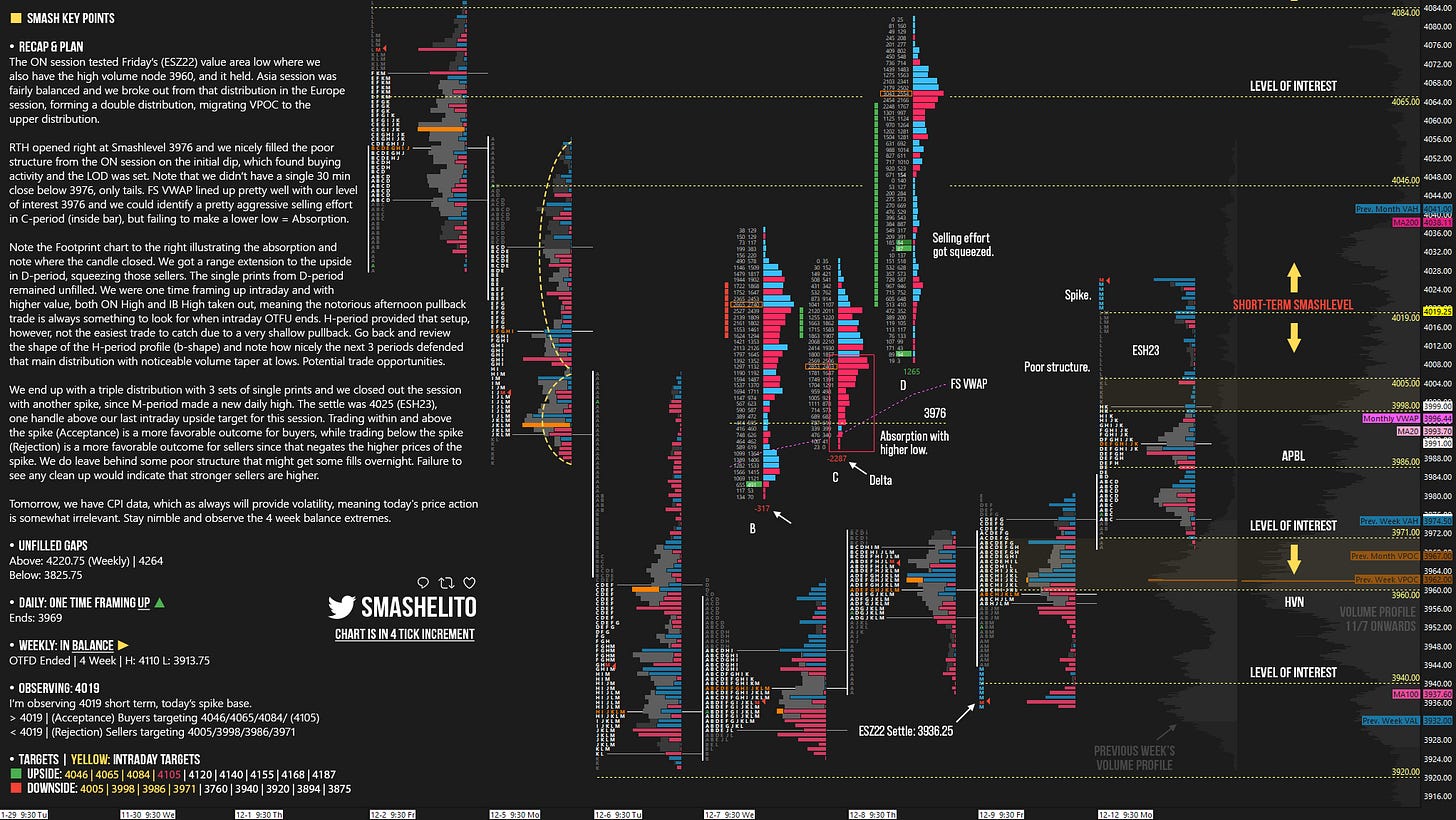

The ON session tested Friday’s (ESZ22) value area low where we also have the high volume node 3960, and it held. Asia session was fairly balanced and we broke out from that distribution in the Europe session, forming a double distribution, migrating VPOC to the upper distribution.

RTH opened right at Smashlevel 3976 and we nicely filled the poor structure from the ON session on the initial dip, which found buying activity and the LOD was set. Note that we didn’t have a single 30 min close below 3976, only tails. FS VWAP lined up pretty well with our level of interest 3976 and we could identify a pretty aggressive selling effort in C-period (inside bar), but failing to make a lower low = Absorption.

Note the Footprint chart to the right illustrating the absorption and note where the candle closed. We got a range extension to the upside in D-period, squeezing those sellers. The single prints from D-period remained unfilled. We were one time framing up intraday and with higher value, both ON High and IB High taken out, meaning the notorious afternoon pullback trade is always something to look for when intraday OTFU ends. H-period provided that setup, however, not the easiest trade to catch due to a very shallow pullback. Go back and review the shape of the H-period profile (b-shape) and note how nicely the next 3 periods defended that main distribution with noticeable volume taper at lows. Potential trade opportunities.

We end up with a triple distribution with 3 sets of single prints and we closed out the session with another spike, since M-period made a new daily high. The settle was 4025 (ESH23), one handle above our last intraday upside target for this session. Trading within and above the spike (Acceptance) is a more favorable outcome for buyers, while trading below the spike (Rejection) is a more favorable outcome for sellers since that negates the higher prices of the spike. We do leave behind some poor structure that might get some fills overnight. Failure to see any clean up would indicate that stronger sellers are higher.

Tomorrow, we have CPI data, which as always will provide volatility, meaning today's price action is somewhat irrelevant. Stay nimble and observe the 4 week balance extremes.

Interesting and positive increase in interactions lately here on Substack, which is nice to see!

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

once again you NAILED it!

mad props to you smash - brilliant!

Grazie mille per le tue utilissime analisi