ES Weekly Plan | September 4-8, 2023

Below are my expectations for the week ahead.

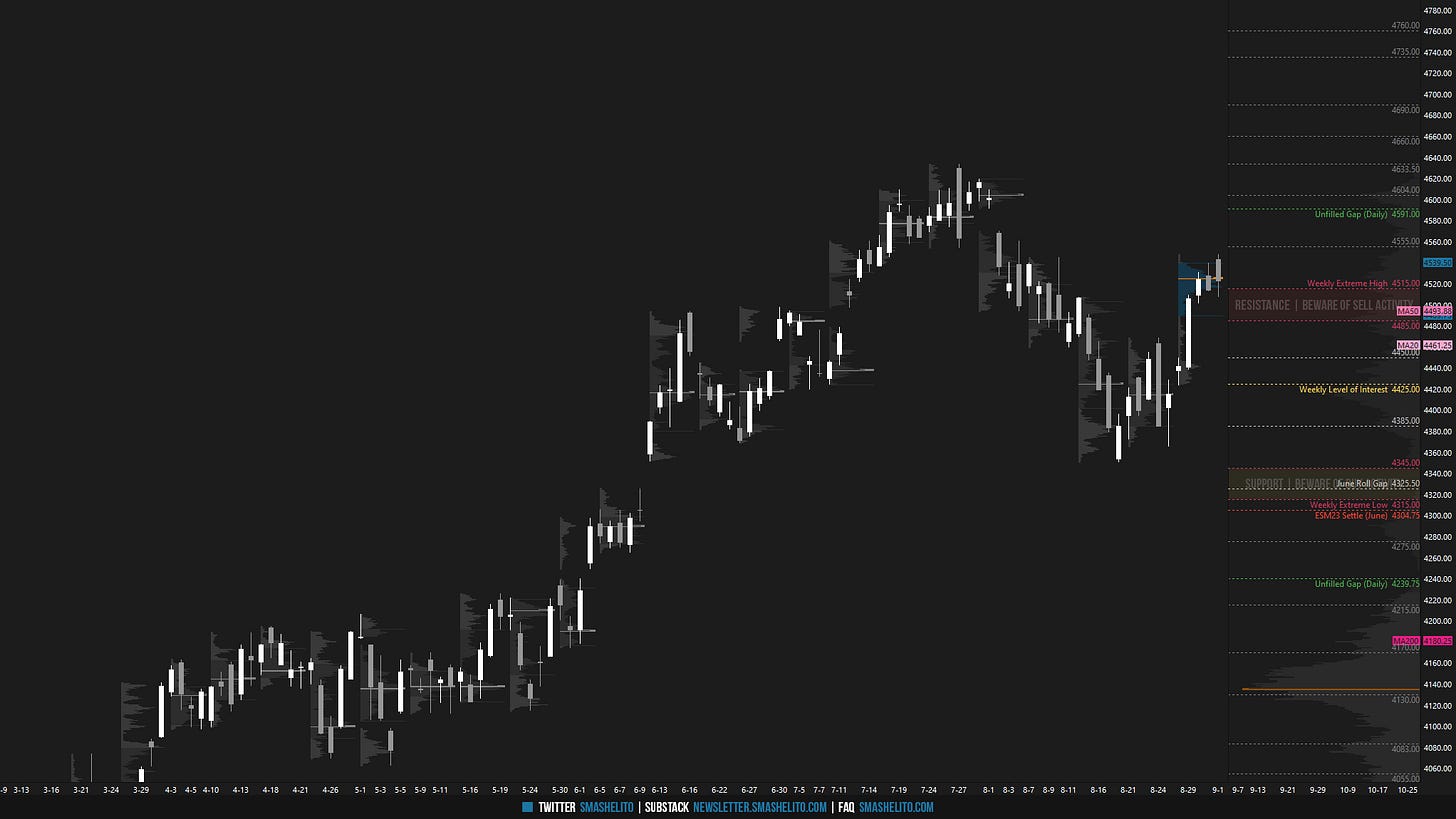

🟨 Daily: BALANCE | 3D | H: 4547.50 L: 4501

🟨 Weekly: BALANCE | 3W | H: 4547.50 L: 4350

🟨 Monthly: BALANCE | 2M | H: 4633.50 L: 4350

Weekly Extreme High: 4605

Weekly Extreme Low: 4440

As usual, a detailed daily plan will be published tomorrow.

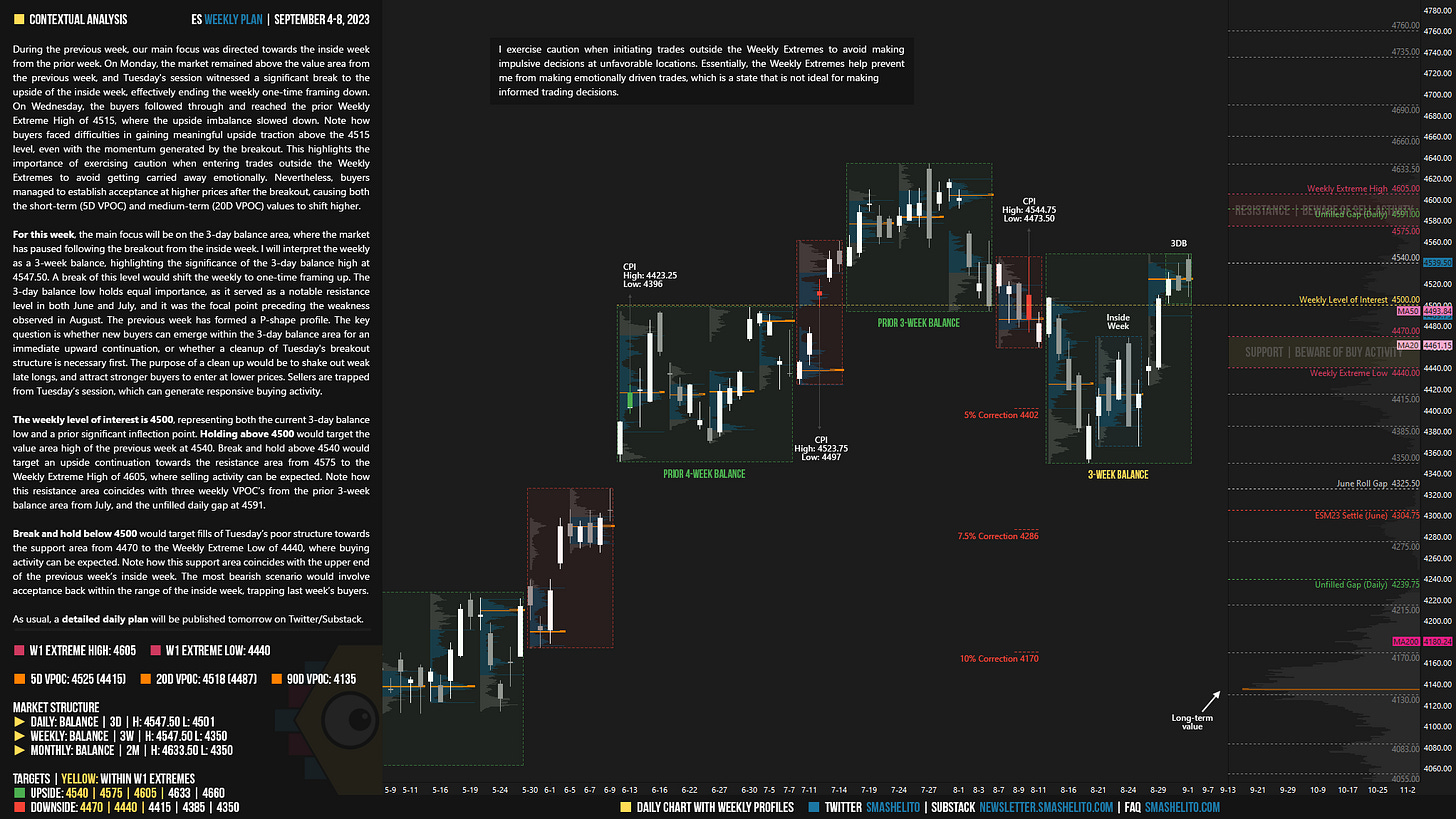

During the previous week, our main focus was directed towards the inside week from the prior week. On Monday, the market remained above the value area from the previous week, and Tuesday's session witnessed a significant break to the upside of the inside week, effectively ending the weekly one-time framing down. On Wednesday, the buyers followed through and reached the prior Weekly Extreme High of 4515, where the upside imbalance slowed down. Note how buyers faced difficulties in gaining meaningful upside traction above the 4515 level, even with the momentum generated by the breakout. This highlights the importance of exercising caution when entering trades outside the Weekly Extremes to avoid getting carried away emotionally. Nevertheless, buyers managed to establish acceptance at higher prices after the breakout, causing both the short-term (5D VPOC) and medium-term (20D VPOC) values to shift higher.

I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes help prevent me from making emotionally driven trades, which is a state that is not ideal for making informed trading decisions.

For this week, the main focus will be on the 3-day balance area, where the market has paused following the breakout from the inside week. I will interpret the weekly as a 3-week balance, highlighting the significance of the 3-day balance high at 4547.50. A break of this level would shift the weekly to one-time framing up. The 3-day balance low holds equal importance, as it served as a notable resistance level in both June and July, and it was the focal point preceding the weakness observed in August. The previous week has formed a P-shape profile. The key question is whether new buyers can emerge within the 3-day balance area for an immediate upward continuation, or whether a cleanup of Tuesday's breakout structure is necessary first. The purpose of a clean up would be to shake out weak late longs, and attract stronger buyers to enter at lower prices. Sellers are trapped from Tuesday’s session, which can generate responsive buying activity.

The weekly level of interest is 4500, representing both the current 3-day balance low and a prior significant inflection point. Holding above 4500 would target the value area high of the previous week at 4540. Break and hold above 4540 would target an upside continuation towards the resistance area from 4575 to the Weekly Extreme High of 4605, where selling activity can be expected. Note how this resistance area coincides with three weekly VPOC’s from the prior 3-week balance area from July, and the unfilled daily gap at 4591.

Break and hold below 4500 would target fills of Tuesday’s poor structure towards the support area from 4470 to the Weekly Extreme Low of 4440, where buying activity can be expected. Note how this support area coincides with the upper end of the previous week’s inside week. The most bearish scenario would involve acceptance back within the range of the inside week, trapping last week’s buyers.

🟩 Upside: 4540 | 4575 | 4605 | 4633 | 4660

🟥 Downside: 4470 | 4440 | 4415 | 4385 | 4350

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you always.

Thanks, Smashelito for the great letter.

How can I determine the inside week values? Is it based on the high and low range of the previous week? So, if I understand correctly, acceptance back within the range of the inside week means that we do not exceed the high of the previous week, is that correct?