Visual Representation

Market Structure

🟥 DAILY: OTFD | ENDS: 4302.25

🟨 WEEKLY: BALANCE | 3W | H: 4423.25 L: 4247.25

🟥 MONTHLY: OTFD | ENDS: 4562

Contextual Analysis

Ahead of the previous week, sellers argued that the recent rally was primarily driven by short-covering, ultimately providing stronger sellers an opportunity to reload at higher prices for a potential downside continuation, and they were correct. We carry forward the unfinished business at the highs, while the market is in the process of cleaning up the unfinished business at the lows.

For this week, the main focus will be on the weekly balance area, with Friday's low marking its lower end. A break of Friday’s low will shift the weekly to one-time framing down. The general guideline suggests going with the break of the highlighted balance area and monitoring for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. Keep in mind that the lower end of a balance area is considered support until proven otherwise, implying that there is a need for initiative sellers, and a lack thereof will attract responsive buyers. The previous week’s VPOC is located at 4402, which is 154 handles above Friday's settlement. This suggests that an immediate breakdown may not be the most favorable scenario for sellers, who would prefer to see some consolidation before a potential downside continuation. Buyers, with their main objective of regaining the important weekly resistance area, would like to see an immediate breakdown that fails, which could potentially trigger a strong counter-move. An immediate bounce, without a failed breakdown, will most likely run into reloading sellers.

The weekly level of interest is 4254, which represents Friday’s M-period spike base, coinciding with MA200. Break and hold above 4254 indicating a lack of initiative sellers, would target Friday’s afternoon rally high at 4285, as well as the previous week’s value area low (VAL) at 4325, where the medium-term value (20D VPOC) is also located. Break and hold above 4325 would target the resistance area from 4350 (prior 6-week balance low) to the Weekly Extreme High of 4380, where selling activity can be expected. Note how this resistance area coincides with the lower end of the multi-day distribution, located at the upper end of the weekly balance area. This area marked the origin of the previous week's weakness, highlighting its significance as a crucial area for sellers to defend.

Holding below 4254, indicating continued weakness, would target 4225 and 4190, which represent two daily NVPOCs, filling the gap at 4239.75 in the process. Break and hold below 4190 would target the support area from 4150 to the Weekly Extreme Low of 4120, where buying activity can be expected. Note how this support area coincides with the most traded price by volume (VPOC) for the year at 4135, serving as a potential downside magnet for this correction.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 4254.

Break and hold above 4254 would target 4285 / 4325 / 4350 / 4380*

Holding below 4254 would target 4225 / 4190 / 4150 / 4120*

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

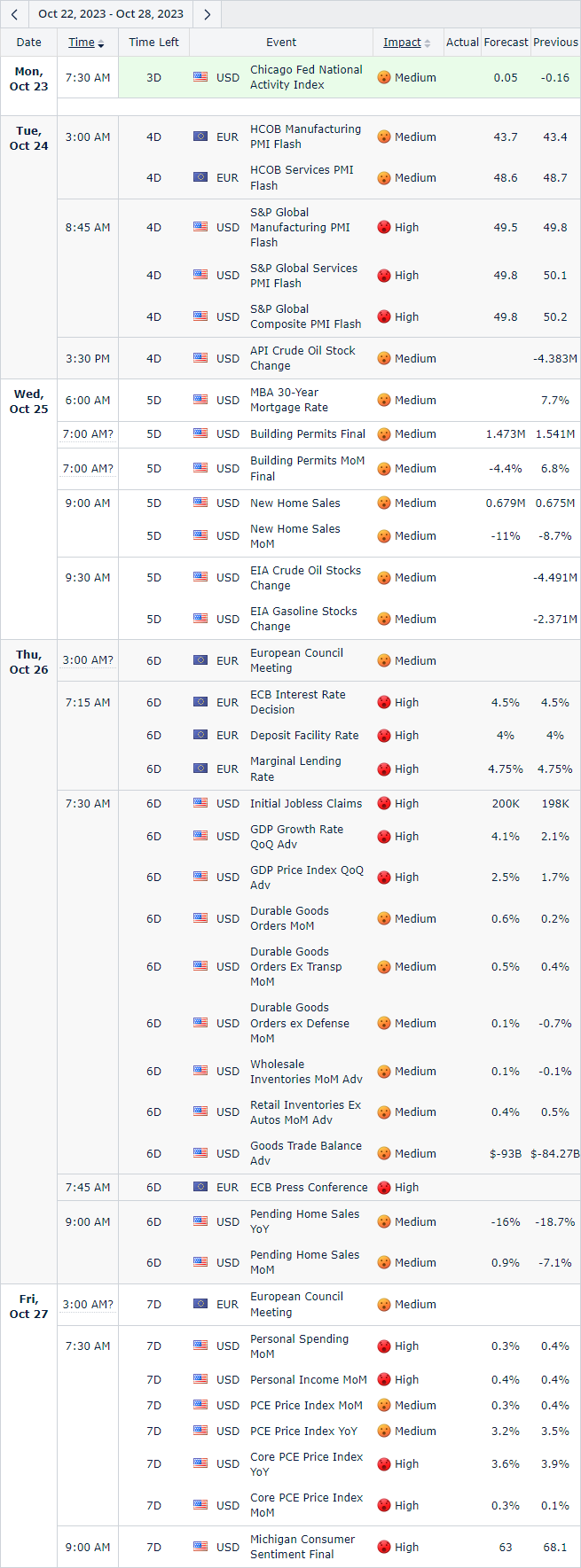

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you

Love the description of the current situation. Buyers and sellers have clear objectives, and the outcome will be decided by the best strategy and execution.