Visual Representation

Market Structure

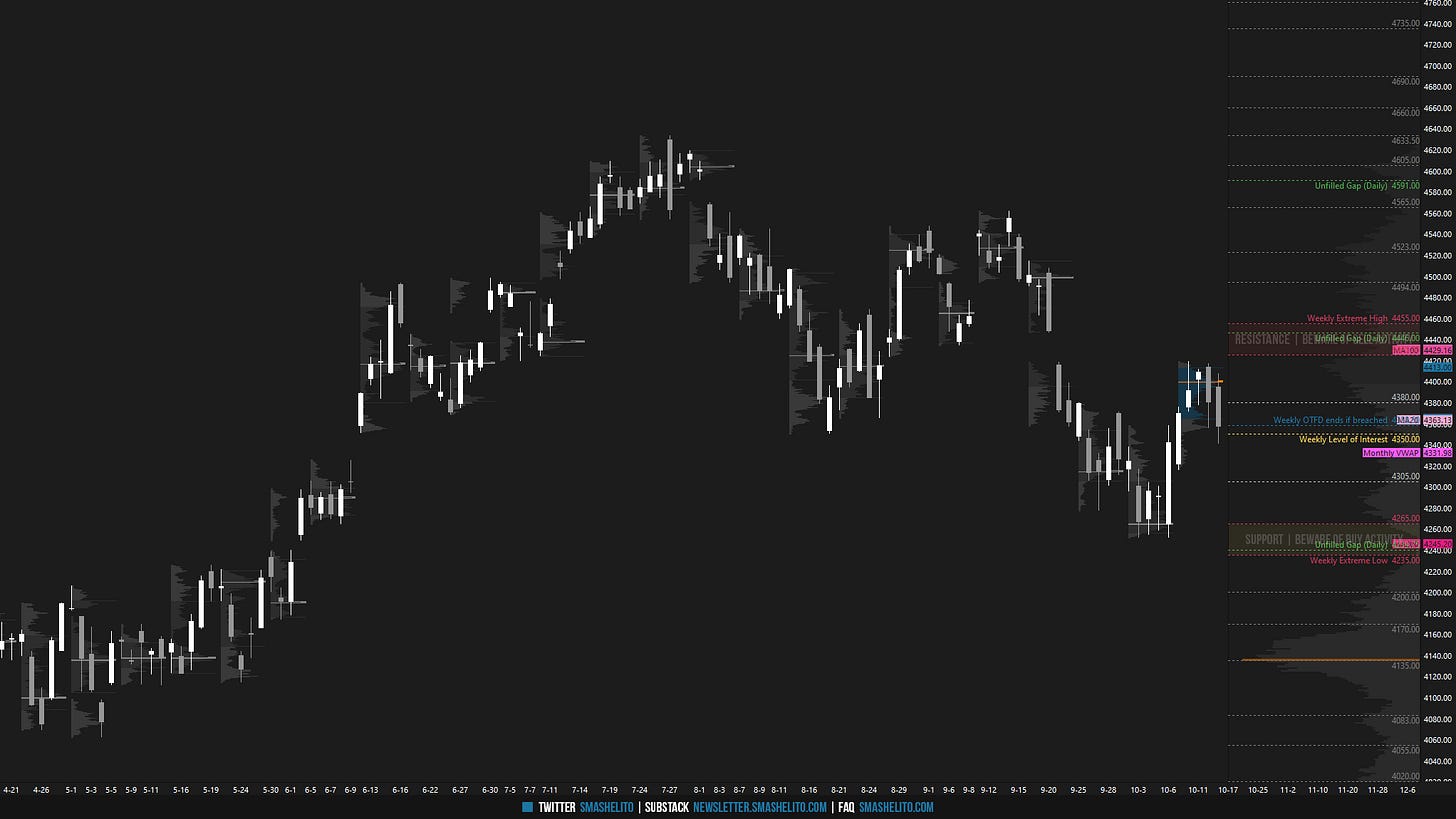

🟥 DAILY: OTFD | ENDS: 4407.75

🟨 WEEKLY: BALANCE | 2W | H: 4419 L: 4251.25

🟥 MONTHLY: OTFD | ENDS: 4562

Contextual Analysis

During the previous week, the market observed an upside continuation early on, effectively putting an end to the weekly one-time framing down. However, the upside momentum stalled with an inside day forming on Wednesday, and weakness emerged on Thursday following an attempt to break the inside day to the upside that ultimately failed.

For this week, the main focus will be on whether the buyers can maintain within the prior 6-week balance after opening strongly last week but ending it on a weaker note. The daily is one-time framing down, while the weekly has returned to balance after breaching the previous week’s high. When analyzing the last two weekly profiles, we can observe that there is unfinished business to resolve both at the upper and lower extreme due to the absence of excess. Buyers will argue that the weakness observed towards the end of the previous week represents a necessary pullback for a potential upside continuation. Conversely, sellers will argue that the recent rally was primarily driven by short-covering, providing stronger sellers an opportunity to reload at higher prices for a potential downside continuation. I will continue to use the 4350 level, representing the prior 6-week balance low, as a key reference point to assess which of these structural deficiencies will be addressed first. Note the precise alignment of 4350 with the lower end of the main distribution from the last week.

The weekly level of interest is 4350, which represents the prior 6-week balance low, and this has continued to be our primary focus for the past three weeks. Holding above 4350 would target Friday’s breakdown single prints at 4384, as well as the upper end of the 2-week balance high at 4419, where there is unfinished business after forming a poor high. Break and hold above 4419, would shift the weekly to one-time framing up, and target the resistance area from 4445 to the Weekly Extreme High of 4475, where selling activity can be expected. Note how this resistance area coincides with the lower end of a previous week’s upper distribution, where the unfilled daily gap at 4446 is located.

Break and hold below 4350, indicating that the recent rally was primarily driven by short-covering rather than stronger buyers, would target the value area high (VAH) from two week’s ago at 4305. Break and hold below 4305 would target a value area traverse towards the support area from 4275 to the Weekly Extreme Low of 4245, where buying activity can be expected. Note how this support area coincides with the MA200, a previous week’s VPOC, and an unfilled daily gap just below at 4239.75. It’s worth noting that the low from two week’s ago has unfinished business after forming a poor low.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 4350.

Holding above 4350 would target 4384 / 4419 / 4445 / 4475*

Break and hold below 4350 would target 4305 / 4275 / 4245*

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you Smash!

Your guidance has been invaluable! Thank you!