ES Weekly Plan | Oct 30 - Nov 3, 2023

My expectations for the upcoming week.

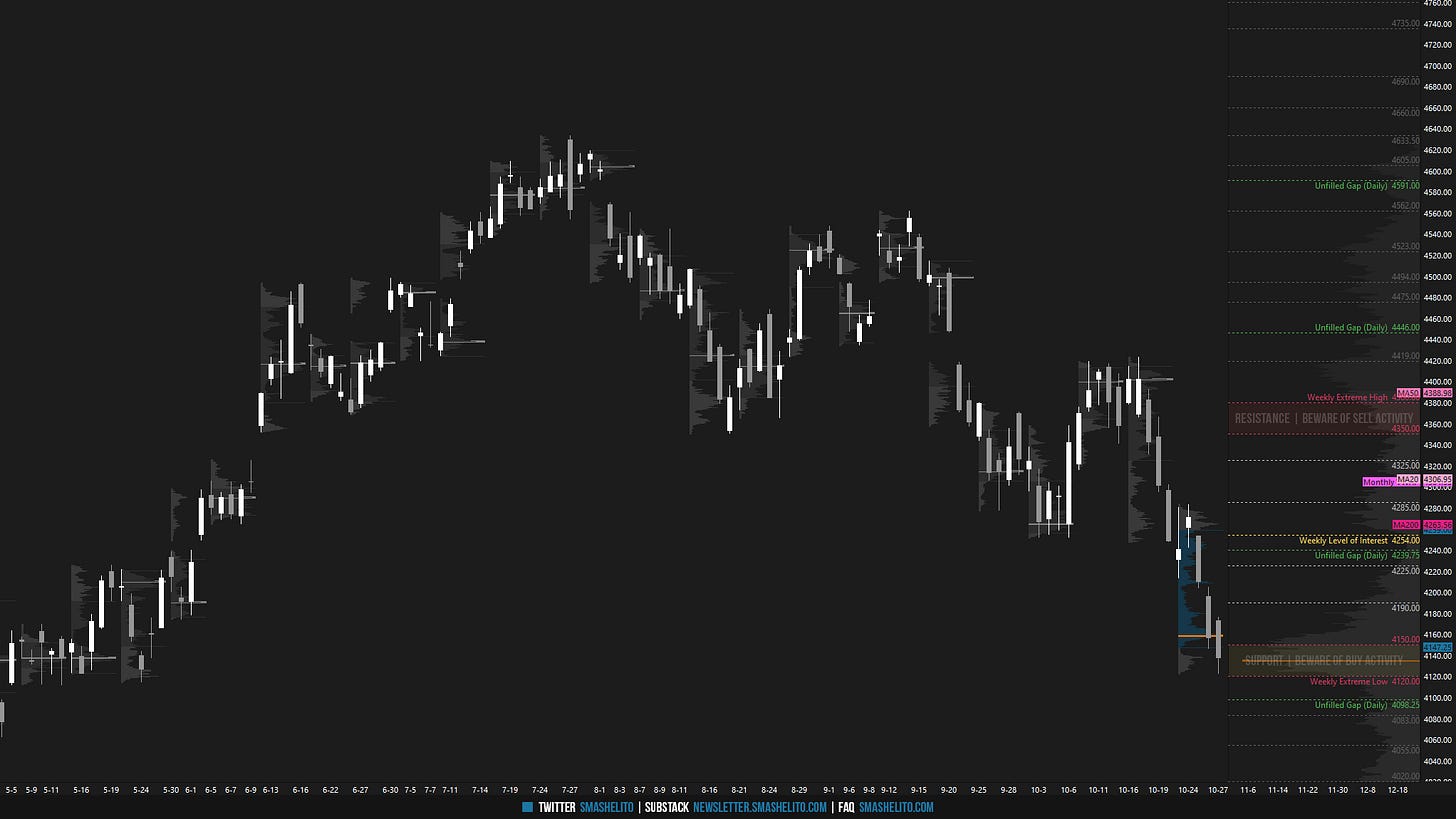

Visual Representation

Market Structure

🟥 DAILY: OTFD | ENDS: 4176.75

🟥 WEEKLY: OTFD | ENDS: 4283.50

🟥 MONTHLY: OTFD | ENDS: 4562

Contextual Analysis

Ahead of the previous week, the 3-week balance area was our main focus. The market saw an immediate breakdown on Monday, which was not the most favorable scenario for sellers, as discussed. This failed breakdown should have triggered a strong counter-move, but it didn’t, allowing sellers to take advantage of the situation later in the week, resulting in test of the prior weekly support area.

For this week, the main focus will be on whether the market will continue its downside imbalance in search for value or take a potential breather, considering that the market has reached an area of prior balance, characterized by the most traded price by volume (VPOC) for the year, situated at 4135. The market is one-time framing down across all time frames. The primary objective for buyers is to put an end to the daily one-time framing down by breaching a previous day's high, signaling a potential shift toward more balanced, two-sided activity, at least in the short term. Thus far, the market continues to confirm the downside trend by establishing value at lower prices. The long-term value (90D VPOC) has shifted from 4415 to 4402, the medium-term value (20D VPOC) has shifted from 4326 to 4265, and sellers managed to shift the short-term value (5D VPOC) to 4159 on Friday. I will closely observe Friday's double distribution early in the week. Remaining within the lower distribution would favor a downside continuation, while re-establishing acceptance within the upper distribution would increase the potential for two-sided activity.

The weekly level of interest is 4145, which represents the low volume node (LVN), separating Friday’s double distribution profile. Break and hold above 4145, indicating a potential for two-sided activity, would target a traverse of Friday’s upper distribution towards the daily NVPOC at 4180, as well as Wednesday’s VPOC at 4209. Break and hold above 4209 would target the resistance area from 4235 to the Weekly Extreme High of 4265, where selling activity can be expected. Note how this resistance area coincides with the lower end of the prior 3-week balance, the MA200 and the 20D VPOC, making it a crucial area for sellers to defend and buyers to reclaim.

Holding below 4145, favoring a downside continuation, would target the unfilled daily gap at 4098.25, as well as a full traverse of the multi-week balance area from early April to late May towards 4062. Break and hold below 4062 would target the support area from 4040 to the Weekly Extreme Low of 4010, where buying activity can be expected. The 4040 level represents a NVPOC from the last week of March, which was a week that broke out from a 3-week balance area. Additionally, take note of the unfilled daily gap at 4009.50.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 4145.

Break and hold above 4145 would target 4180 / 4209 / 4235 / 4265*

Holding below 4145 would target 4098 / 4062 / 4040 / 4010*

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, Buddy. Let's have another great week.