Visual Representation

Market Structure

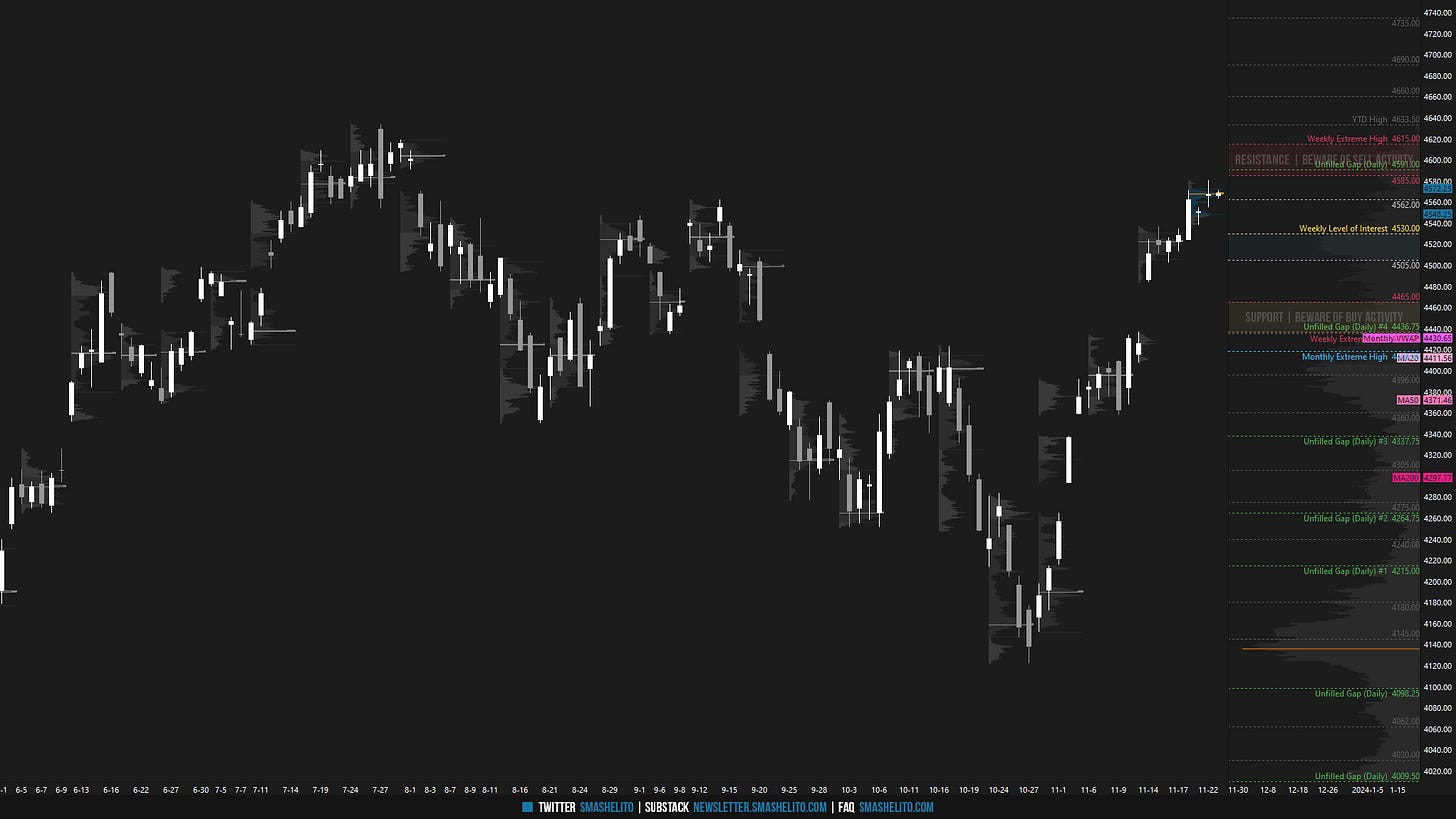

🟩 DAILY: OTFU | ENDS: 4562.75

🟩 WEEKLY: OTFU | ENDS: 4524.50

🟨 MONTHLY: BALANCE | TBD

Contextual Analysis

During the previous shortened week, the market kicked off with a multi-distribution trend day on Monday, breaching the September swing high of 4562 and effectively cleaning up the unfinished business at the upper end of the prior 4-day balance area. The rest of the week was fairly quiet, with the market successfully defending and accepting the breakout above the prior week’s high. During Wednesday's session, the market established its fifth gap higher since the low established on October 27th and also formed an excess high during the same session, which will be of interest in the short-term.

For this week, the main focus will be on the fifth unfilled gap since the low established October 27th, located at 4554.75. Failure to fill the gap indicates a continued absence of stronger sellers. Wednesday’s session established an excess high. As excess marks the end of one auction and the beginning of another, it becomes crucial to monitor the developments in the early part of the week. Buyers aim to promptly take out and negate the excess, targeting the unfilled daily gap above at 4591 and the year-to-date (YTD) high at 4633.50 (RTH), with untested overnight activity at 4634.50. The daily and weekly time frames are one-time framing up, and the primary objective for sellers is to break that pattern. Overall, the expectation is that buyers will continue to be active on dips as long as acceptance is not established below the prior 4-day balance area, which would open the door to a more profound decline.

The weekly level of interest is 4554.75, which represents the fifth unfilled gap since the low established October 27th. Holding above 4554.75, indicating continued absence of stronger sellers, would target the unfilled daily gap at 4591. Break and hold above 4591 would target the resistance area from 4615 to the Weekly Extreme High of 4645, where selling activity can be expected. Note how this resistance area coincides with the year-to-date (YTD) high at 4633.50, where there is also untested overnight activity at 4634.50.

Break and hold below 4554.75 would target the support area from 4520 to the Weekly Extreme Low of 4490, where buying activity can be expected. This would effectively put an end to the weekly one-time framing up in the process (4524.50). Note how this support area coincides with the lower end of the prior 4-day balance low. For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low. A preference is placed on achieving a weekly close below this level, as it would indicate the potential for a more profound decline.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 4554.75.

Holding above 4554.75 would target 4591 / 4615 / 4645* / 4690 / 4735

Break and hold below 4554.75 would target 4520 / 4490* / 4465 / 4436 / 4418

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you for your great work 🍀

Thanks for sharing