ES Weekly Plan | March 20-24, 2023

My expectations for the week ahead.

🟩 Daily: OTFU | Ends: 3932.50

🟥 Weekly: OTFD | Ends: 3999

🟨 Monthly: BALANCE | 3 Month | H: 4208.50 L: 3814.50

Weekly Extreme High: 4090

Weekly Extreme Low: 3800

As usual, a detailed daily plan will be published tomorrow.

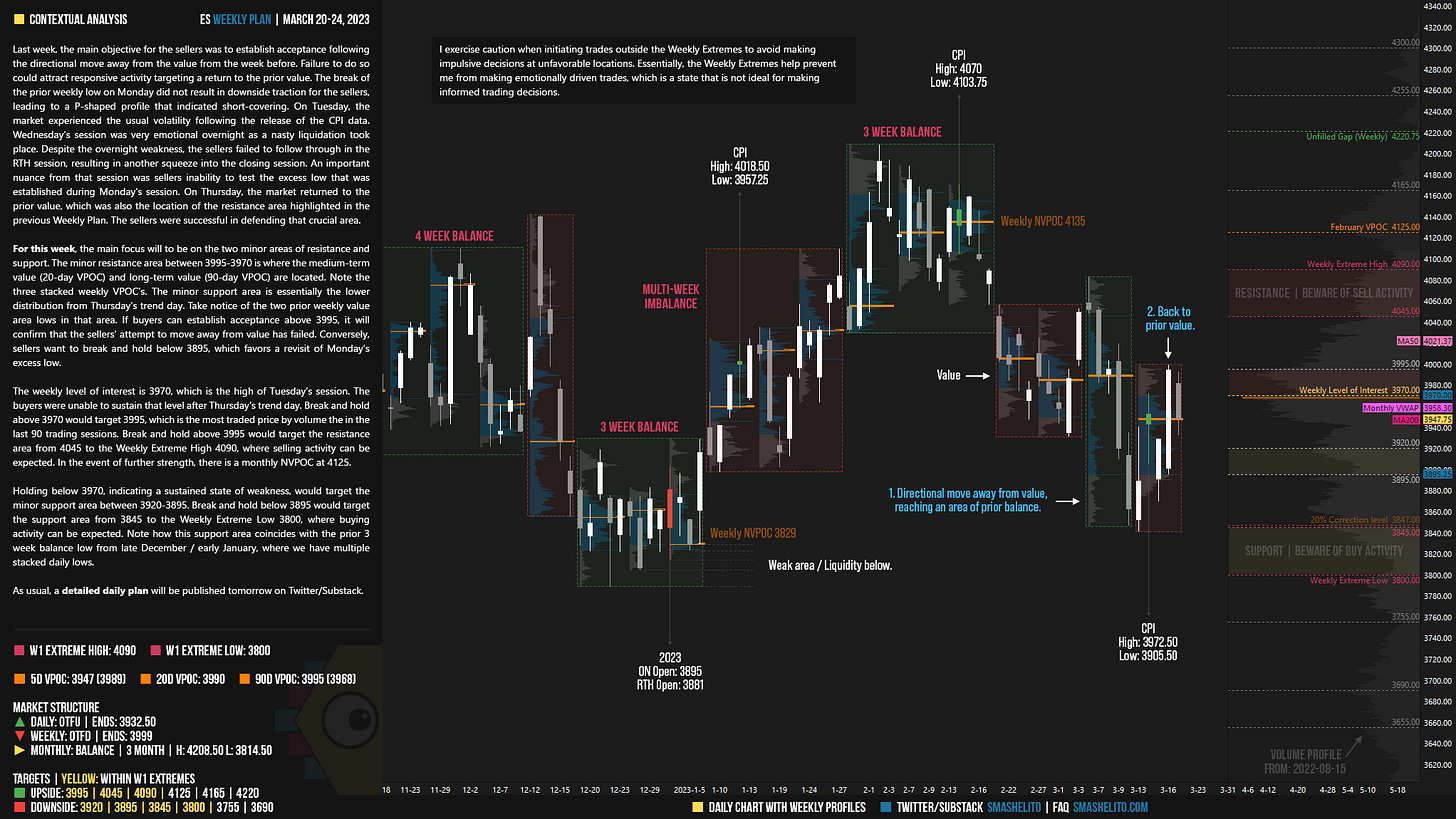

Last week, the main objective for the sellers was to establish acceptance following the directional move away from the value from the week before. Failure to do so could attract responsive activity targeting a return to the prior value. The break of the prior weekly low on Monday did not result in downside traction for the sellers, leading to a P-shaped profile that indicated short-covering. On Tuesday, the market experienced the usual volatility following the release of the CPI data. Wednesday’s session was very emotional overnight as a nasty liquidation took place. Despite the overnight weakness, the sellers failed to follow through in the RTH session, resulting in another squeeze into the closing session. An important nuance from that session was sellers inability to test the excess low that was established during Monday's session. On Thursday, the market returned to the prior value, which was also the location of the resistance area highlighted in the previous Weekly Plan. The sellers were successful in defending that crucial area.

For this week, the main focus will to be on the two minor areas of resistance and support. The minor resistance area between 3995-3970 is where the medium-term value (20-day VPOC) and long-term value (90-day VPOC) are located. Note the three stacked weekly VPOC’s. The minor support area is essentially the lower distribution from Thursday’s trend day. Take notice of the two prior weekly value area lows in that area. If buyers can establish acceptance above 3995, it will confirm that the sellers' attempt to move away from value has failed. Conversely, sellers want to break and hold below 3895, which favors a revisit of Monday’s excess low.

The weekly level of interest is 3970, which is the high of Tuesday’s session. The buyers were unable to sustain that level after Thursday's trend day. Break and hold above 3970 would target 3995, which is the most traded price by volume the in the last 90 trading sessions. Break and hold above 3995 would target the resistance area from 4045 to the Weekly Extreme High 4090, where selling activity can be expected. In the event of further strength, there is a monthly NVPOC at 4125.

Holding below 3970, indicating a sustained state of weakness, would target the minor support area between 3920-3895. Break and hold below 3895 would target the support area from 3845 to the Weekly Extreme Low 3800, where buying activity can be expected. Note how this support area coincides with the prior 3 week balance low from late December / early January, where we have multiple stacked daily lows.

🟩 Upside: 3995 | 4045 | 4090 | 4125 | 4165 | 4220

🟥 Downside: 3920 | 3895 | 3845 | 3800 | 3755 | 3690

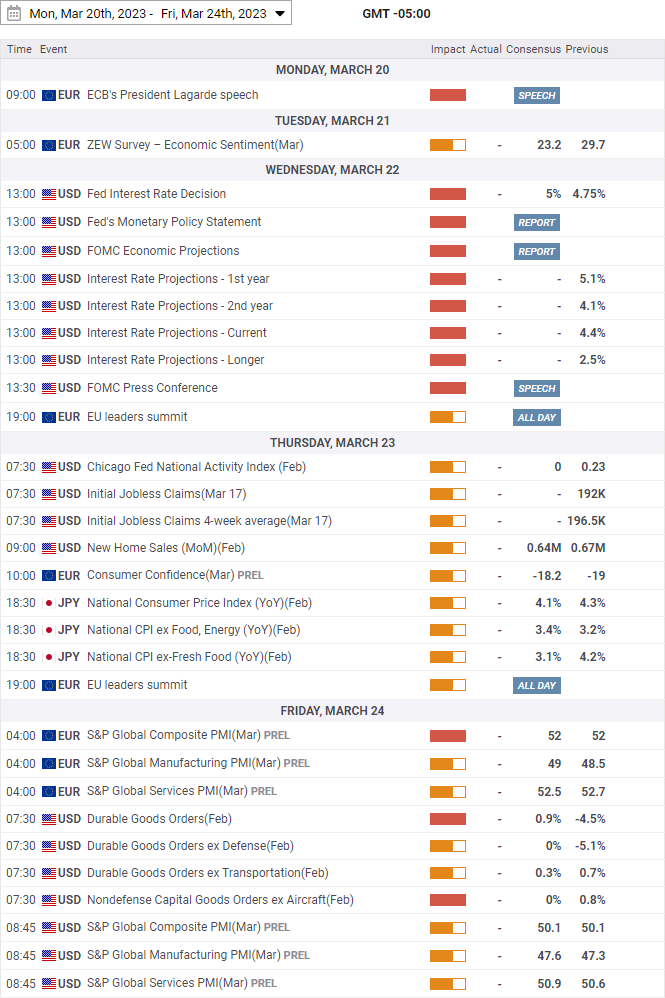

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Thanks Smashelito! Appreciate your help.. Do you suggest or planning to post some knowledge on the order flow and terminology you commonly use? If not, can you please