ES Weekly Plan | January 6-10, 2025

My expectations for the upcoming week.

Visual Representation

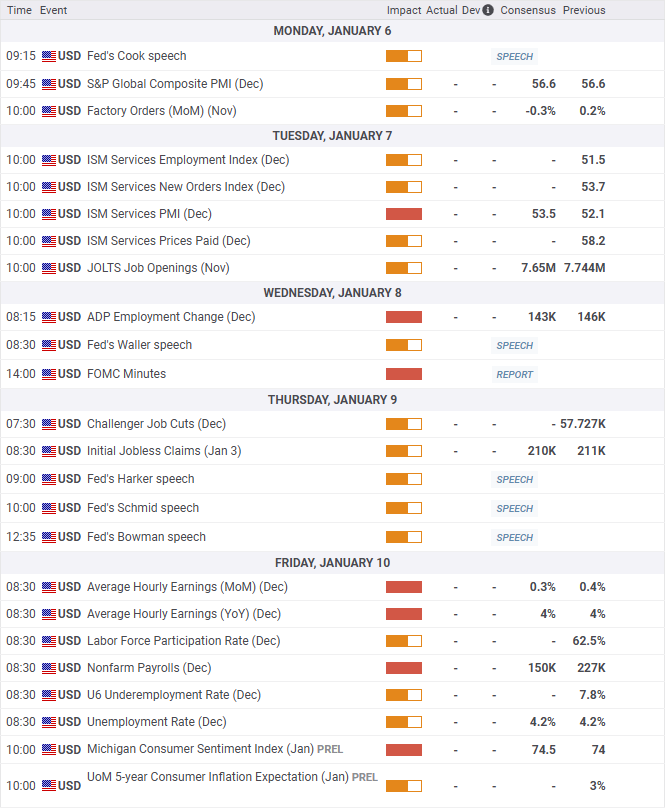

Economic Calendar

Market Structure

🟨 DAILY: BALANCE | 4D | 5996.75-5874.75

🟥 WEEKLY: OTFD | ENDS: 5996.75

🟨 MONTHLY: BALANCE | TBD

Contextual Analysis

During the previous week, the market experienced an inside week breakdown right on Monday, triggered by a weak overnight session that resulted in the RTH session opening with a true gap down. The weekly support area between 5930 and 5900 was already tested on Monday, and the rest of the week became a battle between buyers defending the weekly support and sellers defending the inside week breakdown. On Thursday, the Weekly Extreme Low of 5900 was tagged and exceeded, which not only shifted the weekly to one-time framing down but also ended the monthly one-time framing up—a solid achievement for the sellers. However, the time spent below 5900 was limited, as the session closed above this level, and the week concluded with a double distribution trend day up on Friday. The key early in the week will be to monitor whether this trend day is accepted or rejected, as it will provide clues about the market's next direction.

For this week, the main focus will be on buyers' ability to remain within the range of the prior week's "inside week", following Friday's double distribution trend day, which ended back inside that range. The strongest market response would involve accepting Friday’s trend day by holding 5965, where change took place, aligning with the "inside week" low. This would open the door to cleaning up structure above, including an unfilled gap, and would immediately end the weekly one-time framing down in the process. Failure to hold 5965 would open the door to traversing the previous week’s value area, with initiating selling activity below value support (VAL) unlocking further weakness.

The weekly Smashlevel is 5965, representing the low of last week's “inside week.” Holding above 5965 would target the high volume node (HVN) at 6014, immediately ending the weekly one-time framing down in the process. Acceptance above 6014 signals strength, targeting the unfilled gap at 6063.25, and the resistance area from 6095 to the Weekly Extreme High of 6125, where selling activity can be expected. This resistance area is the breakdown point from the FOMC weakness that buyers need to regain to negate the move, coinciding with the upper end of the inside week and the medium-term value (20D VPOC).

Break and hold below 5965 would target 5920—a pivotal level last week. Acceptance below 5920 signals weakness, targeting the support area from 5885 to the Weekly Extreme Low of 5855, where buying activity can be expected. Defending this support area is crucial for buyers; otherwise, it opens the door for a move back to the long-term value (90 VPOC) at 5785, effectively filling the gap at 5813.50 in the process. Note the 5% correction level, situated at 5856.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will closely observe the behavior around 5965.

Holding above 5965 would target 6014 / 6063 / 6095 / 6125* / 6163

Break and hold below 5965 would target 5920 / 5885 / 5855* / 5813 / 5785

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Thanks, HAGW!

Thank you!