ES Weekly Plan | Jan 29 - Feb 2, 2024

My expectations for the upcoming week.

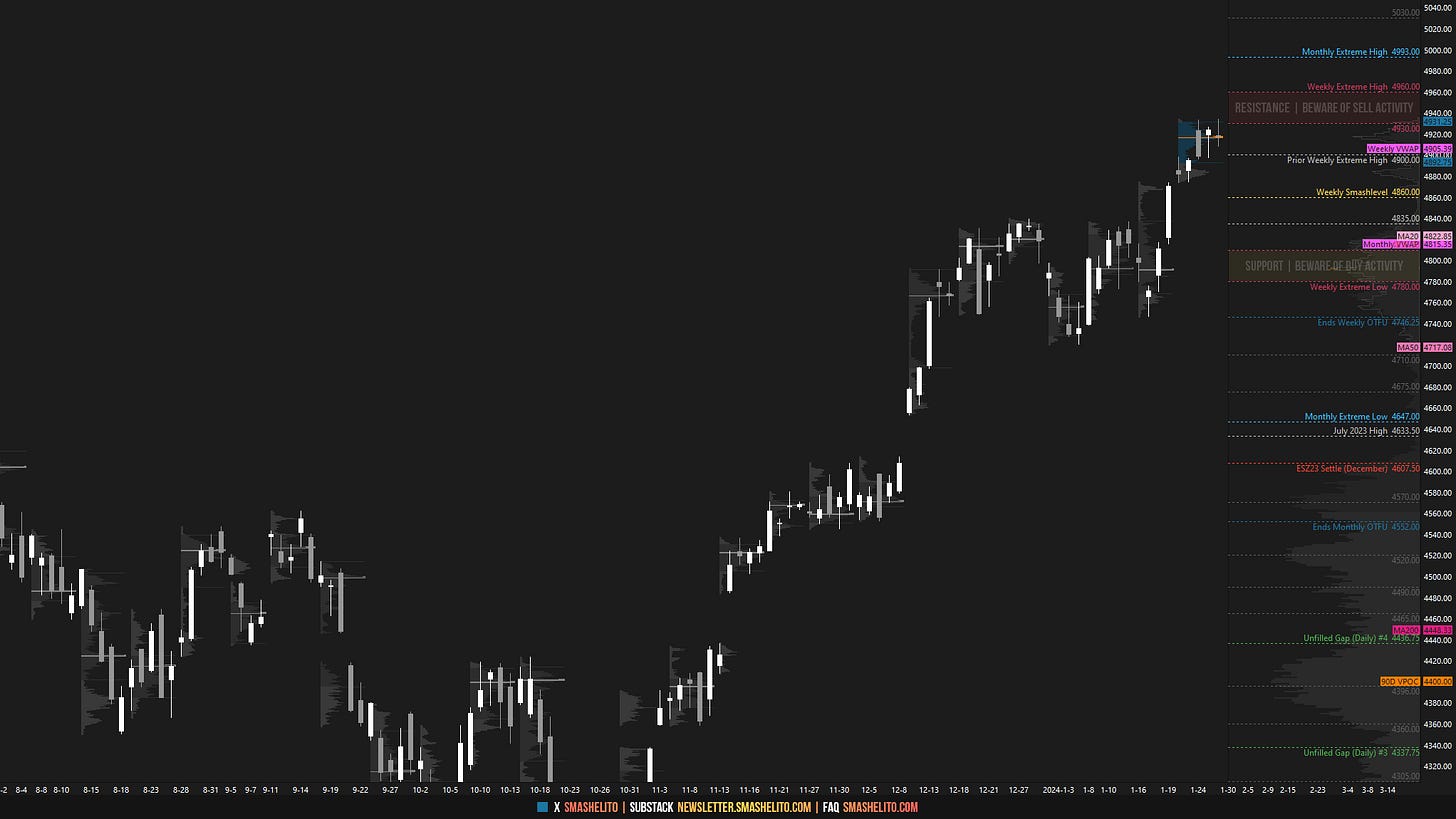

Visual Representation

Market Structure

🟩 DAILY: OTFU | ENDS: 4907.50

🟩 WEEKLY: OTFU | ENDS: 4873.50

🟩 MONTHLY: OTFU | ENDS: 4552

Contextual Analysis

During the previous week, buyers successfully achieved their primary objective of establishing value at higher prices, following the breakout from the prior 4-week balance area. Early in the week, a 2-day balance formed, which was subsequently breached to the upside on Wednesday. However, the upside momentum stalled for the rest of the week by the lower end of the weekly resistance area at 4930, resulting in the formation of a poor high, which we carry forward as unfinished business.

For this week, our main focus will be on the 3-day balance area, where the market is currently taking a breather following the breakout observed on Friday 19th. The upper extreme has unfinished business, marked by a non-excess high, while the lower extreme is considered weak. While the daily chart technically maintains its one-time framing up, due to sellers' continued inability to break a previous day’s low, the value of the last three sessions remains unchanged, suggesting short-term balance. Sellers, with their main objective to end the weekly one-time framing up, would prefer an immediate upside continuation leading to a cleanup of the high, followed by a failure, potentially sparking a counter-move. An immediate pullback without a cleanup is likely to encounter reloading buyers. Overall, buyers are not facing significant trouble as long as the highlighted weekly support area is maintained—trouble would kick in below.

The weekly Smashlevel (Pivot) is 4924, representing Friday’s afternoon rally high. Break and hold above 4924 would target an upside continuation toward the 100% range expansion level at 4960, effectively cleaning up the unfinished business in the process. Break and hold above 4960 would target the resistance area from 4975 to the Weekly Extreme High of 5005, where selling activity can be expected. It’s worth noting that the Monthly Extreme High (January) is located at 4993, adding an additional layer of confluence to the resistance area.

Holding below 4924 would target the lower end of the 3-day balance area at 4900—an inflection point last week. Break and hold below 4900 would target the support area from 4865 to the Weekly Extreme Low of 4835, where buying activity can be expected. Note how this support area coincides with the low volume area from the breakout on Friday 19th—a crucial area for buyers to hold.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 4924.

Break and hold above 4924 would target 4960 / 4975 / 4993 / 5005* / 5025

Holding below 4924 would target 4900 / 4865 / 4835* / 4810 / 4780

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy! It's been a great week, let's maintain this positive energy.