Visual Representation

Market Structure

🟨 DAILY: BALANCE | 10D | H: 5066.50 L: 4936.50

🟨 WEEKLY: BALANCE | 2W | H: 5066.50 L: 4936.50

🟩 MONTHLY: OTFU | ENDS: 4917.75

Contextual Analysis

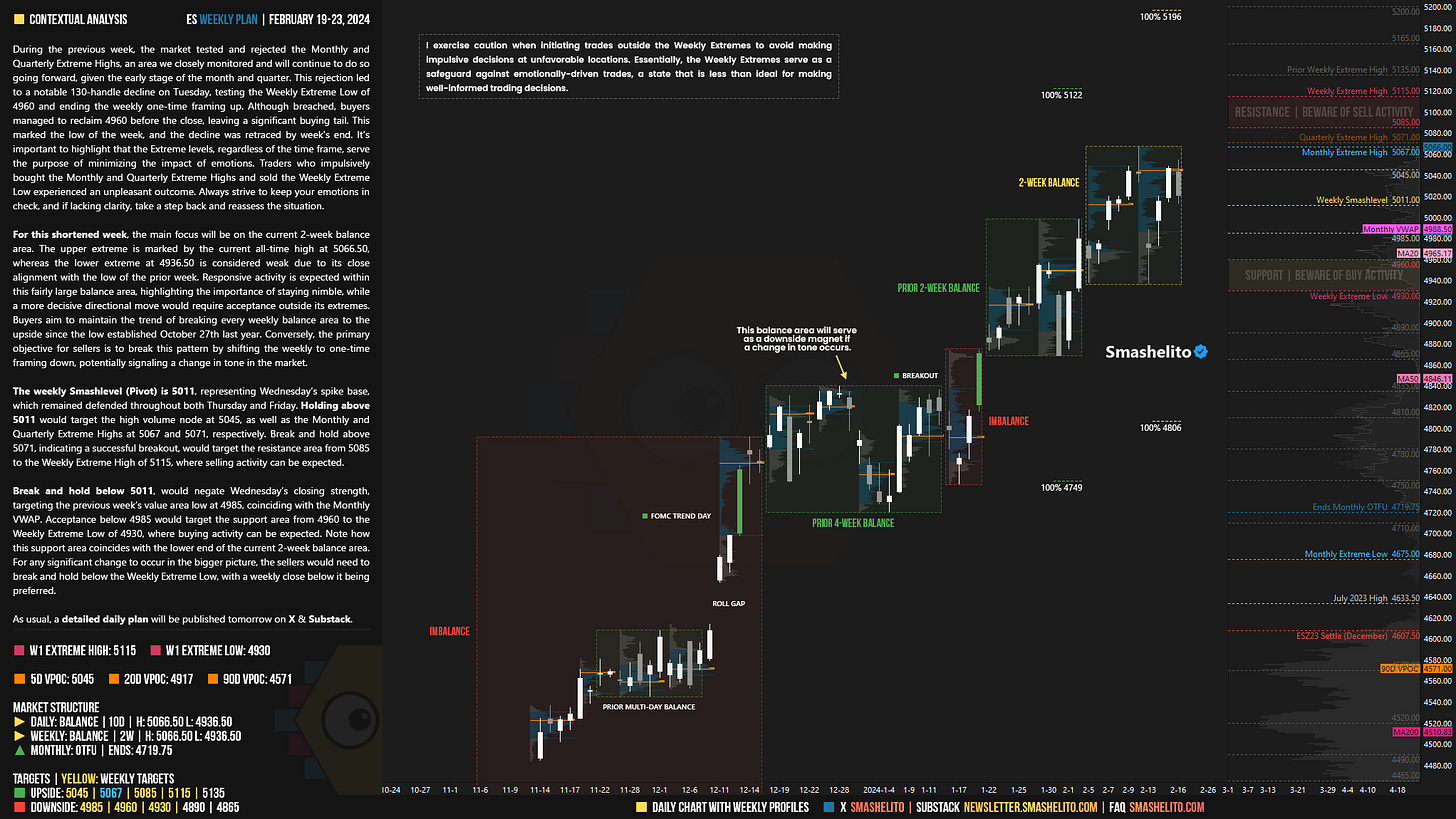

During the previous week, the market tested and rejected the Monthly and Quarterly Extreme Highs, an area we closely monitored and will continue to do so going forward, given the early stage of the month and quarter. This rejection led to a notable 130-handle decline on Tuesday, testing the Weekly Extreme Low of 4960 and ending the weekly one-time framing up. Although breached, buyers managed to reclaim 4960 before the close, leaving a significant buying tail. This marked the low of the week, and the decline was retraced by week's end. It's important to highlight that the Extreme levels, regardless of the time frame, serve the purpose of minimizing the impact of emotions. Traders who impulsively bought the Monthly and Quarterly Extreme Highs and sold the Weekly Extreme Low experienced an unpleasant outcome. Always strive to keep your emotions in check, and if lacking clarity, take a step back and reassess the situation.

For this week, the main focus will be on the current 2-week balance area. The upper extreme is marked by the current all-time high at 5066.50, whereas the lower extreme at 4936.50 is considered weak due to its close alignment with the low of the prior week. Responsive activity is expected within this fairly large balance area, highlighting the importance of staying nimble, while a more decisive directional move would require acceptance outside its extremes. Buyers aim to maintain the trend of breaking every weekly balance area to the upside since the low established October 27th last year. Conversely, the primary objective for sellers is to break this pattern by shifting the weekly to one-time framing down, potentially signaling a change in tone in the market.

The weekly Smashlevel (Pivot) is 5011, representing Wednesday’s spike base, which remained defended throughout both Thursday and Friday. Holding above 5011 would target the high volume node at 5045, as well as the Monthly and Quarterly Extreme Highs at 5067 and 5071, respectively. Break and hold above 5071, indicating a successful breakout, would target the resistance area from 5085 to the Weekly Extreme High of 5115, where selling activity can be expected.

Break and hold below 5011, would negate Wednesday’s closing strength, targeting the previous week’s value area low at 4985, coinciding with the Monthly VWAP. Acceptance below 4985 would target the support area from 4960 to the Weekly Extreme Low of 4930, where buying activity can be expected. Note how this support area coincides with the lower end of the current 2-week balance area. For any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred.

As usual, a detailed daily plan will be published tomorrow. In the meantime, enjoy the rest of your weekend!

Levels of Interest

In the upcoming week, I will observe 5011.

Holding above 5011 would target 5045 / 5067 / 5085 / 5115* / 5135

Break and hold below 5011 would target 4985 / 4960 / 4930* / 4890 / 4865

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy! Another amazing week, Friday your level x 5048 was key, sellers were holding that area and took shorts all the way, closed slightly earlier but caught around 19 handles.

Thank you! Your level on Friday 4032 provided a lot of opportunities. enjoy rest of your weekend!