ES Weekly Plan | August 14-18, 2023

Below are my expectations for the week ahead.

🟥 Daily: OTFD | Ends: 4493

🟥 Weekly: OTFD | Ends: 4544.75

🟩 Monthly: OTFU | Ends: 4419.50

Weekly Extreme High: 4575

Weekly Extreme Low: 4390

As usual, a detailed daily plan will be published tomorrow.

As I’ve mentioned since the month of April, for any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low, with a weekly close below it being preferred, and this indeed happened two weeks ago. During the previous week, the sellers were able to sustain their downside momentum, leading to a break of the 3-week balance low, shifting the weekly to one-time framing down for the first time since the month of March. On Friday, the market tested and held the MA50.

For this week, the main focus will on sellers’ ability to maintain below the prior 3-week balance low of 4493. The daily and weekly is one-time framing down, while the monthly one-time framing up remains intact. The buyers aim to re-establish acceptance within the prior 3-week balance area, with the primary objective of ending the weekly one-time framing down by breaking 4544.75. This would immediately put a question mark on the recent weakness. Conversely, the sellers aim to maintain downside pressure by establishing acceptance within the prior 4-week balance area, with the primary objective of ending the monthly one-time framing up by breaking 4419.50. I’ve added correction levels on the chart, with 5% at 4402 of short-term interest, coinciding with the weekly support area.

The weekly level of interest is 4493, representing both the prior 3-week balance low and Friday’s high. Break and hold above 4493 would target the value area high (VAH) from the previous week at 4520. Break and hold above 4520 would target the resistance area from 4545 to the Weekly Extreme High of 4575, where selling activity can be expected. Note how this resistance area coincides with the MA20, the value area high (VAH) of the inceluded 9-week volume profile, and the high of the previous week. This area is of immense importance as it presents a significant challenge for buyers to break and serves as a crucial area for sellers to defend in order to maintain downward pressure.

Holding below 4493 would target 4459, representing Friday’s low. Break and hold below 4459 would target the support area from 4420 to the Weekly Extreme Low of 4390, where buying activity can be expected. Be sure to observe that this support area coincides with the most traded price by volume (VPOC) from both the last nine weeks and the previous 4-week balance area, making it crucial for buyers to defend. Additionally, a break of 4419.50 would put the monthly one-time framing up to an end.

🟩 Upside: 4520 | 4545 | 4575 | 4604 | 4634

🟥 Downside: 4459 | 4420 | 4390 | 4355 | 4327

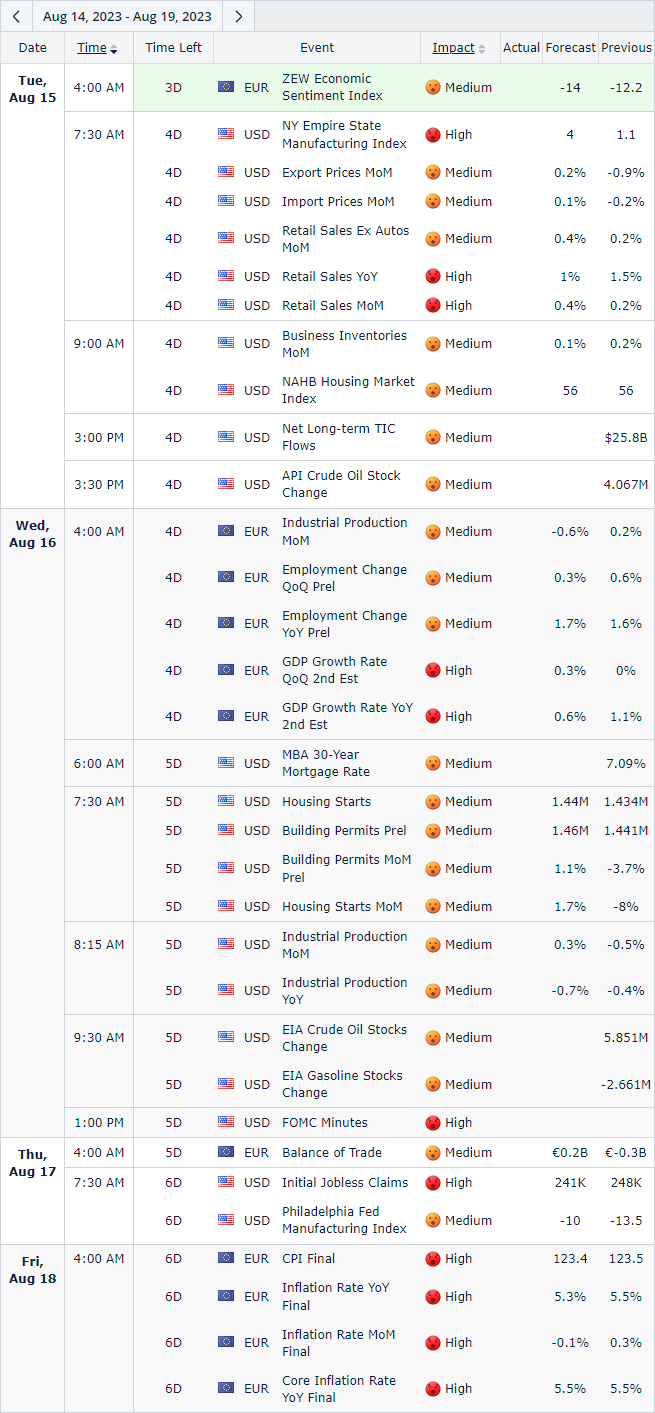

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

thanks a mill for the rundown boss! coming from a noob I cant thank you enough

Thank you buddy!