ES Weekly Plan | April 17-21, 2023

Below are my expectations for the week ahead.

🟩 Daily: OTFU | Ends: 4138

🟩 Weekly: OTFU | Ends: 4098.75

🟨 Monthly: BALANCE | 3 Month | H: 4208.50 L: 3814.50

Weekly Extreme High: 4265

Weekly Extreme Low: 4060

As usual, a detailed daily plan will be published tomorrow.

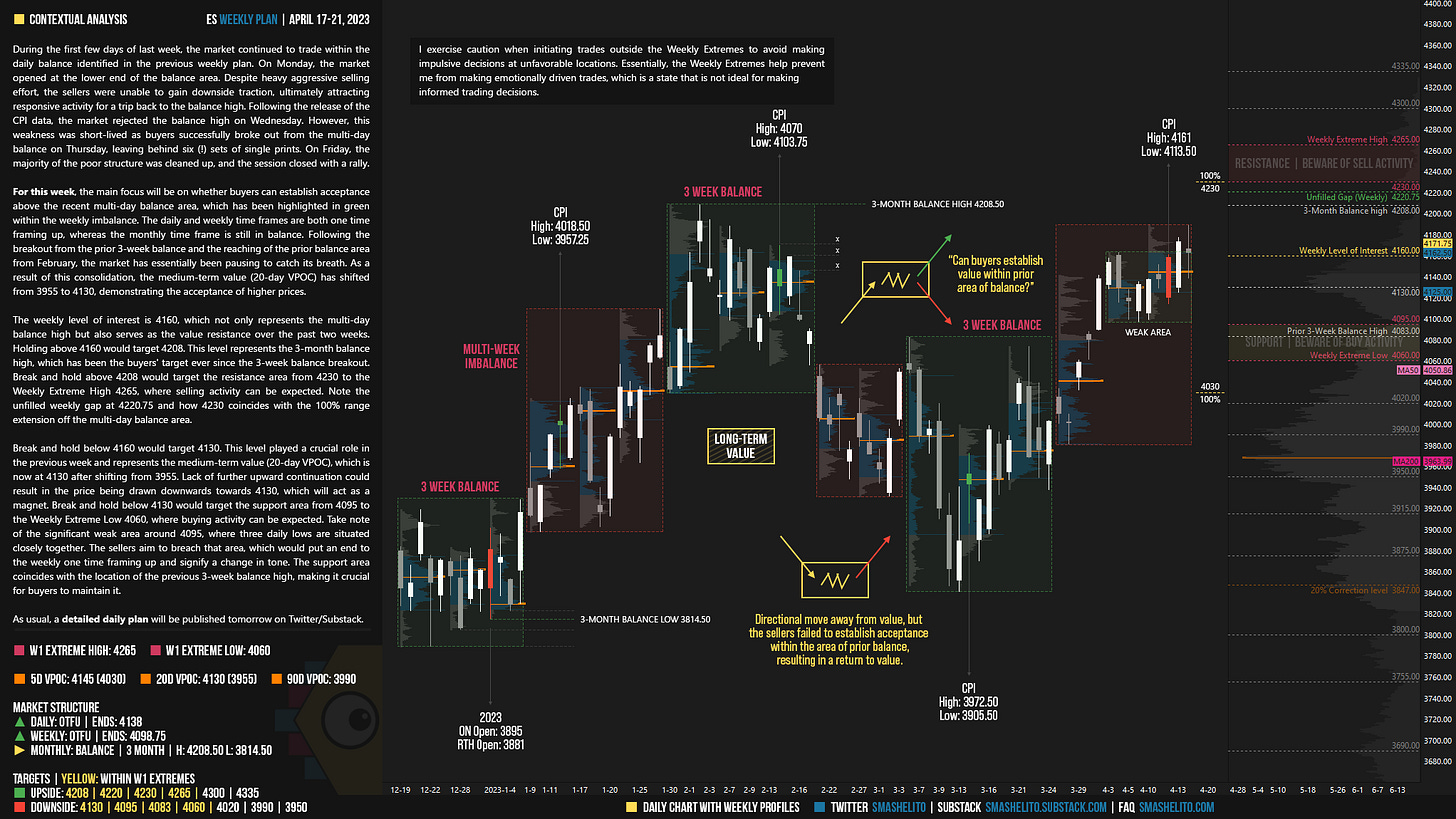

During the first few days of last week, the market continued to trade within the daily balance identified in the previous weekly plan. On Monday, the market opened at the lower end of the balance area. Despite heavy aggressive selling effort, the sellers were unable to gain downside traction, ultimately attracting responsive activity for a trip back to the balance high. Following the release of the CPI data, the market rejected the balance high on Wednesday. However, this weakness was short-lived as buyers successfully broke out from the multi-day balance on Thursday, leaving behind six (!) sets of single prints. On Friday, the majority of the poor structure was cleaned up, and the session closed with a rally.

For this week, the main focus will be on whether buyers can establish acceptance above the recent multi-day balance area, which has been highlighted in green within the weekly imbalance. The daily and weekly time frames are both one time framing up, whereas the monthly time frame is still in balance. Following the breakout from the prior 3-week balance and the reaching of the prior balance area from February, the market has essentially been pausing to catch its breath. As a result of this consolidation, the medium-term value (20-day VPOC) has shifted from 3955 to 4130, demonstrating the acceptance of higher prices.

The weekly level of interest is 4160, which not only represents the multi-day balance high but also serves as the value resistance over the past two weeks. Holding above 4160 would target 4208. This level represents the 3-month balance high, which has been the buyers' target ever since the 3-week balance breakout. Break and hold above 4208 would target the resistance area from 4230 to the Weekly Extreme High 4265, where selling activity can be expected. Note the unfilled weekly gap at 4220.75 and how 4230 coincides with the 100% range extension off the multi-day balance area.

Break and hold below 4160 would target 4130. This level played a crucial role in the previous week and represents the medium-term value (20-day VPOC), which is now at 4130 after shifting from 3955. Lack of further upward continuation could result in the price being drawn downwards towards 4130, which will act as a magnet. Break and hold below 4130 would target the support area from 4095 to the Weekly Extreme Low 4060, where buying activity can be expected. Take note of the significant weak area around 4095, where three daily lows are situated closely together. The sellers aim to breach that area, which would put an end to the weekly one time framing up and signify a change in tone. The support area coincides with the location of the previous 3-week balance high, making it crucial for buyers to maintain it.

🟩 Upside: 4208 | 4220 | 4230 | 4265 | 4300 | 4335

🟥 Downside: 4130 | 4095 | 4083 | 4060 | 4020 | 3990 | 3950

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Incredibly detailed roadmap of the above and below of the weekly smash level!! Thanks again for your analysis!

been following for last month, and your planned levels are spot on. I haven’t begun utilizing VIX as strength/weakness confirmation but will give that a try this week. Really appreciate the lessons Smash 🥷