ES Daily Plan | September 8, 2023

Buyers primarily aim to bring the daily back to balance by ending to the daily one-time framing down.

Sellers aim to continue establishing acceptance at lower prices after yesterday's breakout from balance.

Contextual Analysis

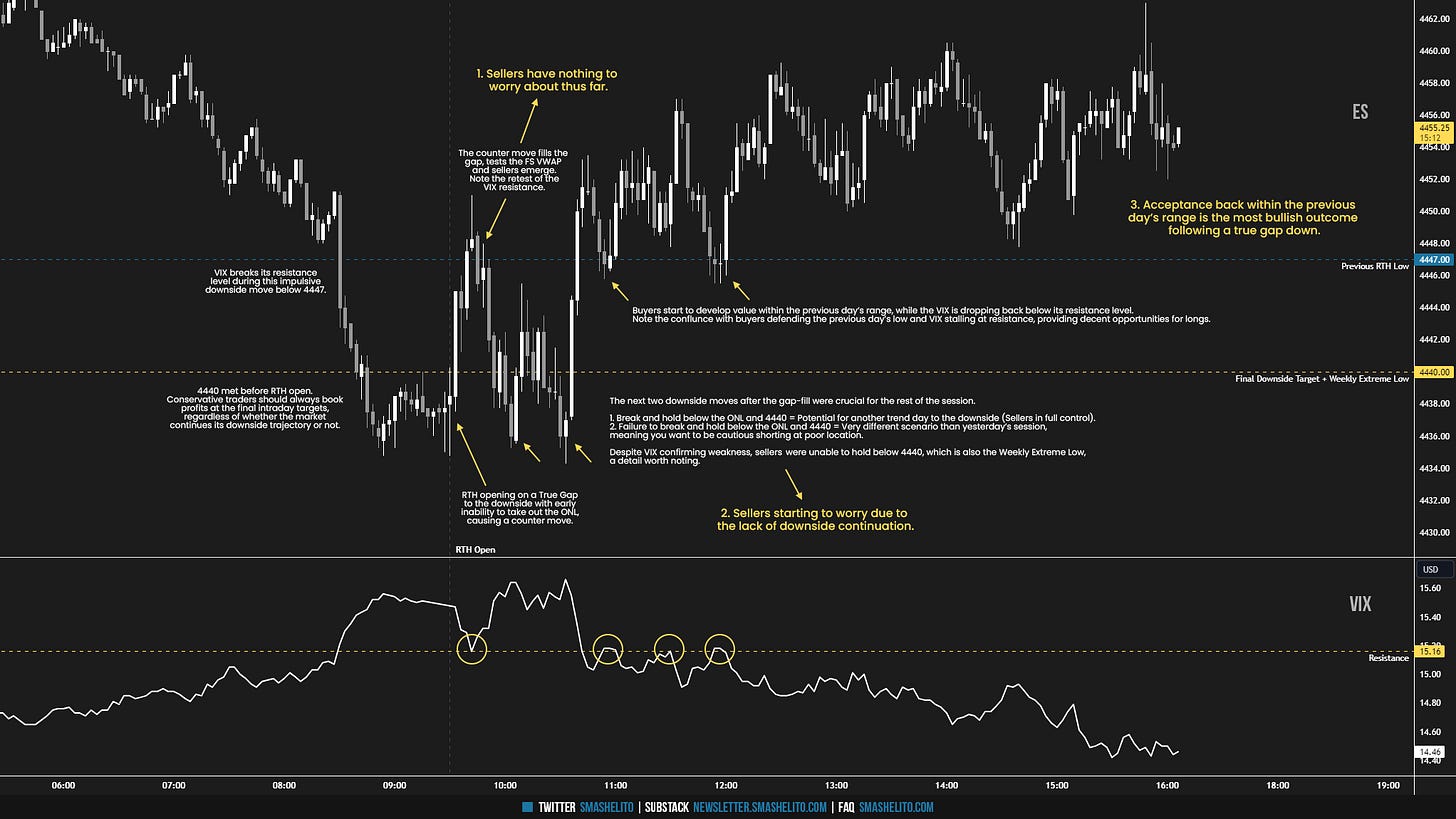

During the overnight (ON) session, buyers failed to reclaim the Smashlevel of 4473, indicating continued weakness, with an ON high of 4471.75. The initial target of 4458 on the downside was reached in the Asian session, and the final target of 4440 was accomplished in the European session. The downside pressure stalled slightly below 4440, where a lot of trading activity was observed prior to the RTH open, leading to the overnight VPOC shifting to 4436. The VIX breached its resistance level of 15.16 during the price exploration below yesterday’s range.

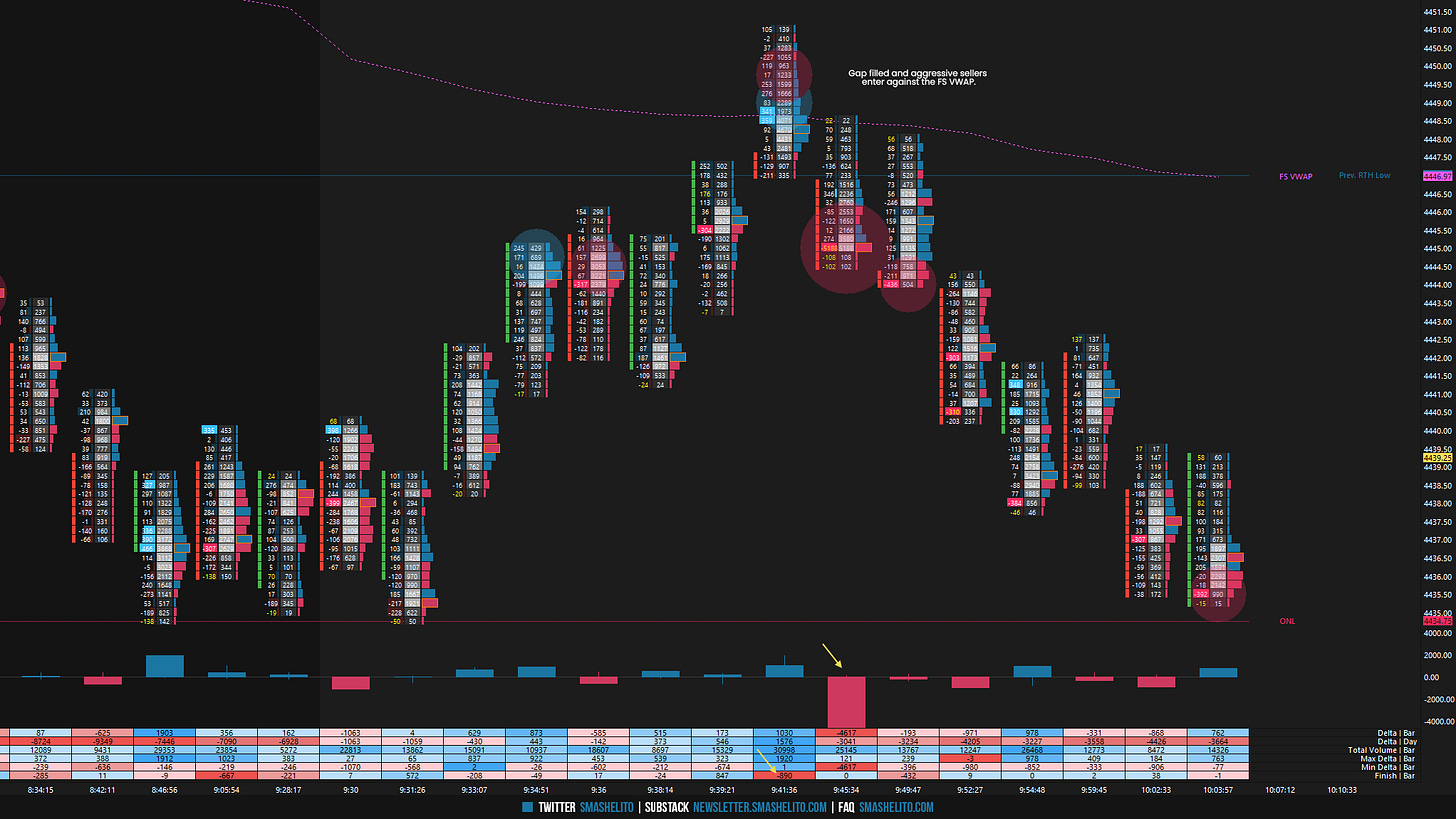

Just like yesterday, today’s RTH session opened on a true gap to the downside. However, the outcome today diverged significantly from that of yesterday. The early inability to break and sustain a move below the ONL led to a counter-move. The gap was filled, a scenario that stronger sellers would not have allowed. However, sellers are not in any real trouble as long as buyers are unable to establish acceptance within the previous day’s range. Aggressive sellers entered as the gap was filled, leaning against the FS VWAP. Did you notice how the VIX retested its broken resistance during that sequence? I will publish a separate recap of today’s session on Substack, explaining my thought process. Sellers were ultimately unable to establish acceptance below the ONL and 4440, forming a poor low. This clearly indicated a cautionary signal against being overly aggressive with short positions, especially considering that 4440 is also the Weekly Extreme Low. Following the unsuccessful attempt at a downside continuation, buyers managed to establish value within the range of the previous day, presenting a few interesting long setups.

The sellers remain in short-term control, as the daily one-time framing down remains intact. The market has currently stalled within the weekly support area from the Weekly Plan (4470-4440). I will use today’s spike base of 4460 as a short-term reference point to gauge strength/weakness. Buyers are primarily aiming to bring the daily back to balance by putting an end to the daily one-time framing down. This could potentially pave the way for filling some of Wednesday's poor structure. Sellers are aiming to continue establishing acceptance at these lower prices after breaking out from the prior 4DB area, and shift the short-term value (5D VPOC) lower, currently at 4517.

For tomorrow, the Smashlevel (Pivot) is 4460, representing the M-period spike base. Break and hold above 4460 would target the prior Smashlevel of 4473, coinciding with the Weekly VWAP. Break and hold above 4473 would target fills of the highlighted poor structure towards the final upside target of 4489. Holding below 4460, indicating continued weakness, would target the Weekly Extreme Low of 4440, as well as the final downside target of 4425.

Going into tomorrow's session, I will observe 4460.

Break and hold above 4460 would target 4473 / 4489

Holding below 4460 would target 4440 / 4425

Additionally, pay attention to the following VIX levels: 15.12 and 13.68. These levels can provide confirmation of strength or weakness.

Break and hold above 4489 with VIX below 13.68 would confirm strength.

Break and hold below 4425 with VIX above 15.12 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy. Your analysis is perfect.

Thank you Smash!