ES Daily Plan | September 4, 2024

My preparations and expectations for the upcoming session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

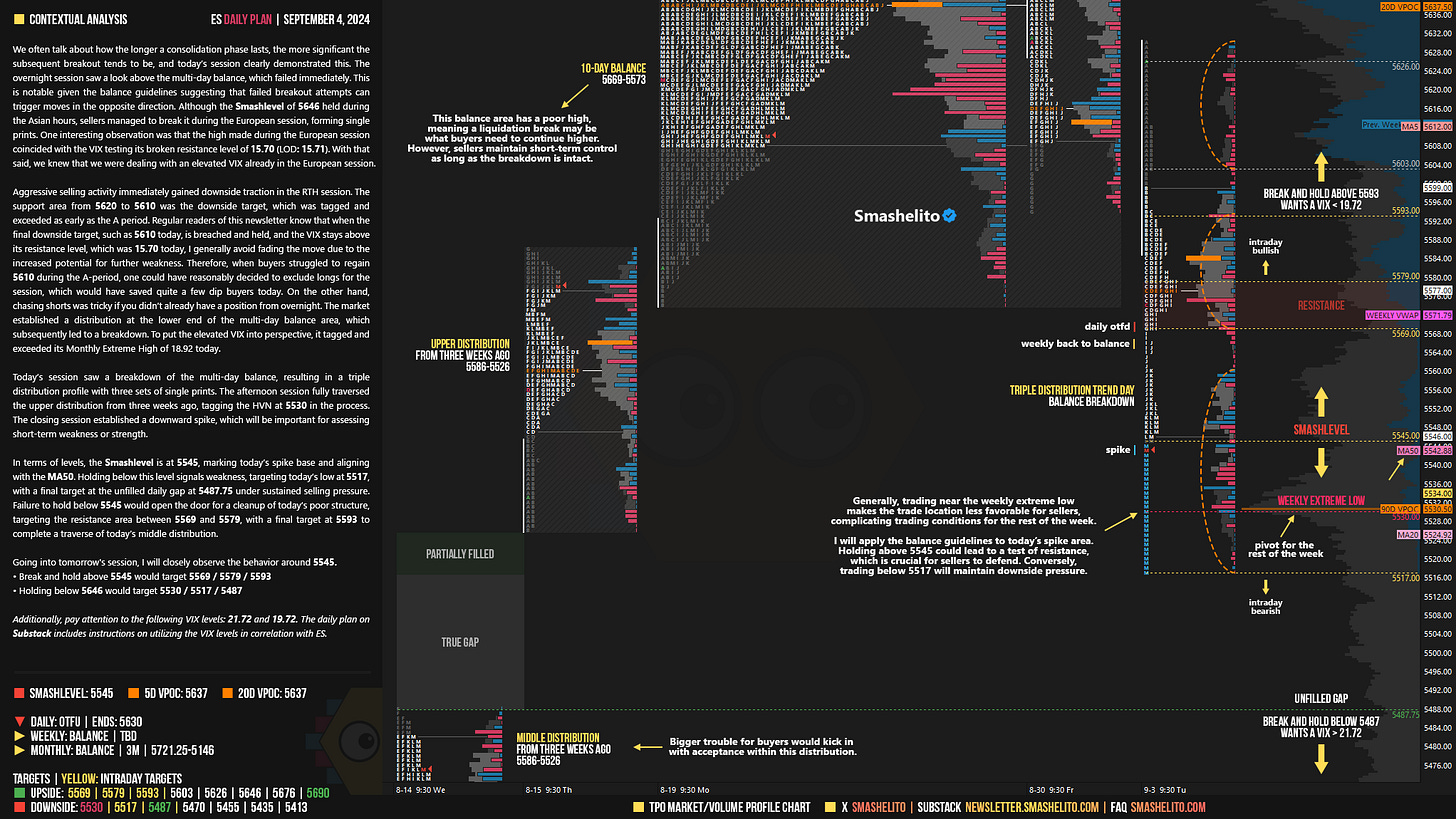

We often talk about how the longer a consolidation phase lasts, the more significant the subsequent breakout tends to be, and today’s session clearly demonstrated this. The overnight session saw a look above the multi-day balance, which failed immediately. This is notable given the balance guidelines suggesting that failed breakout attempts can trigger moves in the opposite direction. Although the Smashlevel of 5646 held during the Asian hours, sellers managed to break it during the European session, forming single prints. One interesting observation was that the high made during the European session coincided with the VIX testing its broken resistance level of 15.70 (LOD: 15.71). With that said, we knew that we were dealing with an elevated VIX already in the European session.

Aggressive selling activity immediately gained downside traction in the RTH session. The support area from 5620 to 5610 was the downside target, which was tagged and exceeded as early as the A period. Regular readers of this newsletter know that when the final downside target, such as 5610 today, is breached and held, and the VIX stays above its resistance level, which was 15.70 today, I generally avoid fading the move due to the increased potential for further weakness. Therefore, when buyers struggled to regain 5610 during the A-period, one could have reasonably decided to exclude longs for the session, which would have saved quite a few dip buyers today. On the other hand, chasing shorts was tricky if you didn’t already have a position from overnight. The market established a distribution at the lower end of the multi-day balance area, which subsequently led to a breakdown. To put the elevated VIX into perspective, it tagged and exceeded its Monthly Extreme High of 18.92 today.

Today’s session saw a breakdown of the multi-day balance, resulting in a triple distribution profile with three sets of single prints. The afternoon session fully traversed the upper distribution from three weeks ago, tagging the HVN at 5530 in the process. The closing session established a downward spike, which will be important for assessing short-term weakness or strength.

In terms of levels, the Smashlevel is at 5545, marking today’s spike base and aligning with the MA50. Holding below this level signals weakness, targeting today’s low at 5517, with a final target at the unfilled daily gap at 5487.75 under sustained selling pressure. Failure to hold below 5545 would open the door for a cleanup of today’s poor structure, targeting the resistance area between 5569 and 5579, with a final target at 5593 to complete a traverse of today’s middle distribution.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5545.

Break and hold above 5545 would target 5569 / 5579 / 5593

Holding below 5545 would target 5530 / 5517 / 5487

Additionally, pay attention to the following VIX levels: 21.72 and 19.72. These levels can provide confirmation of strength or weakness.

Break and hold above 5593 with VIX below 19.72 would confirm strength.

Break and hold below 5487 with VIX above 21.72 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thanks Smash! Great narrative I went back to review your weekly letter it was laid out that the possibility of breakdown and dint expect it to be this devastating

Learning experience to pay attention and look for a great set

Missed a great move downside

Really appreciate your comments and sharing knowledge

Thanks Smash! Can sellers break 5530 is the question!