ES Daily Plan | September 25, 2024

My preparations and expectations for the upcoming session.

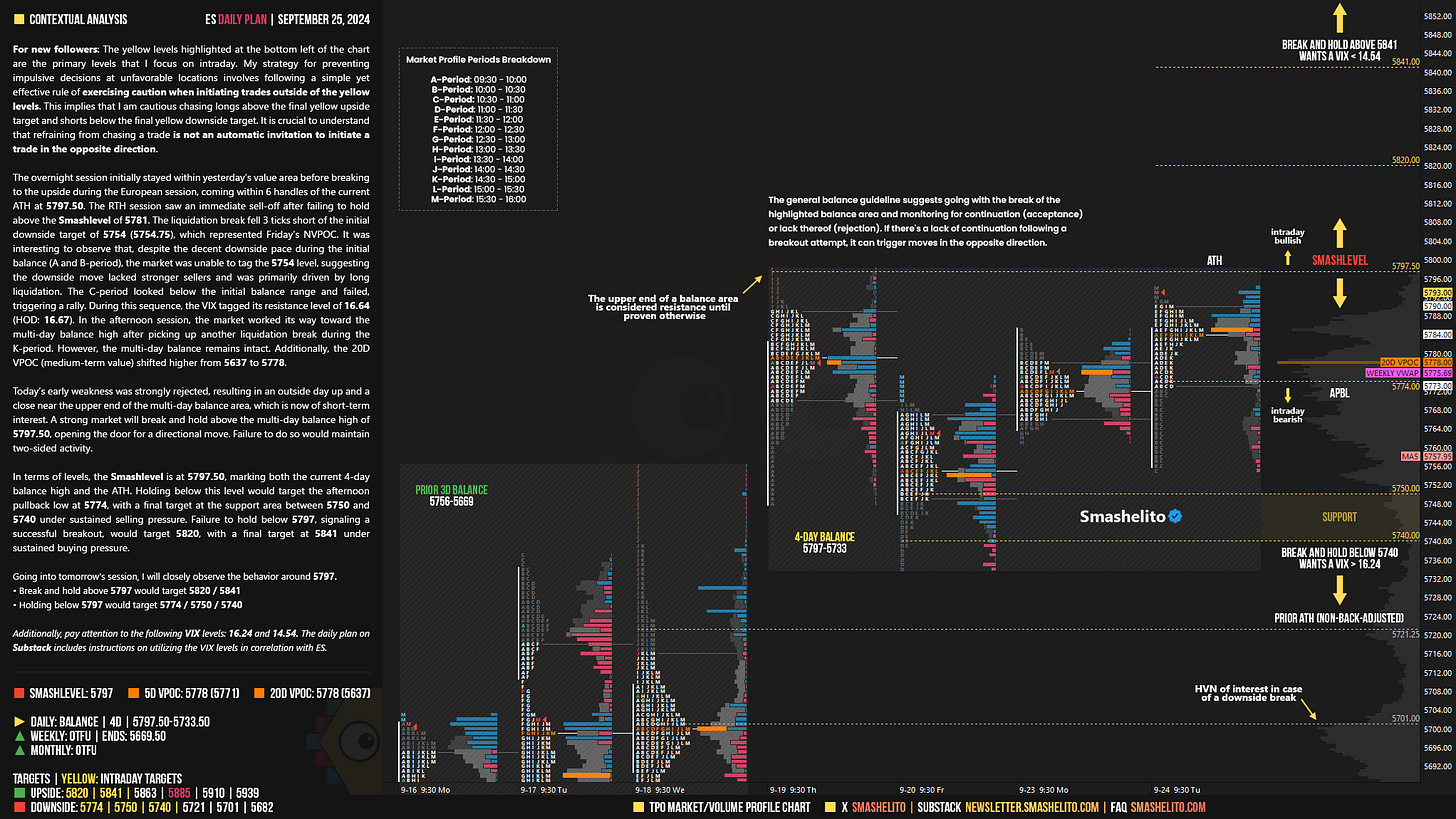

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

The overnight session initially stayed within yesterday’s value area before breaking to the upside during the European session, coming within 6 handles of the current ATH at 5797.50. The RTH session saw an immediate sell-off after failing to hold above the Smashlevel of 5781. The liquidation break fell 3 ticks short of the initial downside target of 5754 (5754.75), which represented Friday’s NVPOC. It was interesting to observe that, despite the decent downside pace during the initial balance (A and B-period), the market was unable to tag the 5754 level, suggesting the downside move lacked stronger sellers and was primarily driven by long liquidation. The C-period looked below the initial balance range and failed, triggering a rally. During this sequence, the VIX tagged its resistance level of 16.64 (HOD: 16.67). In the afternoon session, the market worked its way toward the multi-day balance high after picking up another liquidation break during the K-period. However, the multi-day balance remains intact. Additionally, the 20D VPOC (medium-term value) shifted higher from 5637 to 5778.

Today’s early weakness was strongly rejected, resulting in an outside day up and a close near the upper end of the multi-day balance area, which is now of short-term interest. A strong market will break and hold above the multi-day balance high of 5797.50, opening the door for a directional move. Failure to do so would maintain two-sided activity.

In terms of levels, the Smashlevel is at 5797.50, marking both the current 4-day balance high and the ATH. Holding below this level would target the afternoon pullback low at 5774, with a final target at the support area between 5750 and 5740 under sustained selling pressure. Failure to hold below 5797, signaling a successful breakout, would target 5820, with a final target at 5841 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5797.

Break and hold above 5797 would target 5820 / 5841

Holding below 5797 would target 5774 / 5750 / 5740

Additionally, pay attention to the following VIX levels: 16.24 and 14.54. These levels can provide confirmation of strength or weakness.

Break and hold above 5841 with VIX below 14.54 would confirm strength.

Break and hold below 5740 with VIX above 16.24 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Lovely plan🔥👌. What is APBL?

Where do you live, roughly?