ES Daily Plan | September 18, 2023

Thursday’s session was completely negated, leading to a triple distribution trend day to the downside on Friday.

In the short term, I'm focusing on Friday's lower distribution to gauge the strength/weakness of the sellers.

Contextual Analysis

I posted a recap of Friday’s session on Substack, where I briefly elaborated on my thought process. I managed to stay away from buying the dip, basing my actions on the information outlined in Friday's daily plan. To my new followers (thank you and welcome), I post daily plans that are made available at the opening of each overnight session. These plans are essentially my personal preparations that I am sharing with all of you.

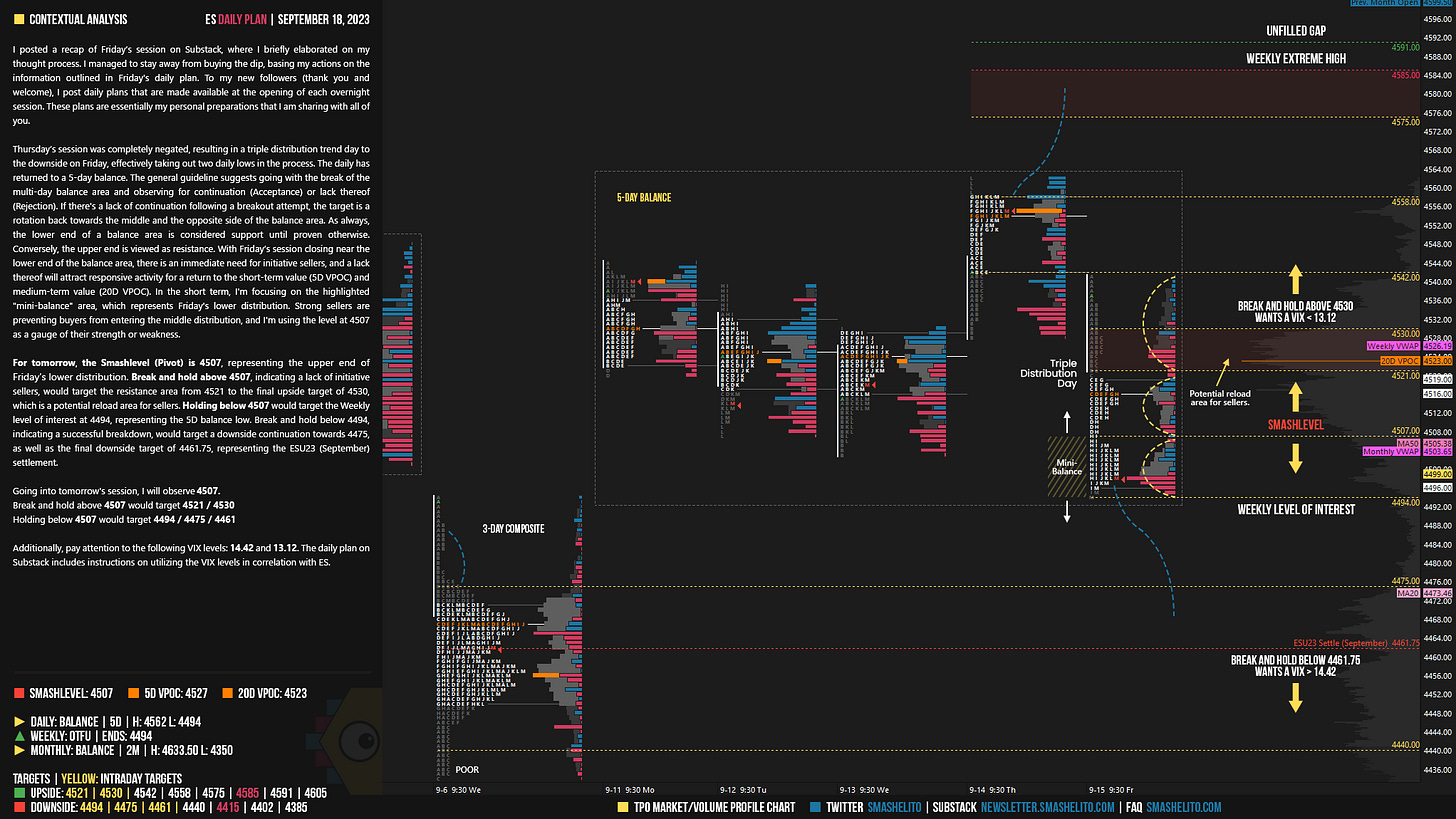

Thursday’s session was completely negated, resulting in a triple distribution trend day to the downside on Friday, effectively taking out two daily lows in the process. The daily has returned to a 5-day balance. The general guideline suggests going with the break of the multi-day balance area and observing for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, the target is a rotation back towards the middle and the opposite side of the balance area. As always, the lower end of a balance area is considered support until proven otherwise. Conversely, the upper end is viewed as resistance. With Friday’s session closing near the lower end of the balance area, there is an immediate need for initiative sellers, and a lack thereof will attract responsive activity for a return to the short-term value (5D VPOC) and medium-term value (20D VPOC). In the short term, I'm focusing on the highlighted "mini-balance" area, which represents Friday's lower distribution. Strong sellers are preventing buyers from entering the middle distribution, and I'm using the level at 4507 as a gauge of their strength or weakness.

For tomorrow, the Smashlevel (Pivot) is 4507, representing the upper end of Friday’s lower distribution. Break and hold above 4507, indicating a lack of initiative sellers, would target the resistance area from 4521 to the final upside target of 4530, which is a potential reload area for sellers. Holding below 4507 would target the Weekly level of interest at 4494, representing the 5D balance low. Break and hold below 4494, indicating a successful breakdown, would target a downside continuation towards 4475, as well as the final downside target of 4461.75, representing the ESU23 (September) settlement.

Going into tomorrow's session, I will observe 4507.

Break and hold above 4507 would target 4521 / 4530

Holding below 4507 would target 4494 / 4475 / 4461

Additionally, pay attention to the following VIX levels: 14.42 and 13.12. These levels can provide confirmation of strength or weakness.

Break and hold above 4530 with VIX below 13.12 would confirm strength.

Break and hold below 4461 with VIX above 14.42 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

great analysis as usual. Semis are selling off pretty steadily, and we are going towards another government shutdown drama. Sellers have the initiative here

Thanks Smash. Always informative