ES Daily Plan | September 17, 2024

My preparations and expectations for the upcoming session.

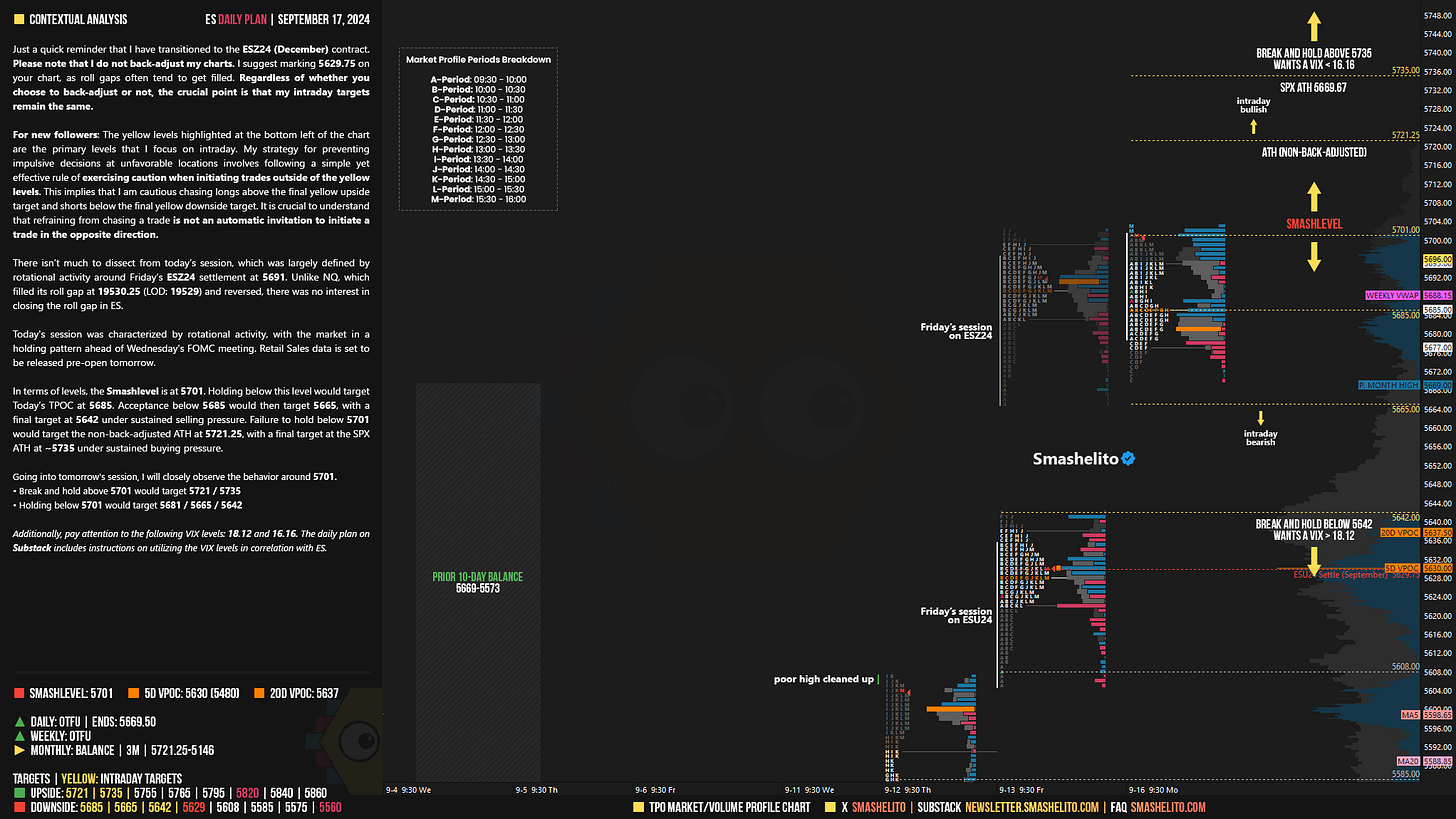

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Just a quick reminder that I have transitioned to the ESZ24 (December) contract. Please note that I do not back-adjust my charts. I suggest marking 5629.75 on your chart, as roll gaps often tend to get filled. Regardless of whether you choose to back-adjust or not, the crucial point is that my intraday targets remain the same.

There isn’t much to dissect from today’s session, which was largely defined by rotational activity around Friday’s ESZ24 settlement at 5691. Unlike NQ, which filled its roll gap at 19530.25 (LOD: 19529) and reversed, there was no interest in closing the roll gap in ES.

Today's session was characterized by rotational activity, with the market in a holding pattern ahead of Wednesday's FOMC meeting. Retail Sales data is set to be released pre-open tomorrow.

In terms of levels, the Smashlevel is at 5701. Holding below this level would target Today’s TPOC at 5685. Acceptance below 5685 would then target 5665, with a final target at 5642 under sustained selling pressure. Failure to hold below 5701 would target the non-back-adjusted ATH at 5721.25, with a final target at the SPX ATH at ~5735 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5701.

Break and hold above 5701 would target 5721 / 5735

Holding below 5701 would target 5685 / 5665 / 5642

Additionally, pay attention to the following VIX levels: 18.12 and 16.16. These levels can provide confirmation of strength or weakness.

Break and hold above 5735 with VIX below 16.16 would confirm strength.

Break and hold below 5642 with VIX above 18.12 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Beautiful work! Monday’s balance overlapped (tight range) with Friday’s. Wednesday or days after should be interesting. OTFU or OTFD will be wild 🔥🔥🔥

Thank you!