ES Daily Plan | September 14, 2023

Contextually, not much changed after today's session. Levels remain unchanged. PPI tomorrow.

Contextual Analysis

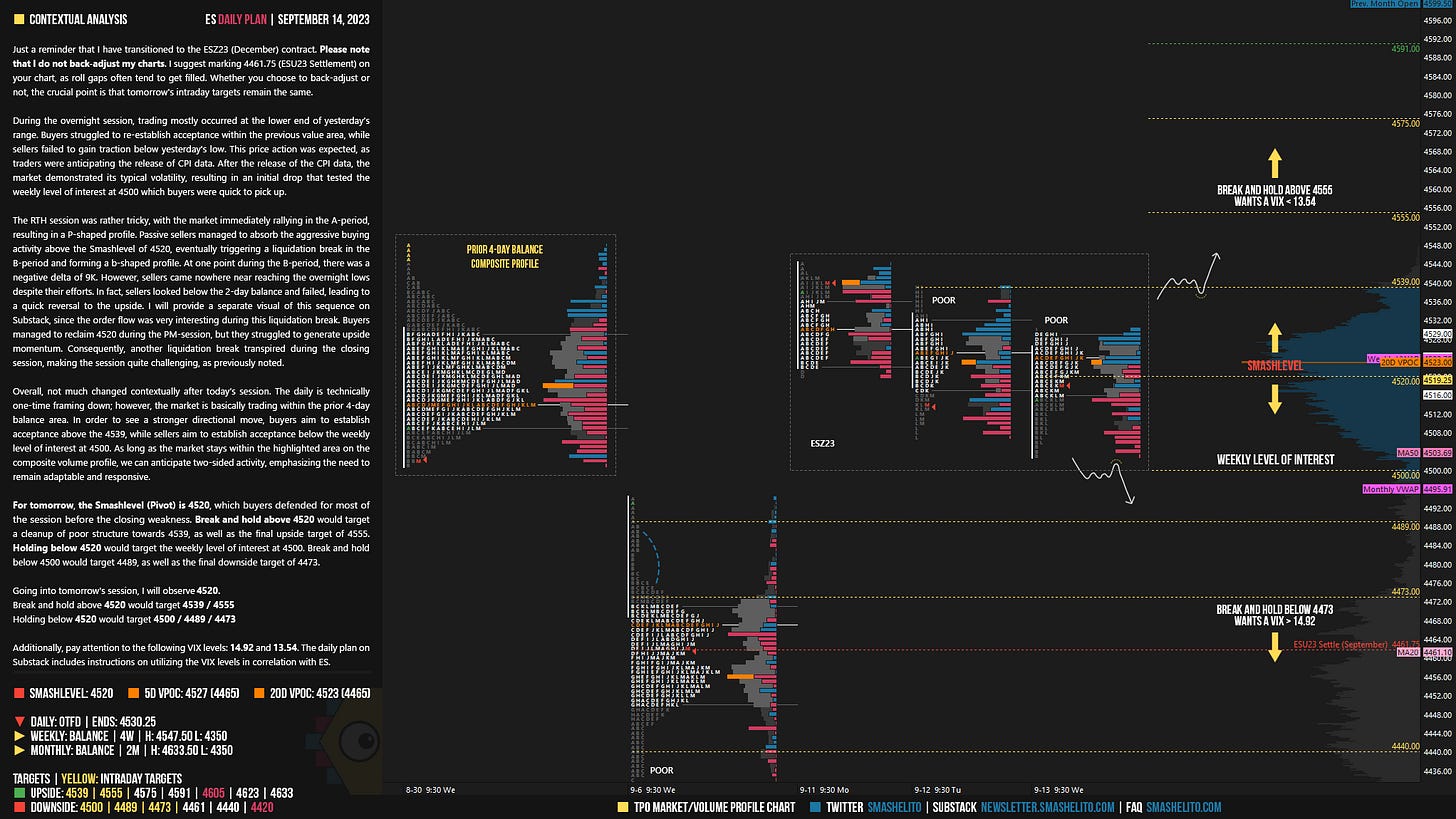

Just a reminder that I have transitioned to the ESZ23 (December) contract. Please note that I do not back-adjust my charts. I suggest marking 4461.75 (ESU23 Settlement) on your chart, as roll gaps often tend to get filled. Whether you choose to back-adjust or not, the crucial point is that tomorrow's intraday targets remain the same.

During the overnight session, trading mostly occurred at the lower end of yesterday’s range. Buyers struggled to re-establish acceptance within the previous value area, while sellers failed to gain traction below yesterday's low. This price action was expected, as traders were anticipating the release of CPI data. After the release of the CPI data, the market demonstrated its typical volatility, resulting in an initial drop that tested the weekly level of interest at 4500 which buyers were quick to pick up.

The RTH session was rather tricky, with the market immediately rallying in the A-period, resulting in a P-shaped profile. Passive sellers managed to absorb the aggressive buying activity above the Smashlevel of 4520, eventually triggering a liquidation break in the B-period and forming a b-shaped profile. At one point during the B-period, there was a negative delta of 9K. However, sellers came nowhere near reaching the overnight lows despite their efforts. In fact, sellers looked below the 2-day balance and failed, leading to a quick reversal to the upside. I will provide a separate visual of this sequence on Substack, since the order flow was very interesting during this liquidation break. Buyers managed to reclaim 4520 during the PM-session, but they struggled to generate upside momentum. Consequently, another liquidation break transpired during the closing session, making the session quite challenging, as previously noted.

Overall, not much changed contextually after today’s session. The daily is technically one-time framing down; however, the market is basically trading within the prior 4-day balance area. In order to see a stronger directional move, buyers aim to establish acceptance above the 4539, while sellers aim to establish acceptance below the weekly level of interest at 4500. As long as the market stays within the highlighted area on the composite volume profile, we can anticipate two-sided activity, emphasizing the need to remain adaptable and responsive.

For tomorrow, the Smashlevel (Pivot) is 4520, which buyers defended for most of the session before the closing weakness. Break and hold above 4520 would target a cleanup of poor structure towards 4539, as well as the final upside target of 4555. Holding below 4520 would target the weekly level of interest at 4500. Break and hold below 4500 would target 4489, as well as the final downside target of 4473.

Going into tomorrow's session, I will observe 4520.

Break and hold above 4520 would target 4539 / 4555

Holding below 4520 would target 4500 / 4489 / 4473

Additionally, pay attention to the following VIX levels: 14.14 and 12.84. These levels can provide confirmation of strength or weakness.

Break and hold above 4555 with VIX below 12.84 would confirm strength.

Break and hold below 4473 with VIX above 14.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Correction: VIX levels: Resistance 14.14, Support 12.84.

Thank buddy. I went long after the CPI at the lows and left and closed at the open—great analysis, as always.