ES Daily Plan | September 12, 2023

The market remains in a state of balance in a broader perspective, awaiting further market-generated information. In terms of immediate focus, I'm keeping an eye on today's low volume node (LVN).

Contextual Analysis

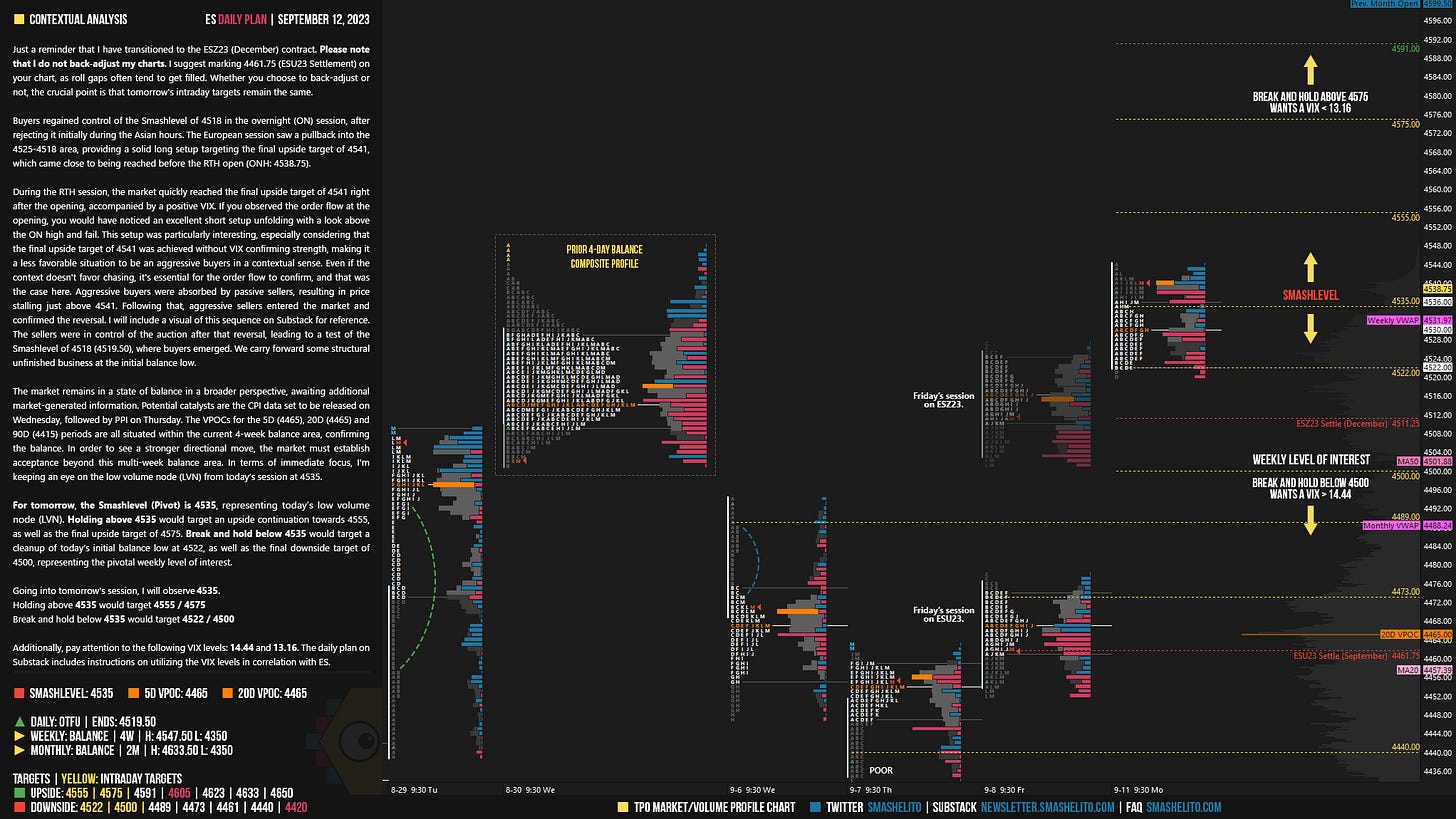

Just a reminder that I have transitioned to the ESZ23 (December) contract. Please note that I do not back-adjust my charts. I suggest marking 4461.75 (ESU23 Settlement) on your chart, as roll gaps often tend to get filled. Whether you choose to back-adjust or not, the crucial point is that tomorrow's intraday targets remain the same.

Buyers regained control of the Smashlevel of 4518 in the overnight (ON) session, after rejecting it initially during the Asian hours. The European session saw a pullback into the 4525-4518 area, providing a solid long setup targeting the final upside target of 4541, which came close to being reached before the RTH open (ONH: 4538.75).

During the RTH session, the market quickly reached the final upside target of 4541 right after the opening, accompanied by a positive VIX. If you observed the order flow at the opening, you would have noticed an excellent short setup unfolding with a look above the ON high and fail. This setup was particularly interesting, especially considering that the final upside target of 4541 was achieved without VIX confirming strength, making it a less favorable situation to be an aggressive buyers in a contextual sense. Even if the context doesn't favor chasing, it's essential for the order flow to confirm, and that was the case here. Aggressive buyers were absorbed by passive sellers, resulting in price stalling just above 4541. Following that, aggressive sellers entered the market and confirmed the reversal. I will include a visual of this sequence on Substack for reference. The sellers were in control of the auction after that reversal, leading to a test of the Smashlevel of 4518 (4519.50), where buyers emerged. We carry forward some structural unfinished business at the initial balance low.

The market remains in a state of balance in a broader perspective, awaiting additional market-generated information. Potential catalysts are the CPI data set to be released on Wednesday, followed by PPI on Thursday. The VPOCs for the 5D (4465), 20D (4465) and 90D (4415) periods are all situated within the current 4-week balance area, confirming the balance. In order to see a stronger directional move, the market must establish acceptance beyond this multi-week balance area. In terms of immediate focus, I'm keeping an eye on the low volume node (LVN) from today’s session at 4535.

For tomorrow, the Smashlevel (Pivot) is 4535, representing today’s low volume node (LVN). Holding above 4535 would target an upside continuation towards 4555, as well as the final upside target of 4575. Break and hold below 4535 would target a cleanup of today’s initial balance low at 4522, as well as the final downside target of 4500, representing the pivotal weekly level of interest.

Going into tomorrow's session, I will observe 4535.

Holding above 4535 would target 4555 / 4575

Break and hold below 4535 would target 4522 / 4500

Additionally, pay attention to the following VIX levels: 14.44 and 13.16. These levels can provide confirmation of strength or weakness.

Break and hold above 4575 with VIX below 13.16 would confirm strength.

Break and hold below 4500 with VIX above 14.44 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy. Great day today!

Thank you Smash!