ES Daily Plan | September 1, 2023

Despite the closing weakness, the daily one-time framing up remains intact as buyers continue the pattern of higher highs and higher lows. NFP tomorrow!

Contextual Analysis

The overnight (ON) session remained largely uneventful, with trading taking place at the upper end of yesterday's range. However, there was a shift after the release of the PCE data, as the market responded by pushing higher, resulting in tagging the first upside target of 4539 (which was yesterday's final upside target). The market retraced back within yesterday’s range prior to the RTH open, and the ON high of 4541.25 ended up being the high of the full session.

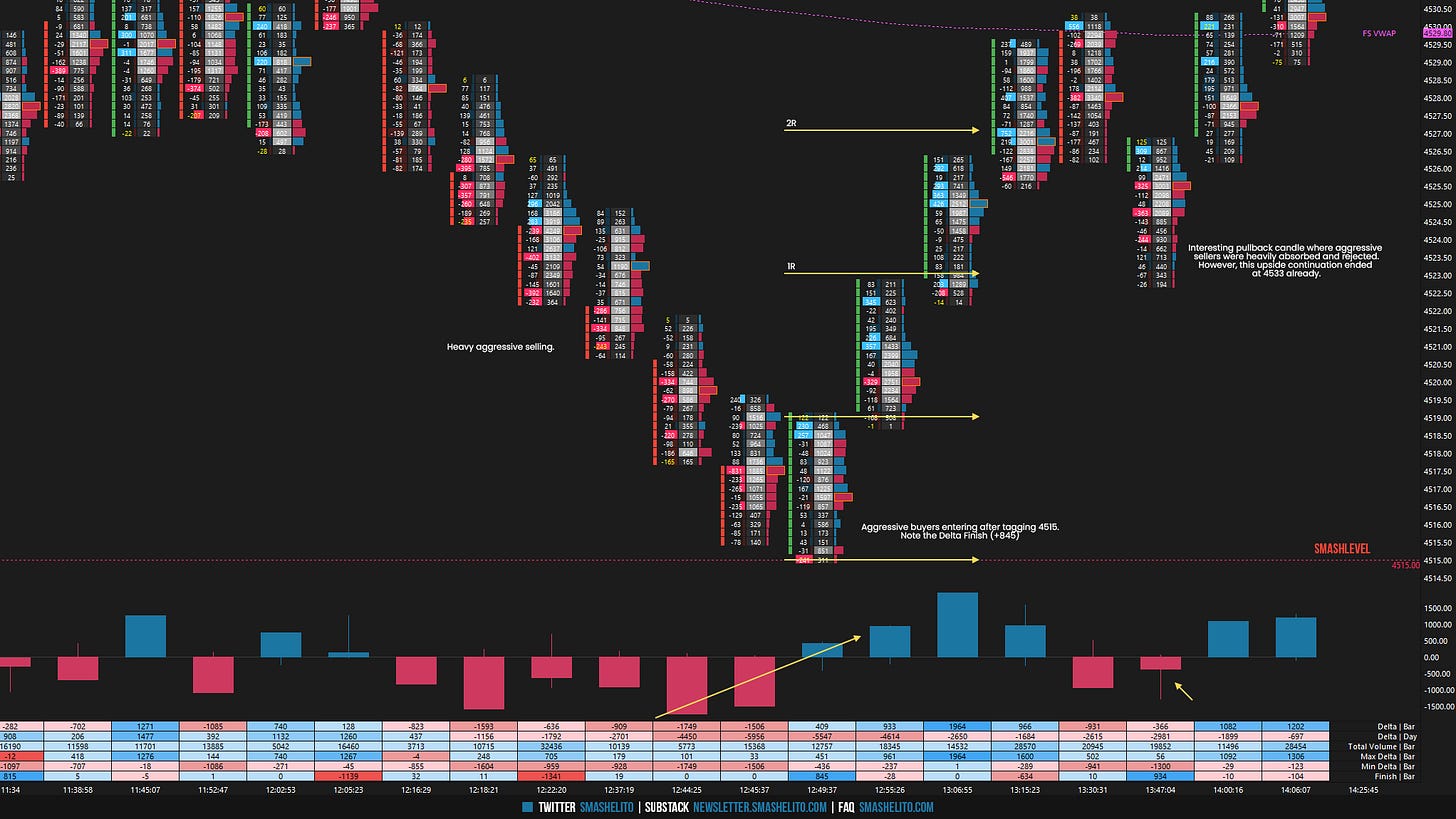

The upside in the RTH session was also capped by the 4539 level (with a high of day at 4539.75), and buyers inability to challenge the ON high resulted in some weakness after the failed range extension in the C-period. After multiple tests of yesterday’s value area high (VAH), the sellers managed to gain downside traction during the F and G-period, resulting in a full traverse of the prior value area, testing the Smashlevel of 4515. After the test of 4515 (to the tick), aggressive buyers entered the market, which was clearly evident by observing the order flow. I will provide a visual of this sequence on Substack for reference. Consequently, a bounce of ~20 handles ensued. This bounce was met with selling pressure, causing the session to conclude at the lows.

Despite the closing weakness, the daily one-time framing up remains intact as buyers continue the pattern of higher highs and higher lows. However, the value is overlapping to higher today, indicating that the imbalance phase is slowing down, at least in the short-term after three day’s of clean value higher. Additionally, today’s session had a delta divergence (higher high with a negative delta). I will keep my levels largely unchanged. The main focus continues to be on the Weekly Extreme High of 4515. Buyers have faced some difficulties in gaining meaningful upside traction above it, even though they have the advantage of momentum from the recent breakout. The added 3D volume profile highlights a clear P-shape profile. This raises the question of whether there are fresh buyers present within the main distribution (after shorts have covered), or if lower prices need to come into play first to draw in more stronger buyers. The short-term value (5D VPOC) has shifted from 4442 to 4524. NFP tomorrow.

For tomorrow, the Smashlevel (Pivot) is 4515, representing the Weekly Extreme High. Holding above 4515, indicating continued strength, would target today’s afternoon rally high at 4534. Break and hold above 4534 would target an upside continuation towards the final upside target of 4555. Break and hold below 4515, would target 4507, as well as the final downside target of 4489, representing the lower end of Tuesday’s upper distribution. The highlighted poor structure below is the main target, in the case of continued weakness.

Going into tomorrow's session, I will observe 4515.

Holding above 4515 would target 4534 / 4555

Break and hold below 4515 would target 4507 / 4489

Additionally, pay attention to the following VIX levels: 14.16 and 12.96. These levels can provide confirmation of strength or weakness.

Break and hold above 4555 with VIX below 12.96 would confirm strength.

Break and hold below 4489 with VIX above 14.16 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks Smash 🙏🏻

4515 has been a killer! Thank you!