ES Daily Plan | October 6, 2023

Today's session ended with another inside day, forming a double inside day in anticipation of tomorrow's NFP data release.

Contextual Analysis

The Smashlevel of 4297 proved to be highly significant today in both the ON and RTH session, and it will remain crucial in the short term. In the ON session, buyers attempted to gain traction above 4297 twice, but both attempts proved unsuccessful, resulting in tests of the upper end of Tuesday's lower distribution at 4282 on both occasions.

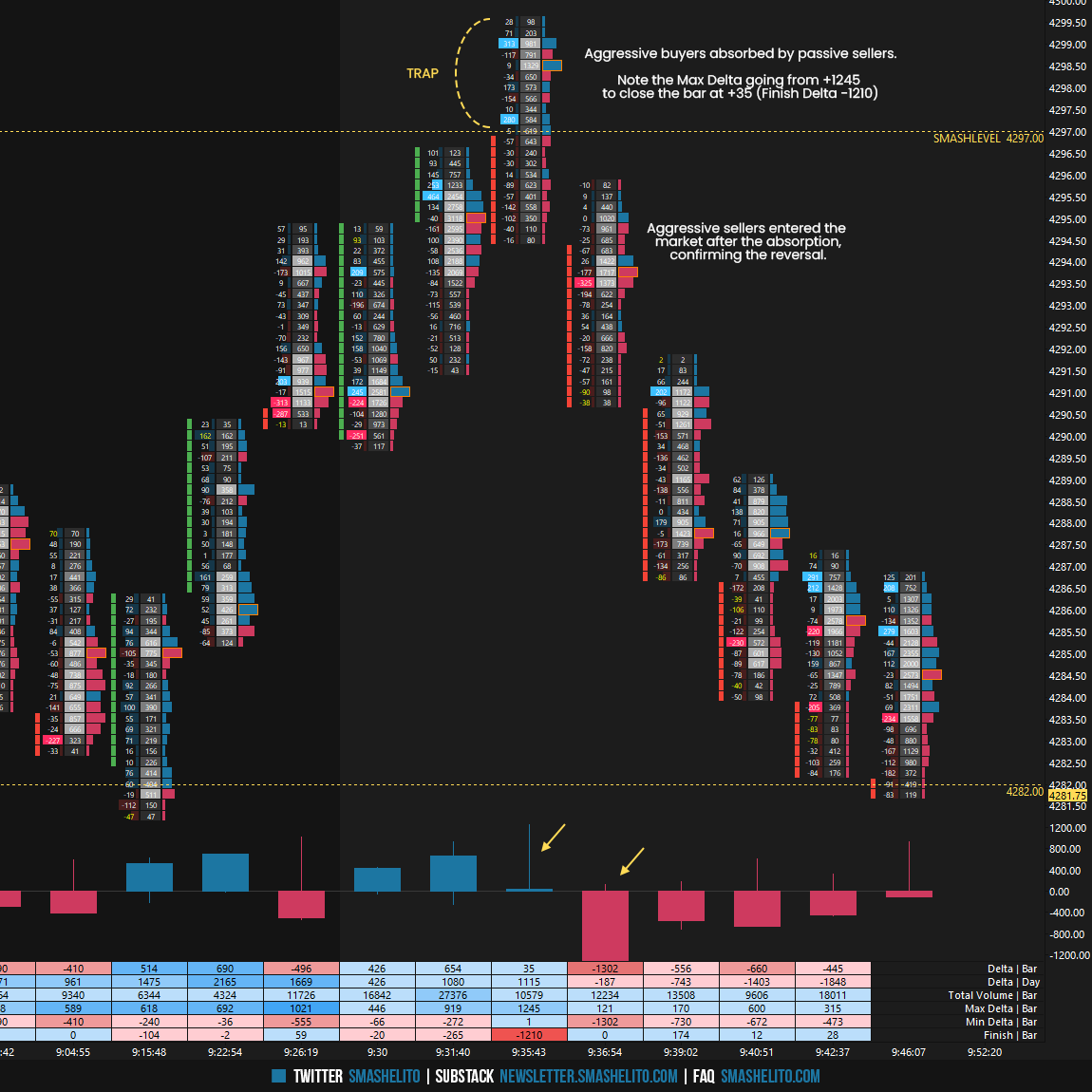

The next attack above 4297 was observed after the opening of the RTH session, but the aggressive buyers once again struggled to gain momentum as their efforts were absorbed by passive sellers. Following this absorption, aggressive sellers entered the market, resulting in a substantial reversal. This dynamic was clearly visible on the footprint chart, and I will provide a visual representation of it on Substack for reference.

During the first four 30-minute periods, the market was one-time framing down, coming within 6 handles of the final downside target of 4252 (LOD: 4258). Did you monitor the VIX resistance level at 19.62 while the market was nearing 4252? Today’s HOD was 19.58, which printed during the D-period low. With both VIX 19.62 and ES 4252 approaching, you know that you should exercise caution with initiating new shorts due to the poor location contextually. This piece of information can also be valuable for profit-taking if you're already in a short position from higher levels. The market experienced a V-shape reversal when buyers successfully put an end to the intraday one-time framing down by breaking above the D-period high in the E-period.

Today's session ended with another inside day, forming a double inside day in anticipation of tomorrow's NFP data release. The general guideline suggests going with the break of the inside day and observing for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. On a technical level, the daily is still one-time framing down. However, it's evident that the market is currently in a short-term state of balance, coiling for a directional move, with the NFP data expected to be a key catalyst. All levels remain the same.

For tomorrow, the Smashlevel (Pivot) is 4297, which represents Wednesday’s spike base. Break and hold above 4297 would target the upside magnet 20D VPOC at 4315. Break and hold above 4315 would target the resistance area from 4340 to the final upside target of 4350. Holding below 4297 would target the upper end of Tuesday’s lower distribution at 4282. Break and hold below 4282 would target the downside magnet 5D VPOC at 4265, as well as the poor low at 4252. In the case of continued weakness, the target is the unfilled daily gap at 4239.75.

Going into tomorrow's session, I will observe 4297.

Break and hold above 4297 would target 4315 / 4340 / 4350

Holding below 4297 would target 4282 / 4266 / 4252 / 4239

Additionally, pay attention to the following VIX levels: 19.52 and 17.46. These levels can provide confirmation of strength or weakness.

Break and hold above 4350 with VIX below 17.46 would confirm strength.

Break and hold below 4239 with VIX above 19.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Those Vix levels work like 🥷

Thank you, buddy, another awesome day!