ES Daily Plan | October 2, 2023

Despite a weak performance from buyers on Friday, the daily is one-time framing up, forming higher highs and higher lows.

However, the value has remained relatively unchanged over the last four sessions, emphasizing the importance of monitoring where value will establish in tomorrow's session.

Contextual Analysis

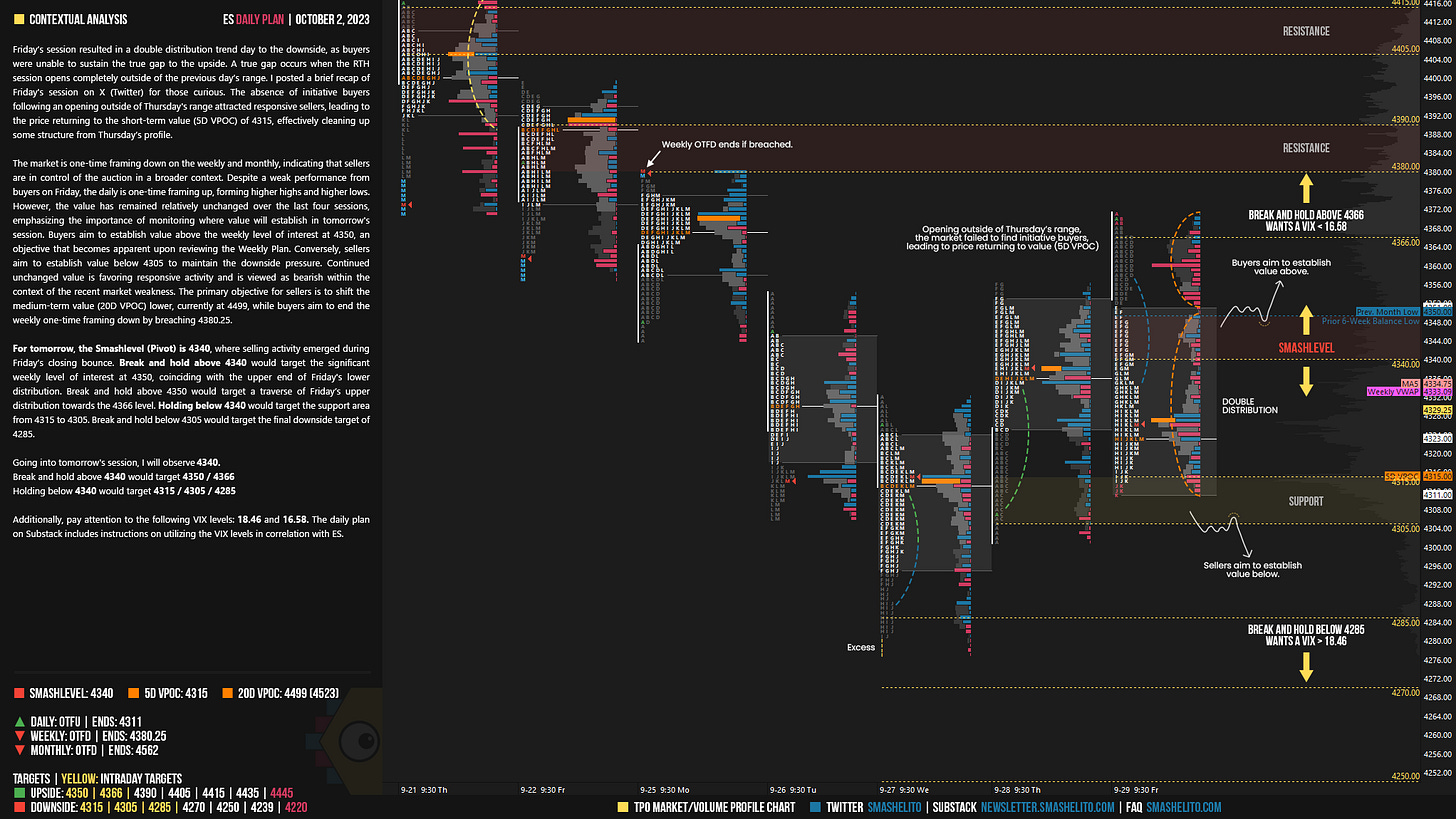

Friday’s session resulted in a double distribution trend day to the downside, as buyers were unable to sustain the true gap to the upside. A true gap occurs when the RTH session opens completely outside of the previous day’s range. I posted a brief recap of Friday's session on X (Twitter) for those curious. The absence of initiative buyers following an opening outside of Thursday's range attracted responsive sellers, leading to price returning to the short-term value (5D VPOC) of 4315, effectively cleaning up some structure from Thursday’s profile.

The market is one-time framing down on the weekly and monthly, indicating that sellers are in control of the auction in a broader context. Despite a weak performance from buyers on Friday, the daily is one-time framing up, forming higher highs and higher lows. However, the value has remained relatively unchanged over the last four sessions, emphasizing the importance of monitoring where value will establish in tomorrow's session. Buyers aim to establish value above the weekly level of interest at 4350, an objective that becomes apparent upon reviewing the Weekly Plan. Conversely, sellers aim to establish value below 4305 to maintain the downside pressure. Continued unchanged value is favoring responsive activity and is viewed as bearish within the context of the recent market weakness. The primary objective for sellers is to shift the medium-term value (20D VPOC) lower, currently at 4499, while buyers aim to end the weekly one-time framing down by breaching 4380.25.

For tomorrow, the Smashlevel (Pivot) is 4340, where selling activity emerged during Friday’s closing bounce. Break and hold above 4340 would target the significant weekly level of interest at 4350, coinciding with the upper end of Friday's lower distribution. Break and hold above 4350 would target a traverse of Friday’s upper distribution towards the 4366 level. Holding below 4340 would target the support area from 4315 to 4305. Break and hold below 4305 would target the final downside target of 4285.

Going into tomorrow's session, I will observe 4340.

Break and hold above 4340 would target 4350 / 4366

Holding below 4340 would target 4315 / 4305 / 4285

Additionally, pay attention to the following VIX levels: 18.46 and 16.58. These levels can provide confirmation of strength or weakness.

Break and hold above 4366 with VIX below 16.58 would confirm strength.

Break and hold below 4285 with VIX above 18.46 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Amazing work Smash!

Thank you, my friend, great week ahead!