ES Daily Plan | October 16, 2023

Friday’s session resulted in another double distribution with one set of single prints in the C-period. My short-term pivot will be Friday’s L-period high, also the previous week’s halfback.

Visual Representation

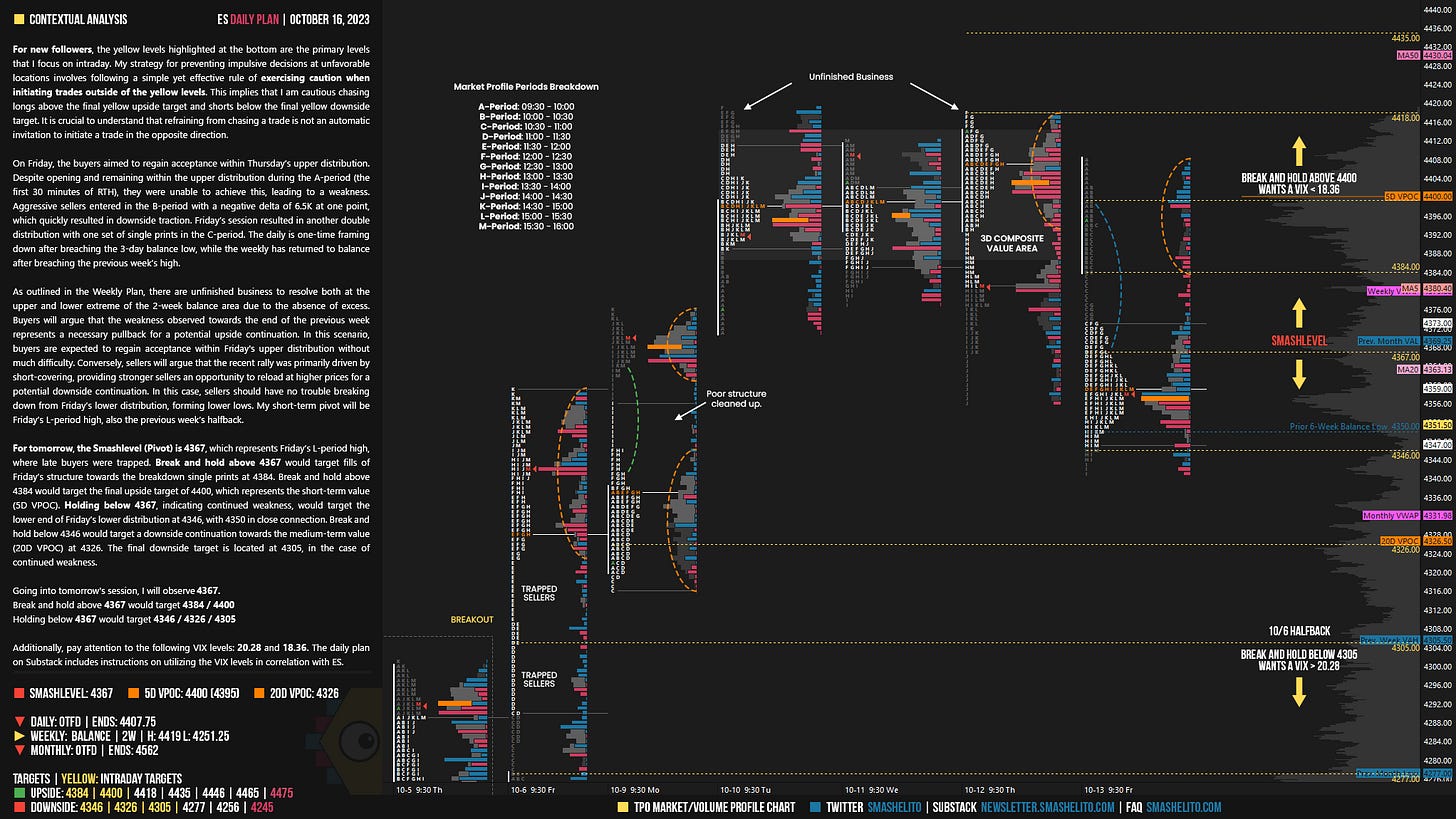

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

On Friday, the buyers aimed to regain acceptance within Thursday’s upper distribution. Despite opening and remaining within the upper distribution during the A-period (the first 30 minutes of RTH), they were unable to achieve this, leading to a weakness. Aggressive sellers entered in the B-period with a negative delta of 6.5K at one point, which quickly resulted in downside traction. Friday’s session resulted in another double distribution with one set of single prints in the C-period. The daily is one-time framing down after breaching the 3-day balance low, while the weekly has returned to balance after breaching the previous week’s high.

As outlined in the Weekly Plan, there are unfinished business to resolve both at the upper and lower extreme of the 2-week balance area due to the absence of excess. Buyers will argue that the weakness observed towards the end of the previous week represents a necessary pullback for a potential upside continuation. In this scenario, buyers are expected to regain acceptance within Friday's upper distribution without much difficulty. Conversely, sellers will argue that the recent rally was primarily driven by short-covering, providing stronger sellers an opportunity to reload at higher prices for a potential downside continuation. In this case, sellers should have no trouble breaking down from Friday’s lower distribution, forming lower lows. My short-term pivot will be Friday’s L-period high, also the previous week’s halfback.

For tomorrow, the Smashlevel (Pivot) is 4367, which represents Friday’s L-period high, where late buyers were trapped. Break and hold above 4367 would target fills of Friday’s structure towards the breakdown single prints at 4384. Break and hold above 4384 would target the final upside target of 4400, which represents the short-term value (5D VPOC). Holding below 4367, indicating continued weakness, would target the lower end of Friday’s lower distribution at 4346, with 4350 in close connection. Break and hold below 4346 would target a downside continuation towards the medium-term value (20D VPOC) at 4326. The final downside target is located at 4305, in the case of continued weakness.

Levels of Interest

Going into tomorrow's session, I will observe 4367.

Break and hold above 4367 would target 4384 / 4400

Holding below 4367 would target 4346 / 4326 / 4305

Additionally, pay attention to the following VIX levels: 20.28 and 18.36. These levels can provide confirmation of strength or weakness.

Break and hold above 4400 with VIX below 18.36 would confirm strength.

Break and hold below 4305 with VIX above 20.28 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you, buddy! I had a brilliant week! Let's continue with the momentum!

There is food for bulls and food for bears. Another item that bulls are going to exploit is VIX. Shorting volatility remains the best trade of the past year so far