ES Daily Plan | November 22, 2024

My preparations and expectations for the upcoming session.

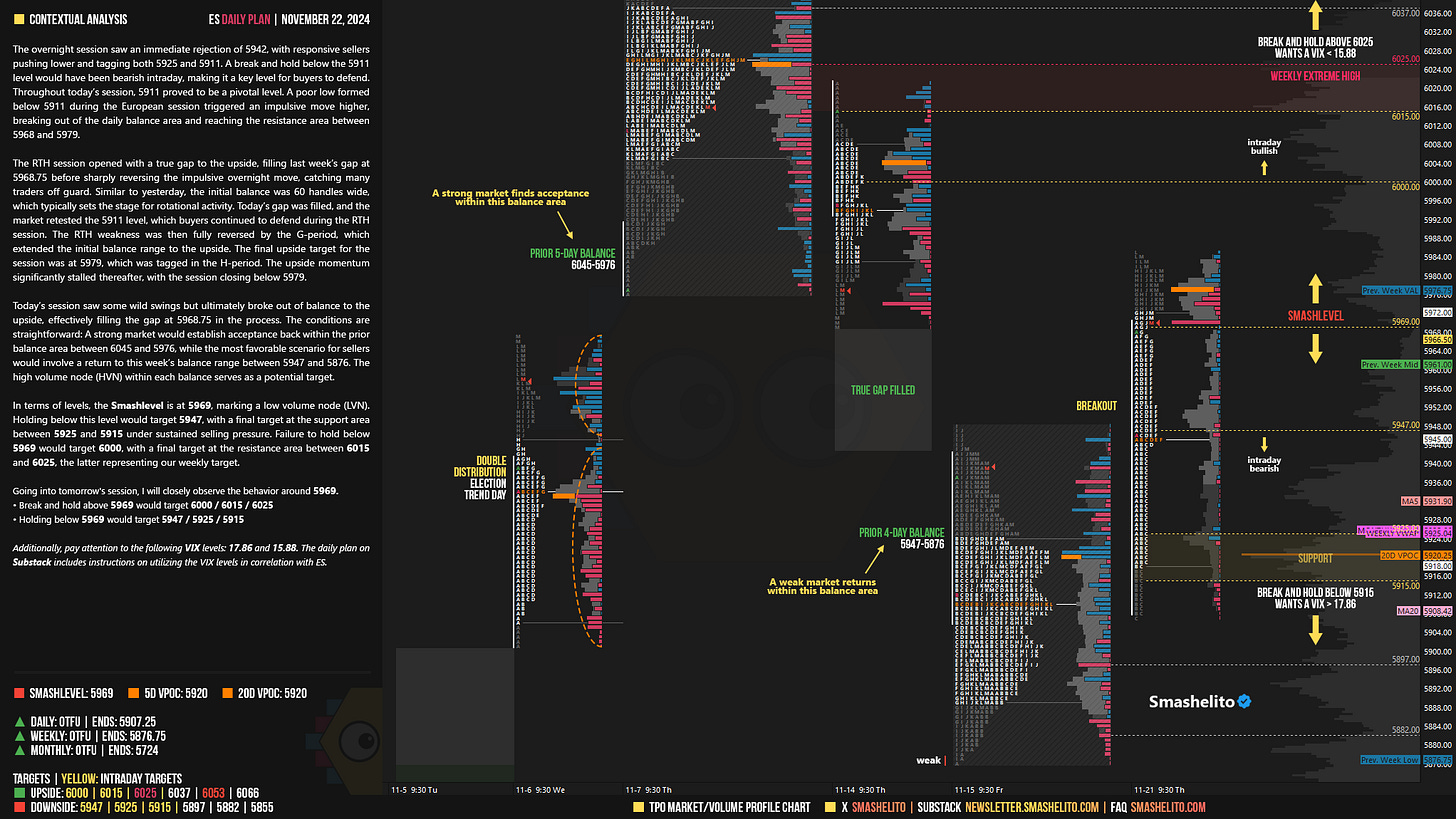

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

The overnight session saw an immediate rejection of 5942, with responsive sellers pushing lower and tagging both 5925 and 5911. A break and hold below the 5911 level would have been bearish intraday, making it a key level for buyers to defend. Throughout today’s session, 5911 proved to be a pivotal level. A poor low formed below 5911 during the European session triggered an impulsive move higher, breaking out of the daily balance area and reaching the resistance area between 5968 and 5979.

The RTH session opened with a true gap to the upside, filling last week’s gap at 5968.75 before sharply reversing the impulsive overnight move, catching many traders off guard. Similar to yesterday, the initial balance was 60 handles wide, which typically sets the stage for rotational activity. Today’s gap was filled, and the market retested the 5911 level, which buyers continued to defend during the RTH session. The RTH weakness was then fully reversed by the G-period, which extended the initial balance range to the upside. The final upside target for the session was at 5979, which was tagged in the H-period. The upside momentum significantly stalled thereafter, with the session closing below 5979.

Today’s session saw some wild swings but ultimately broke out of balance to the upside, effectively filling the gap at 5968.75 in the process. The conditions are straightforward: A strong market would establish acceptance back within the prior balance area between 6045 and 5976, while the most favorable scenario for sellers would involve a return to this week’s balance range between 5947 and 5876. The high volume node (HVN) within each balance serves as a potential target.

In terms of levels, the Smashlevel is at 5969, marking a low volume node (LVN). Holding below this level would target 5947, with a final target at the support area between 5925 and 5915 under sustained selling pressure. Failure to hold below 5969 would target 6000, with a final target at the resistance area between 6015 and 6025, the latter representing our weekly target.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5969.

Break and hold above 5969 would target 6000 / 6015 / 6025

Holding below 5969 would target 5947 / 5925 / 5915

Additionally, pay attention to the following VIX levels: 17.86 and 15.88. These levels can provide confirmation of strength or weakness.

Break and hold above 6025 with VIX below 15.88 would confirm strength.

Break and hold below 5915 with VIX above 17.86 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Green trading day! Thank you buddy!

Smashlevel smashed it today!