ES Daily Plan | November 21, 2023

Today’s session formed a multi-distribution profile after breaking out from the 4-day balance area, effectively cleaning up the unfinished business from the previous week in the process.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

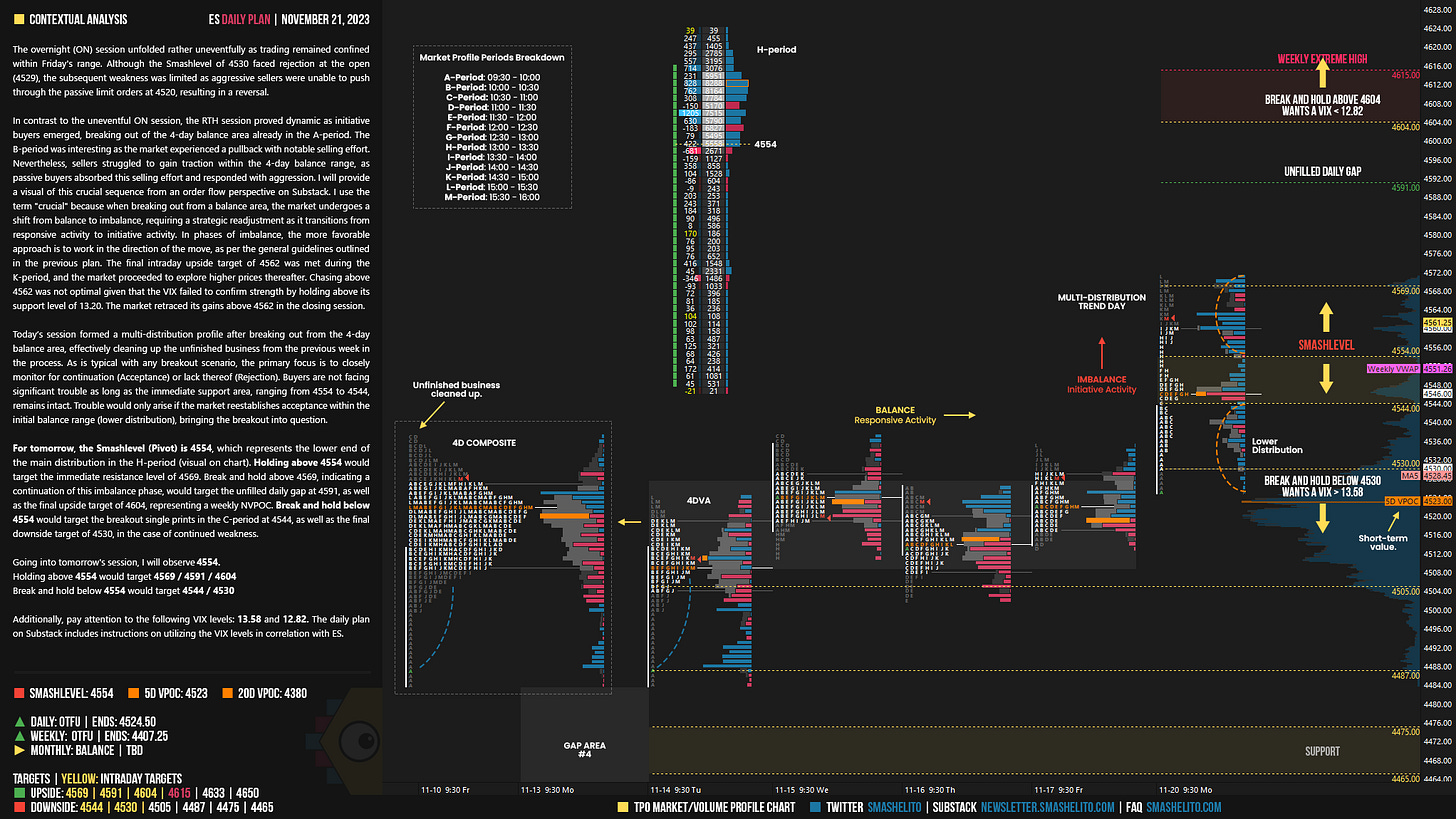

The overnight (ON) session unfolded rather uneventfully as trading remained confined within Friday's range. Although the Smashlevel of 4530 faced rejection at the open (4529), the subsequent weakness was limited as aggressive sellers were unable to push through the passive limit orders at 4520, resulting in a reversal.

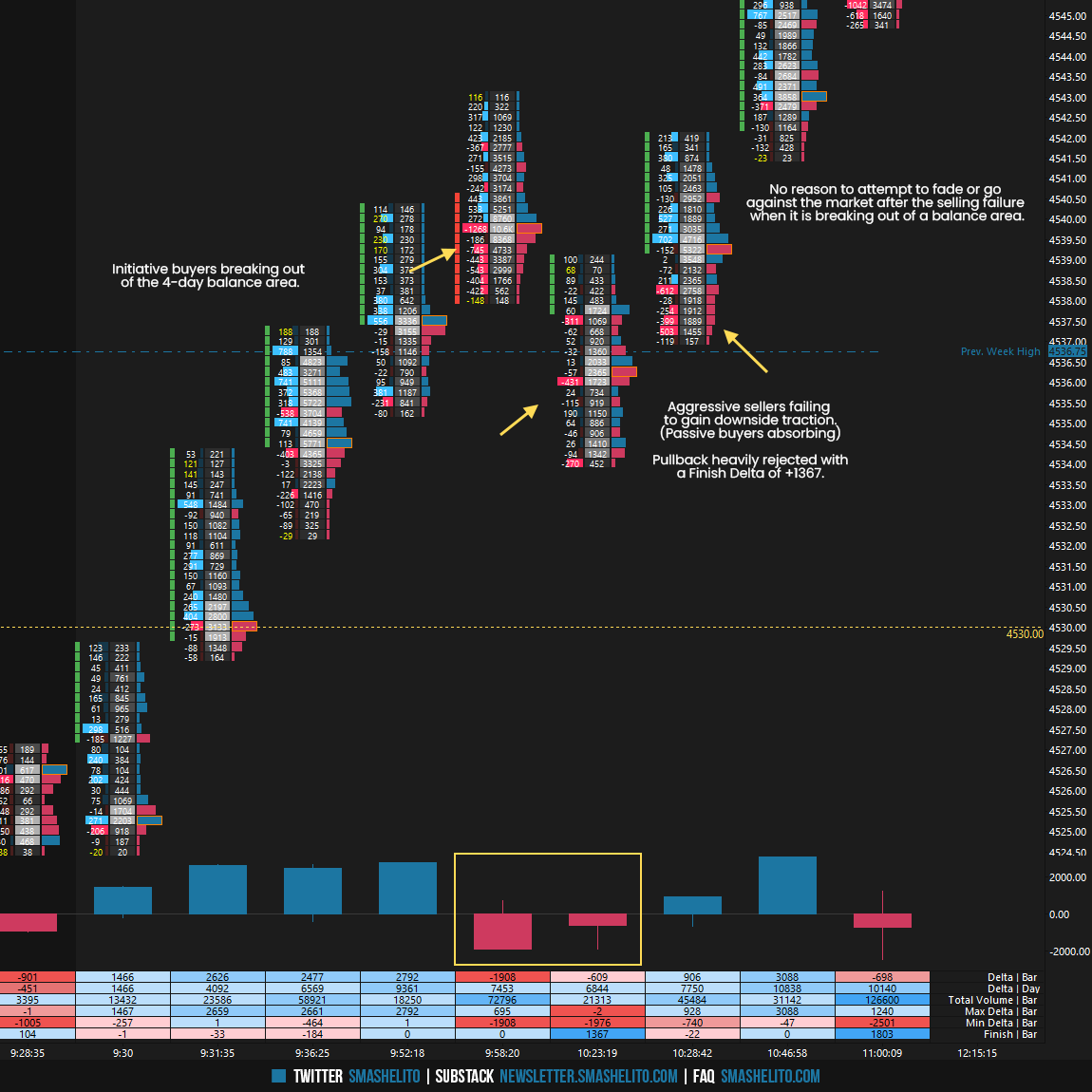

In contrast to the uneventful ON session, the RTH session proved dynamic as initiative buyers emerged, breaking out of the 4-day balance area already in the A-period. The B-period was interesting as the market experienced a pullback with notable selling effort. Nevertheless, sellers struggled to gain traction within the 4-day balance range, as passive buyers absorbed this selling effort and responded with aggression. I will provide a visual of this crucial sequence from an order flow perspective on Substack.

I use the term "crucial" because when breaking out from a balance area, the market undergoes a shift from balance to imbalance, requiring a strategic readjustment as it transitions from responsive activity to initiative activity. In phases of imbalance, the more favorable approach is to work in the direction of the move, as per the general guidelines outlined in the previous plan. The final intraday upside target of 4562 was met during the K-period, and the market proceeded to explore higher prices thereafter. Chasing above 4562 was not optimal given that the VIX failed to confirm strength by holding above its support level of 13.20. The market retraced its gains above 4562 in the closing session.

Today’s session formed a multi-distribution profile after breaking out from the 4-day balance area, effectively cleaning up the unfinished business from the previous week in the process. As is typical with any breakout scenario, the primary focus is to closely monitor for continuation (Acceptance) or lack thereof (Rejection). Buyers are not facing significant trouble as long as the immediate support area, ranging from 4554 to 4544, remains intact. Trouble would only arise if the market reestablishes acceptance within the initial balance range (lower distribution), bringing the breakout into question.

For tomorrow, the Smashlevel (Pivot) is 4554, which represents the lower end of the main distribution in the H-period (visual on chart). Holding above 4554 would target the immediate resistance level of 4569. Break and hold above 4569, indicating a continuation of this imbalance phase, would target the unfilled daily gap at 4591, as well as the final upside target of 4604, representing a weekly NVPOC. Break and hold below 4554 would target the breakout single prints in the C-period at 4544, as well as the final downside target of 4530, in the case of continued weakness.

Levels of Interest

Going into tomorrow's session, I will observe 4554.

Holding above 4554 would target 4569 / 4591 / 4604

Break and hold below 4554 would target 4544 / 4530

Additionally, pay attention to the following VIX levels: 13.98 and 12.82. These levels can provide confirmation of strength or weakness.

Break and hold above 4604 with VIX below 12.82 would confirm strength.

Break and hold below 4530 with VIX above 13.98 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Correction: VIX levels: 13.98 and 12.82.

Thanks.