ES Daily Plan | November 20, 2024

My preparations and expectations for the upcoming session.

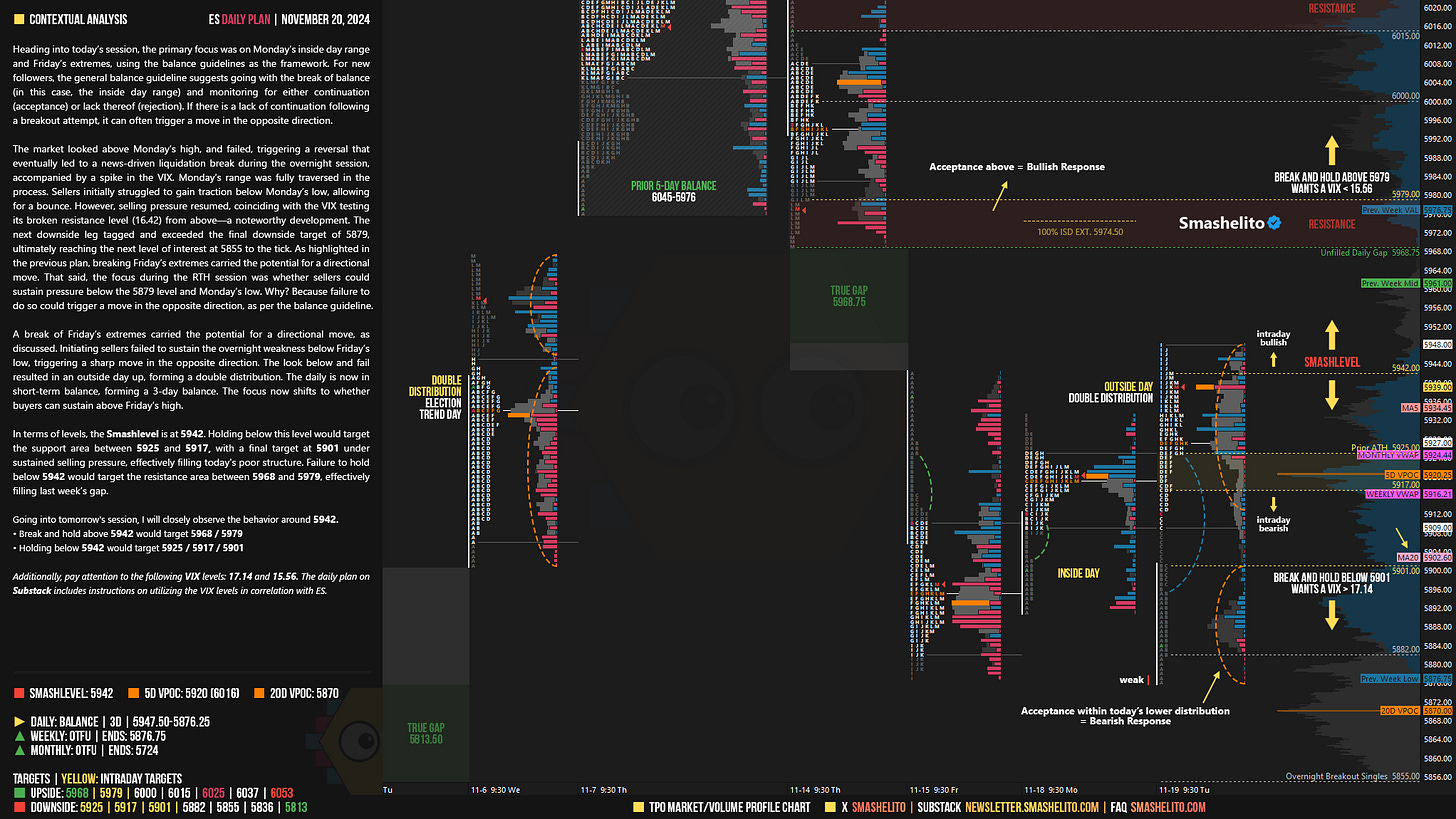

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Heading into today’s session, the primary focus was on Monday’s inside day range and Friday’s extremes, using the balance guidelines as the framework. For new followers, the general balance guideline suggests going with the break of balance (in this case, the inside day range) and monitoring for either continuation (acceptance) or lack thereof (rejection). If there is a lack of continuation following a breakout attempt, it can often trigger a move in the opposite direction.

The market looked above Monday’s high, and failed, triggering a reversal that eventually led to a news-driven liquidation break during the overnight session, accompanied by a spike in the VIX. Monday’s range was fully traversed in the process. Sellers initially struggled to gain traction below Monday’s low, allowing for a bounce. However, selling pressure resumed, coinciding with the VIX testing its broken resistance level (16.42) from above—a noteworthy development. The next downside leg tagged and exceeded the final downside target of 5879, ultimately reaching the next level of interest at 5855 to the tick. As highlighted in the previous plan, breaking Friday’s extremes carried the potential for a directional move. That said, the focus during the RTH session was whether sellers could sustain pressure below the 5879 level and Monday’s low. Why? Because failure to do so could trigger a move in the opposite direction, as per the balance guideline.

A break of Friday’s extremes carried the potential for a directional move, as discussed. Initiating sellers failed to sustain the overnight weakness below Friday’s low, triggering a sharp move in the opposite direction. The look below and fail resulted in an outside day up, forming a double distribution. The daily is now in short-term balance, forming a 3-day balance. The focus now shifts to whether buyers can sustain above Friday’s high.

In terms of levels, the Smashlevel is at 5942. Holding below this level would target the support area between 5925 and 5917, with a final target at 5901 under sustained selling pressure, effectively filling today's poor structure. Failure to hold below 5942 would target the resistance area between 5968 and 5979, effectively filling last week’s gap.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5942.

Break and hold above 5942 would target 5968 / 5979

Holding below 5942 would target 5925 / 5917 / 5901

Additionally, pay attention to the following VIX levels: 17.14 and 15.56. These levels can provide confirmation of strength or weakness.

Break and hold above 5979 with VIX below 15.56 would confirm strength.

Break and hold below 5901 with VIX above 17.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thanks. Do you make anything of the big passive sellers getting filled today? Approx 5925/5930/5945

Thanks Smash! Weekly still OTFU?