ES Daily Plan | November 20, 2023

On Friday, the market maintained its state of short-term balance defined by two-sided activity, awaiting further market-generated information.

Visual Representation

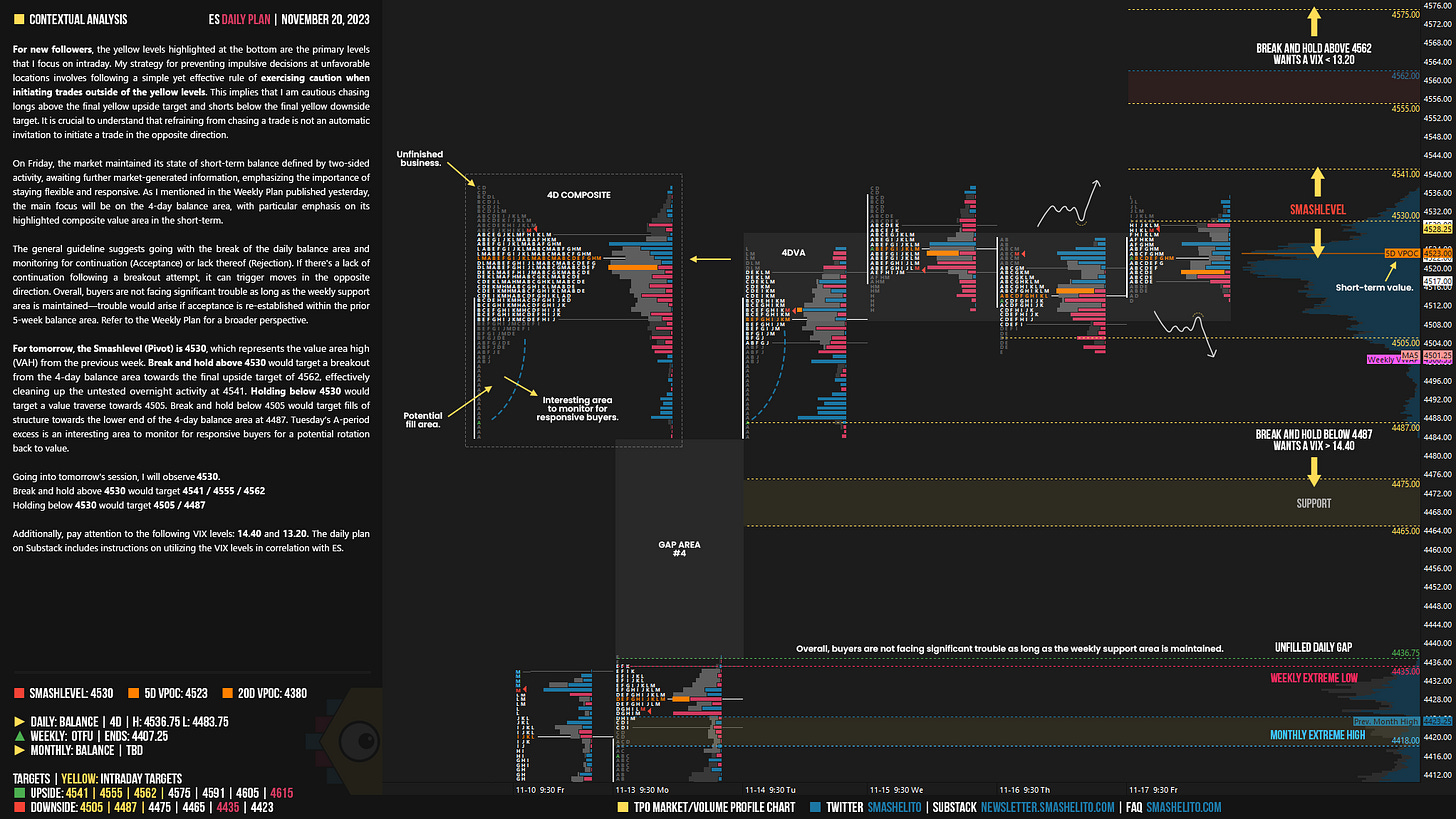

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

On Friday, the market maintained its state of short-term balance defined by two-sided activity, awaiting further market-generated information, emphasizing the importance of staying flexible and responsive. As I mentioned in the Weekly Plan published yesterday, the main focus will be on the 4-day balance area, with particular emphasis on its highlighted composite value area in the short-term.

The general guideline suggests going with the break of the daily balance area and monitoring for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. Overall, buyers are not facing significant trouble as long as the weekly support area is maintained—trouble would arise if acceptance is re-established within the prior 5-week balance area. Refer to the Weekly Plan for a broader perspective.

For tomorrow, the Smashlevel (Pivot) is 4530, which represents the value area high (VAH) from the previous week. Break and hold above 4530 would target a breakout from the 4-day balance area towards the final upside target of 4562, effectively cleaning up the untested overnight activity at 4541. Holding below 4530 would target a value traverse towards 4505. Break and hold below 4505 would target fills of structure towards the lower end of the 4-day balance area at 4487. Tuesday’s A-period excess is an interesting area to monitor for responsive buyers for a potential rotation back to value.

Levels of Interest

Going into tomorrow's session, I will observe 4530.

Break and hold above 4530 would target 4541 / 4555 / 4562

Holding below 4530 would target 4505 / 4487

Additionally, pay attention to the following VIX levels: 14.40 and 13.20. These levels can provide confirmation of strength or weakness.

Break and hold above 4562 with VIX below 13.20 would confirm strength.

Break and hold below 4487 with VIX above 14.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you 🌼

So tomorrow 13:00 est we actually have 20y bond auction, interestingly not showing up on some of the economic calendars.