ES Daily Plan | November 16, 2023

The market continues to form higher highs and higher lows, showing no interest in corrective activity thus far. The conditions remain unchanged.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

Important notice: I will be away from my desk for the next few days. As a result, the daily plans will be given in a concise format without commentary. Regular, detailed plans will resume on Monday, the 20th. Stay nimble.

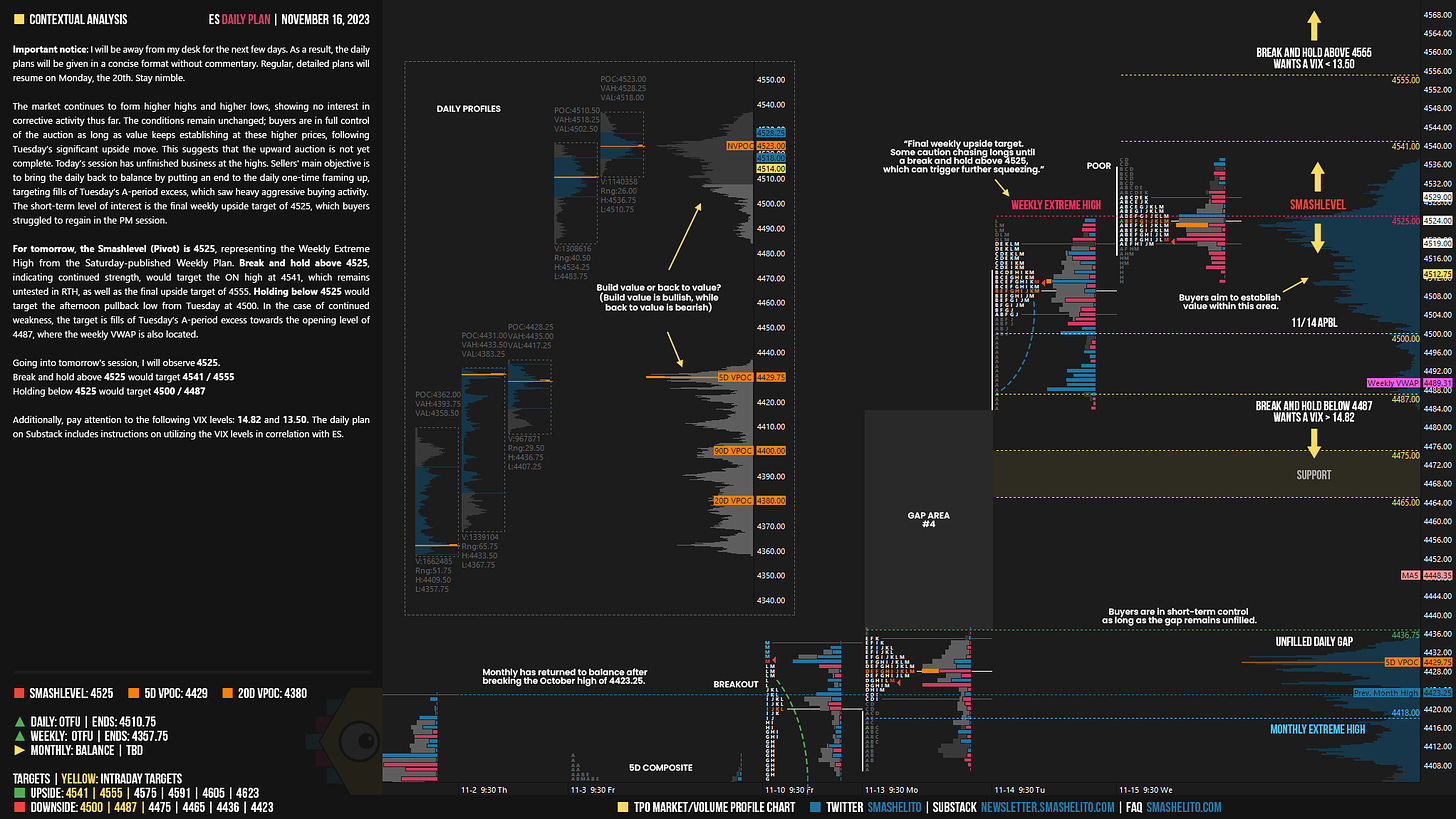

The market continues to form higher highs and higher lows, showing no interest in corrective activity thus far. The conditions remain unchanged; buyers are in full control of the auction as long as value keeps establishing at these higher prices, following Tuesday’s significant upside move. This suggests that the upward auction is not yet complete. Today's session has unfinished business at the highs. Sellers' main objective is to bring the daily back to balance by putting an end to the daily one-time framing up, targeting fills of Tuesday’s A-period excess, which saw heavy aggressive buying activity. The short-term level of interest is the final weekly upside target of 4525, which buyers struggled to regain in the PM session.

For tomorrow, the Smashlevel (Pivot) is 4525, representing the Weekly Extreme High from the Saturday-published Weekly Plan. Break and hold above 4525, indicating continued strength, would target the ON high at 4541, which remains untested in RTH, as well as the final upside target of 4555. Holding below 4525 would target the afternoon pullback low from Tuesday at 4500. In the case of continued weakness, the target is fills of Tuesday’s A-period excess towards the opening level of 4487, where the weekly VWAP is also located.

Levels of Interest

Going into tomorrow's session, I will observe 4525.

Break and hold above 4525 would target 4541 / 4555

Holding below 4525 would target 4500 / 4487

Additionally, pay attention to the following VIX levels: 14.82 and 13.50. These levels can provide confirmation of strength or weakness.

Break and hold above 4555 with VIX below 13.50 would confirm strength.

Break and hold below 4487 with VIX above 14.82 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you😍

Consolidating, but held up only by the prospect of NVDA earnings. Perilous