ES Daily Plan | May 9, 2023

Today's session perfectly filled the poor structure from Friday's session, resulting in an inside day.

First of all, it gives me great pleasure to share that our newsletter on Substack has surpassed 4000 subscribers. Thank you for your unwavering support and for being a part of this project!

The general rule is to go with the breakout and monitor for continuation or lack thereof.

Contextual Analysis

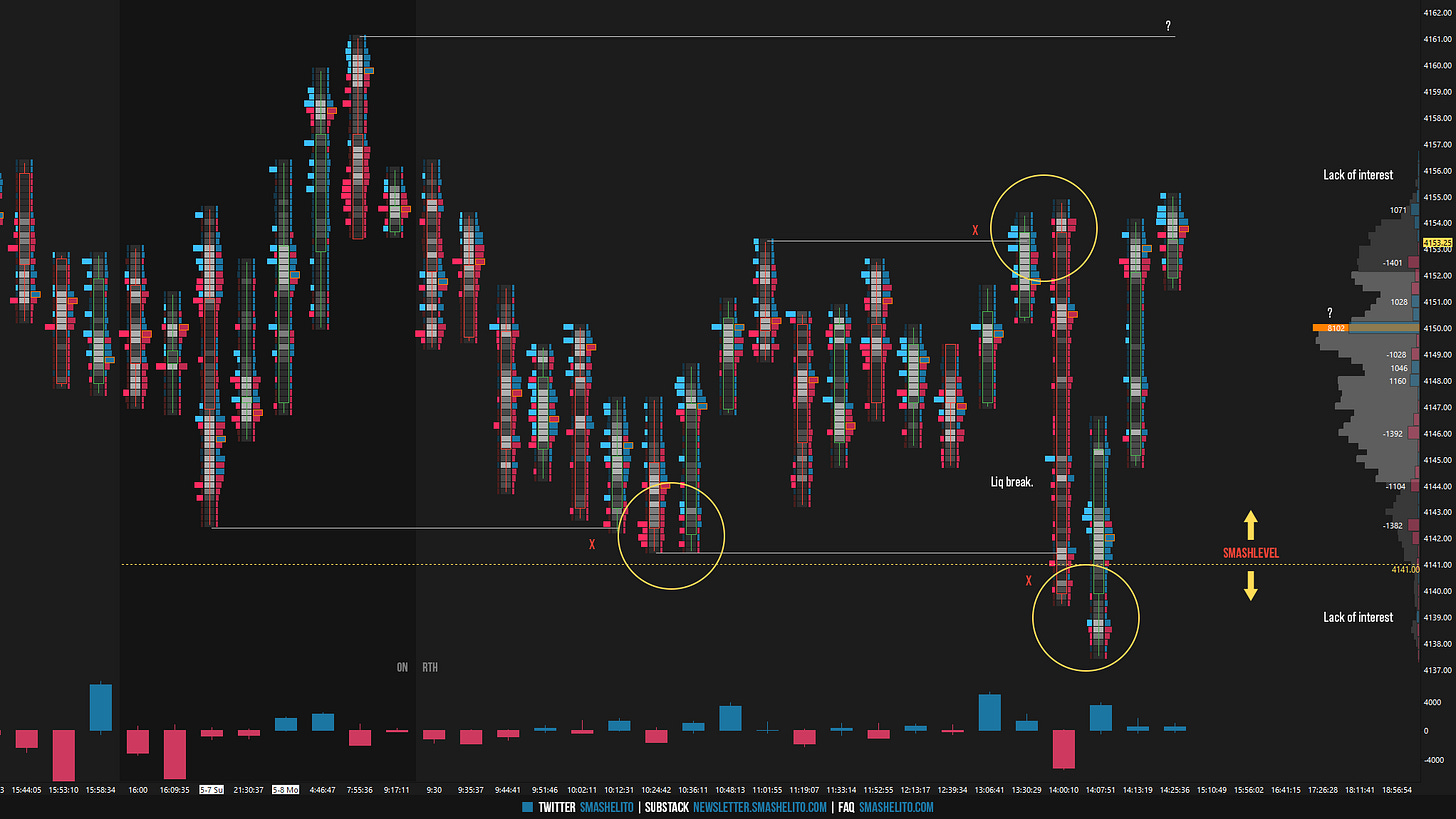

Following today's session, there isn't much more to add, so I'll keep it brief. During the overnight (ON) session, trading took place within Friday’s upper distribution, resulting in a balanced profile. Friday’s poor structure was cleaned up in the process. The market tested the Smashlevel of 4141, with an ON low of 4142.50, before reversing and eventually tagging the next level of interest at 4159.

There wasn't much action during the regular trading hours (RTH) as trading remained confined to a narrow range around the short, medium, and long-term value of 4150. In the previous plan, I emphasized the importance of maintaining flexibility while trading within value. Markets are constantly shifting between balance (consolidation) and imbalance (trending) phases. Being aware of the market conditions can prevent you from taking trades at unfavorable locations. If your trading strategy focuses on identifying significant directional moves or breakout trades, trading a balanced market will get you smashed. Conversely, if your strategy involves taking responsive trades or reversals to the mean, you will get smashed during an imbalanced market. It’s crucial to identify the market conditions and adapt your strategy accordingly. Today, breakout traders (chasers) got demolished in both directions. I shared a visual of this on Twitter for reference.

I want to highlight the first trade opportunity that occurred when the market looked below the ON low and failed. Despite the presence of heavy and aggressive selling, the downward momentum failed to materialize, and the market reversed back to its value. A visual of this sequence will be shared on Substack.

The second noteworthy highlight of today's session was the liquidation break during J-period. It's worth noting that the drop stopped precisely at the prior RTH halfback (green line), indicating that it was likely caused by weak long positions rather than stronger sellers. If stronger sellers were present, the market would not have stopped at such a visual reference.

Today's session resulted in an inside day, characterized by its price range being contained within the previous day’s range. The market is currently in balance across all time frames, awaiting more market generated information. There is an unfilled daily gap above at 4182.25 and one below at 4098.25. Which one gets filled first? The buyers aim to break the inside day to the upside to target the upside gap. Conversely, the sellers aim to break the inside day to the downside to target fills of Friday’s A-period excess.

Going into tomorrow's session, I will observe 4156.

Break and hold above 4156 would target 4170 / 4182 / 4194

Holding below 4156 would target 4141 / 4125 / 4115

Additionally, pay attention to the following VIX levels: 17.90 and 16.06. These levels can provide confirmation of strength or weakness.

Break and hold above 4194 with VIX below 16.06 would confirm strength.

Break and hold below 4115 with VIX above 17.90 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Congratulations on 4k, hoping 10k by year end.

Smashelito - thank you for your time and efforts sharing your thoughts and views on the market. Helps me a lot here to grow and support my market views . All the best and have a great trading day 😘