ES Daily Plan | May 8, 2023

The market is currently in balance across all time frames, awaiting more market generated information.

Contextual Analysis

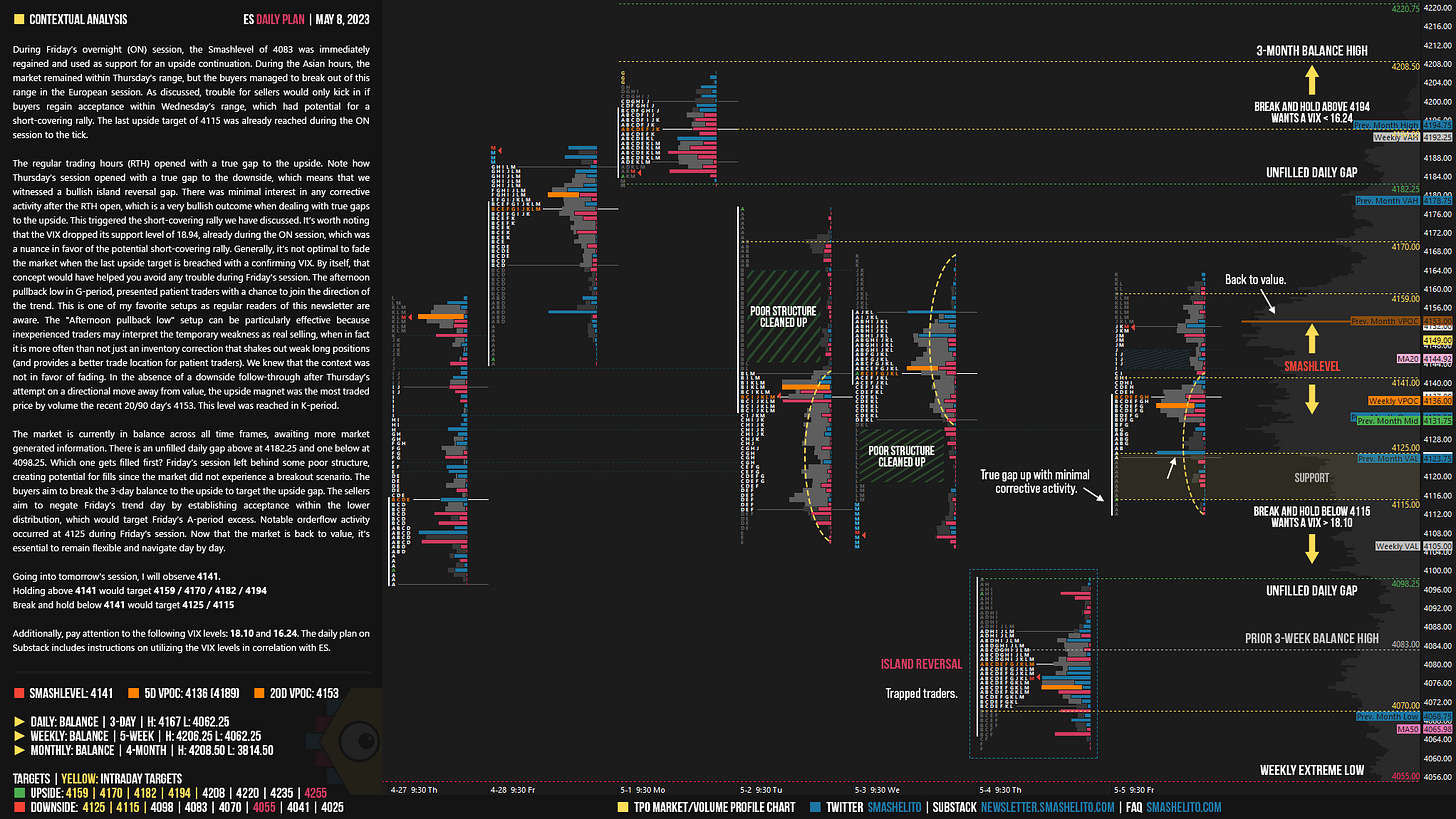

During Friday’s overnight (ON) session, the Smashlevel of 4083 was immediately regained and used as support for an upside continuation. During the Asian hours, the market remained within Thursday's range, but the buyers managed to break out of this range in the European session. As discussed, trouble for sellers would only kick in if buyers regain acceptance within Wednesday’s range, which had potential for a short-covering rally. The last upside target of 4115 was already reached during the ON session to the tick.

The regular trading hours (RTH) opened with a true gap to the upside. Note how Thursday’s session opened with a true gap to the downside, which means that we witnessed a bullish island reversal gap. There was minimal interest in any corrective activity after the RTH open, which is a very bullish outcome when dealing with true gaps to the upside. This triggered the short-covering rally we have discussed. It’s worth noting that the VIX dropped its support level of 18.94, already during the ON session, which was a nuance in favor of the potential short-covering rally. Generally, it’s not optimal to fade the market when the last upside target is breached with a confirming VIX. By itself, that concept would have helped you avoid any trouble during Friday's session. The afternoon pullback low in G-period, presented patient traders with a chance to join the direction of the trend. This is one of my favorite setups as regular readers of this newsletter are aware. The "Afternoon pullback low" setup can be particularly effective because inexperienced traders may interpret the temporary weakness as real selling, when in fact it is more often than not just an inventory correction that shakes out weak long positions (and provides a better trade location for patient traders). We knew that the context was not in favor of fading. In the absence of a downside follow-through after Thursday’s attempt on a directional move away from value, the upside magnet was the most traded price by volume the recent 20/90 day’s 4153. This level was reached in K-period.

The market is currently in balance across all time frames, awaiting more market generated information. There is an unfilled daily gap above at 4182.25 and one below at 4098.25.

Friday’s session left behind some poor structure, creating potential for fills since the market did not experience a breakout scenario. The buyers aim to break the 3-day balance to the upside to target the upside gap. The sellers aim to negate Friday’s trend day by establishing acceptance within the lower distribution, which would target Friday’s A-period excess. Notable orderflow activity occurred at 4125 during Friday's session. Now that the market is back to value, it's essential to remain flexible and navigate day by day.

Going into tomorrow's session, I will observe 4141.

Holding above 4141 would target 4159 / 4170 / 4182 / 4194

Break and hold below 4141 would target 4125 / 4115

Additionally, pay attention to the following VIX levels: 18.10 and 16.24. These levels can provide confirmation of strength or weakness.

Break and hold above 4194 with VIX below 16.24 would confirm strength.

Break and hold below 4115 with VIX above 18.10 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Have a great week, Smash!