ES Daily Plan | May 30, 2024

Now, all eyes are on Thursday’s highlighted lower distribution, marking the lower end of the current multi-day balance area.

For new followers: the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

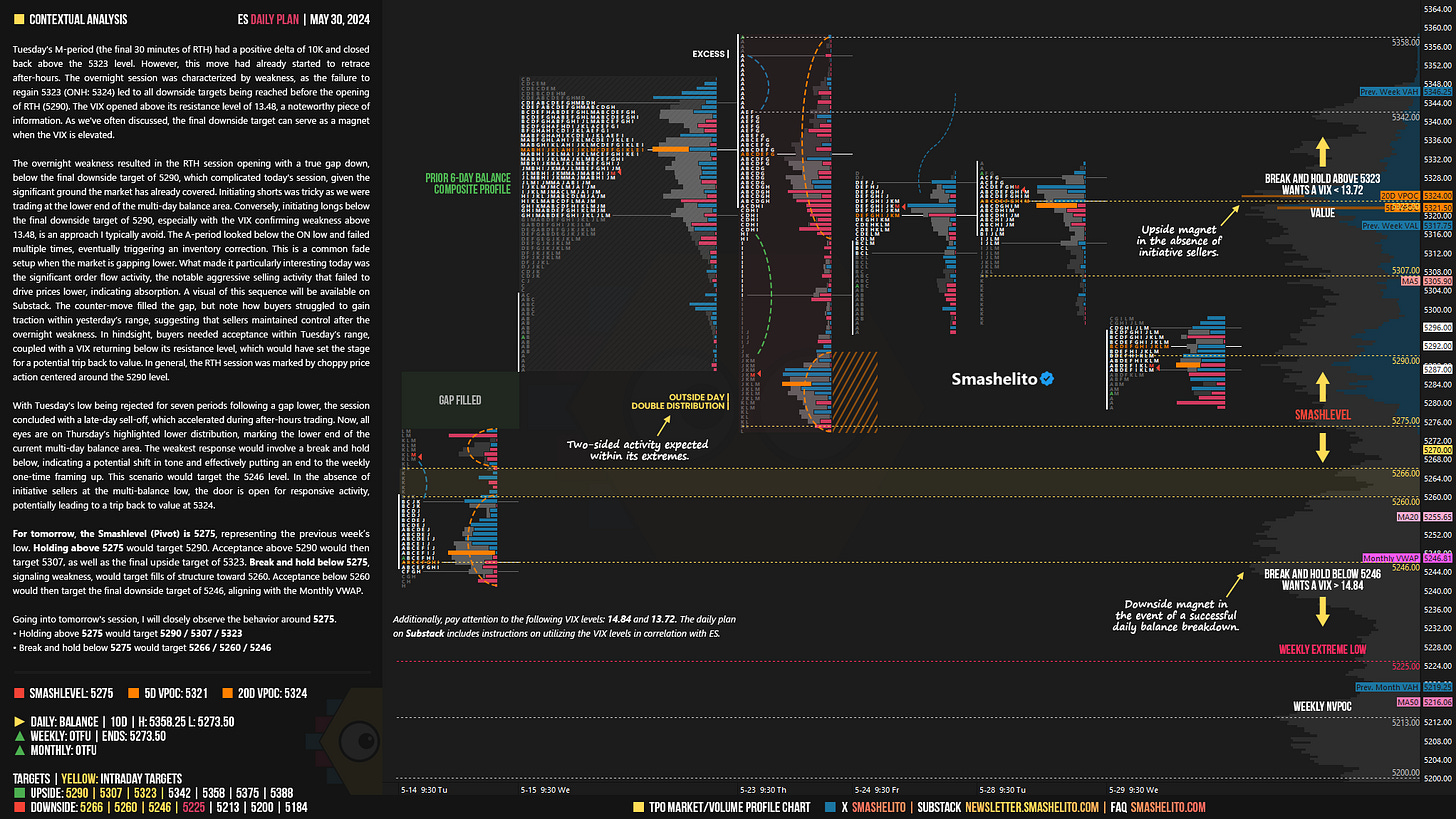

Tuesday's M-period (the final 30 minutes of RTH) had a positive delta of 10K and closed back above the 5323 level. However, this move had already started to retrace after-hours. The overnight session was characterized by weakness, as the failure to regain 5323 (ONH: 5324) led to all downside targets being reached before the opening of RTH (5290). The VIX opened above its resistance level of 13.48, a noteworthy piece of information. As we've often discussed, the final downside target can serve as a magnet when the VIX is elevated.

The overnight weakness resulted in the RTH session opening with a true gap down, below the final downside target of 5290, which complicated today's session, given the significant ground the market has already covered. Initiating shorts was tricky as we were trading at the lower end of the multi-day balance area. Conversely, initiating longs below the final downside target of 5290, especially with the VIX confirming weakness above 13.48, is an approach I typically avoid.

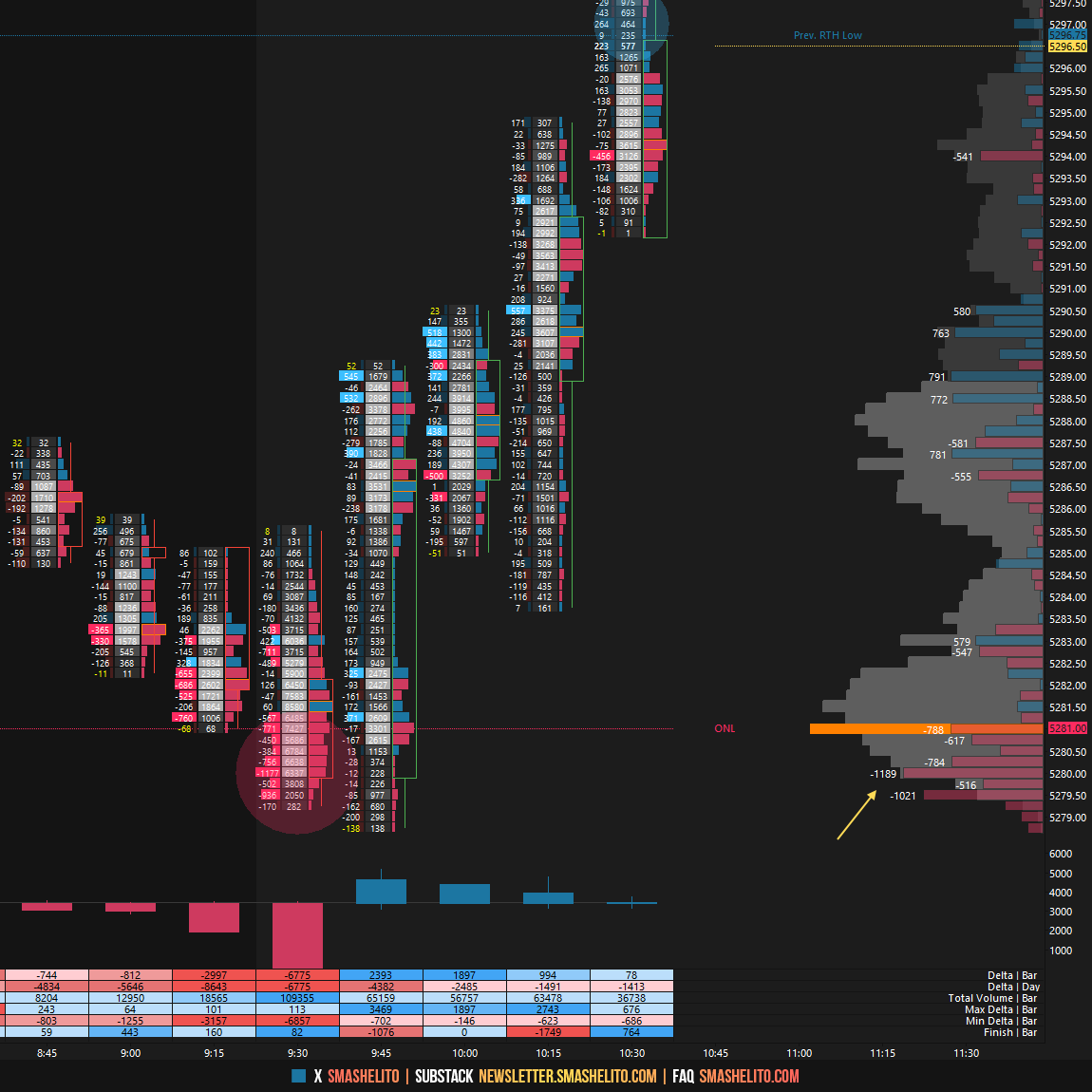

The A-period looked below the ON low and failed multiple times, eventually triggering an inventory correction. This is a common fade setup when the market is gapping lower. What made it particularly interesting today was the significant order flow activity, the notable aggressive selling activity that failed to drive prices lower, indicating absorption. A visual of this sequence will be available on Substack. The counter-move filled the gap, but note how buyers struggled to gain traction within yesterday’s range, suggesting that sellers maintained control after the overnight weakness. In hindsight, buyers needed acceptance within Tuesday’s range, coupled with a VIX returning below its resistance level, which would have set the stage for a potential trip back to value. In general, the RTH session was marked by choppy price action centered around the 5290 level.

With Tuesday's low being rejected for seven periods following a gap lower, the session concluded with a late-day sell-off, which accelerated during after-hours trading. Now, all eyes are on Thursday’s highlighted lower distribution, marking the lower end of the current multi-day balance area. The weakest response would involve a break and hold below, indicating a potential shift in tone and effectively putting an end to the weekly one-time framing up. This scenario would target the 5246 level. In the absence of initiative sellers at the multi-balance low, the door is open for responsive activity, potentially leading to a trip back to value at 5324.

Important note from the previous daily plan that still applies:

“As outlined in the Weekly Plan, Thursday’s outside day marks the playground moving forward. Responsive activity is expected within this range, while a stronger directional move requires acceptance beyond its extremes. Although the ATH has established an excess high, we carry forward the untested overnight ATH at 5368.25.”

For tomorrow, the Smashlevel (Pivot) is 5275, representing the previous week’s low. Holding above 5275 would target 5290. Acceptance above 5290 would then target 5307, as well as the final upside target of 5323. Break and hold below 5275, signaling weakness, would target fills of structure toward 5260. Acceptance below 5260 would then target the final downside target of 5246, aligning with the Monthly VWAP.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5275.

Holding above 5275 would target 5290 / 5307 / 5323

Break and hold below 5275 would target 5266 / 5260 / 5246

Additionally, pay attention to the following VIX levels: 14.84 and 13.72. These levels can provide confirmation of strength or weakness.

Break and hold above 5323 with VIX below 13.72 would confirm strength.

Break and hold below 5246 with VIX above 14.84 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Additionally, the Weekly Extreme High for VIX is at 13.32. It remains to be seen whether this means that the Weekly Extreme Low at 5225 for ES will serve as a downside magnet.