ES Daily Plan | May 17, 2023

Today’s session resulted in an inside day, making it a double inside day.

The closing weakness resulted in a downward spike, with a base at 4127, which will be the more aggressive level to observe short-term.

Contextual Analysis

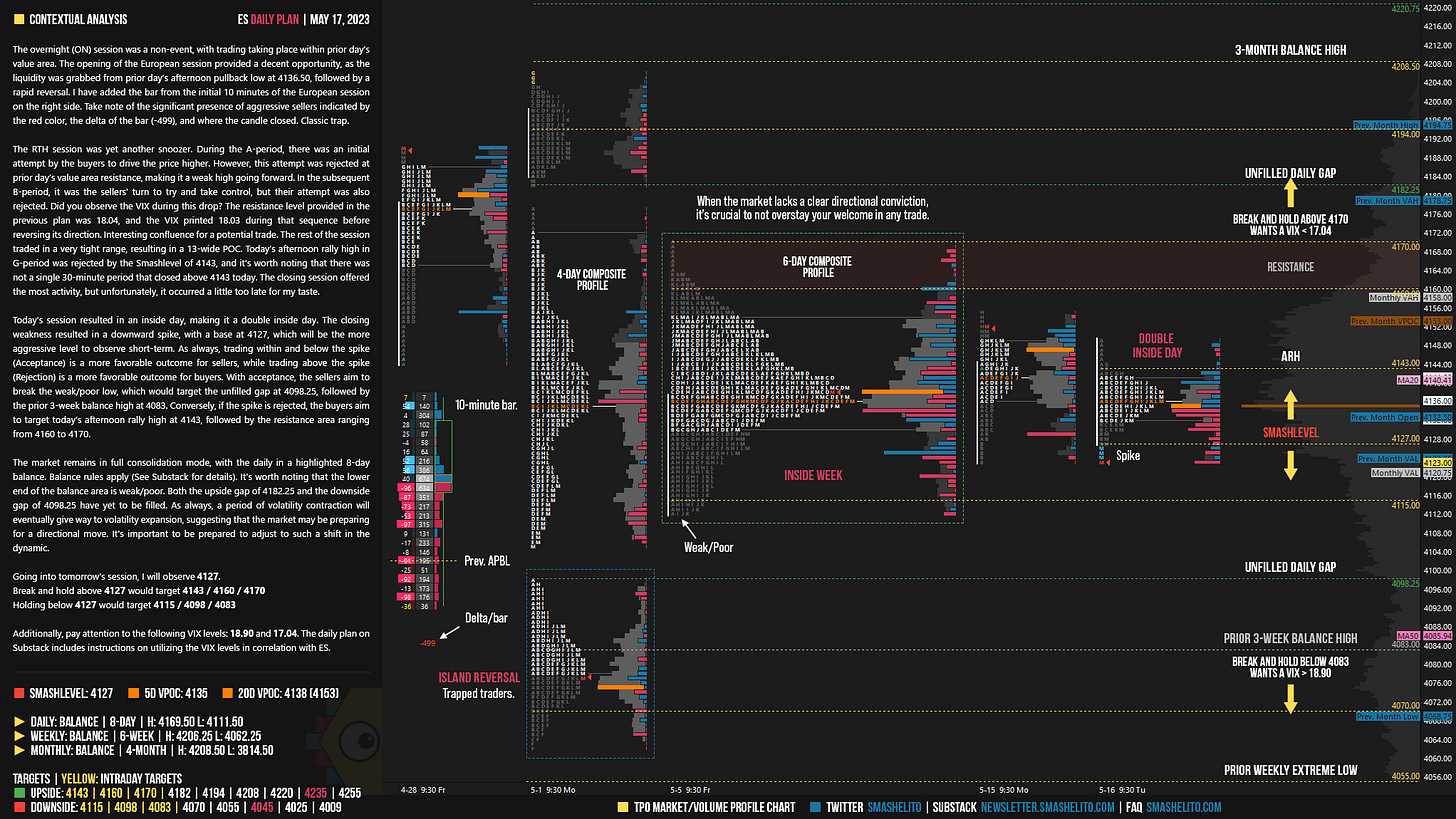

The overnight (ON) session was a non-event, with trading taking place within prior day’s value area. The opening of the European session provided a decent opportunity, as the liquidity was grabbed from prior day’s afternoon pullback low at 4136.50, followed by a rapid reversal. I have added the bar from the initial 10 minutes of the European session on the right side. Take note of the significant presence of aggressive sellers indicated by the red color, the delta of the bar (-499), and where the candle closed. Classic trap.

The RTH session was yet another snoozer. During the A-period, there was an initial attempt by the buyers to drive the price higher. However, this attempt was rejected at prior day’s value area resistance, making it a weak high going forward. In the subsequent B-period, it was the sellers' turn to try and take control, but their attempt was also rejected. Did you observe the VIX during this drop? The resistance level provided in the previous plan was 18.04, and the VIX printed 18.03 during that sequence before reversing its direction. Interesting confluence for a potential trade. The rest of the session traded in a very tight range, resulting in a 13-wide POC. Today’s afternoon rally high in G-period was rejected by the Smashlevel of 4143, and it’s worth noting that there was not a single 30-minute period that closed above 4143 today. The closing session offered the most activity, but unfortunately, it occurred a little too late for my taste.

Today’s session resulted in an inside day, making it a double inside day. The closing weakness resulted in a downward spike, with a base at 4127, which will be the more aggressive level to observe short-term. As always, trading within and below the spike (Acceptance) is a more favorable outcome for sellers, while trading above the spike (Rejection) is a more favorable outcome for buyers. With acceptance, the sellers aim to break the weak/poor low, which would target the unfilled gap at 4098.25, followed by the prior 3-week balance high at 4083. Conversely, if the spike is rejected, the buyers aim to target today’s afternoon rally high at 4143, followed by the resistance area ranging from 4160 to 4170.

The market remains in full consolidation mode, with the daily in a highlighted 8-day balance. Balance rules apply (See Substack for details).

Balance Rules: The general rule is to go with the break of the balance area. Break to the upside (Look above and go), you want to be a buyer. Break to the downside (Look below and go), you want to be a seller. Monitor for continuation (Acceptance) or lack thereof. Lack of continuation (Failed breakout / Look above/below and fail), you want to fade and target other side of balance.

It’s worth noting that the lower end of the balance area is weak/poor. Both the upside gap of 4182.25 and the downside gap of 4098.25 have yet to be filled. As always, a period of volatility contraction will eventually give way to volatility expansion, suggesting that the market may be preparing for a directional move. It's important to be prepared to adjust to such a shift in the dynamic.

Going into tomorrow's session, I will observe 4127.

Break and hold above 4127 would target 4143 / 4160 / 4170

Holding below 4127 would target 4115 / 4098 / 4083

Additionally, pay attention to the following VIX levels: 18.90 and 17.04. These levels can provide confirmation of strength or weakness.

Break and hold above 4170 with VIX below 17.04 would confirm strength.

Break and hold below 4083 with VIX above 18.90 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Smashlevels are incredibly useful as pivots. The market looks more and more like a wedge. I wonder what type of information is going to take to break up or down.

I know most people run to the levels but understanding Smash's contextual analysis is where you will learn to be a better trader. Excellent work as always, Smash!