ES Daily Plan | May 16, 2023

The market continues its never-ending consolidation, with today's session resulting in an inside day.

Remember that the longer a consolidation lasts, the more significant the move out of it tends to be.

Contextual Analysis

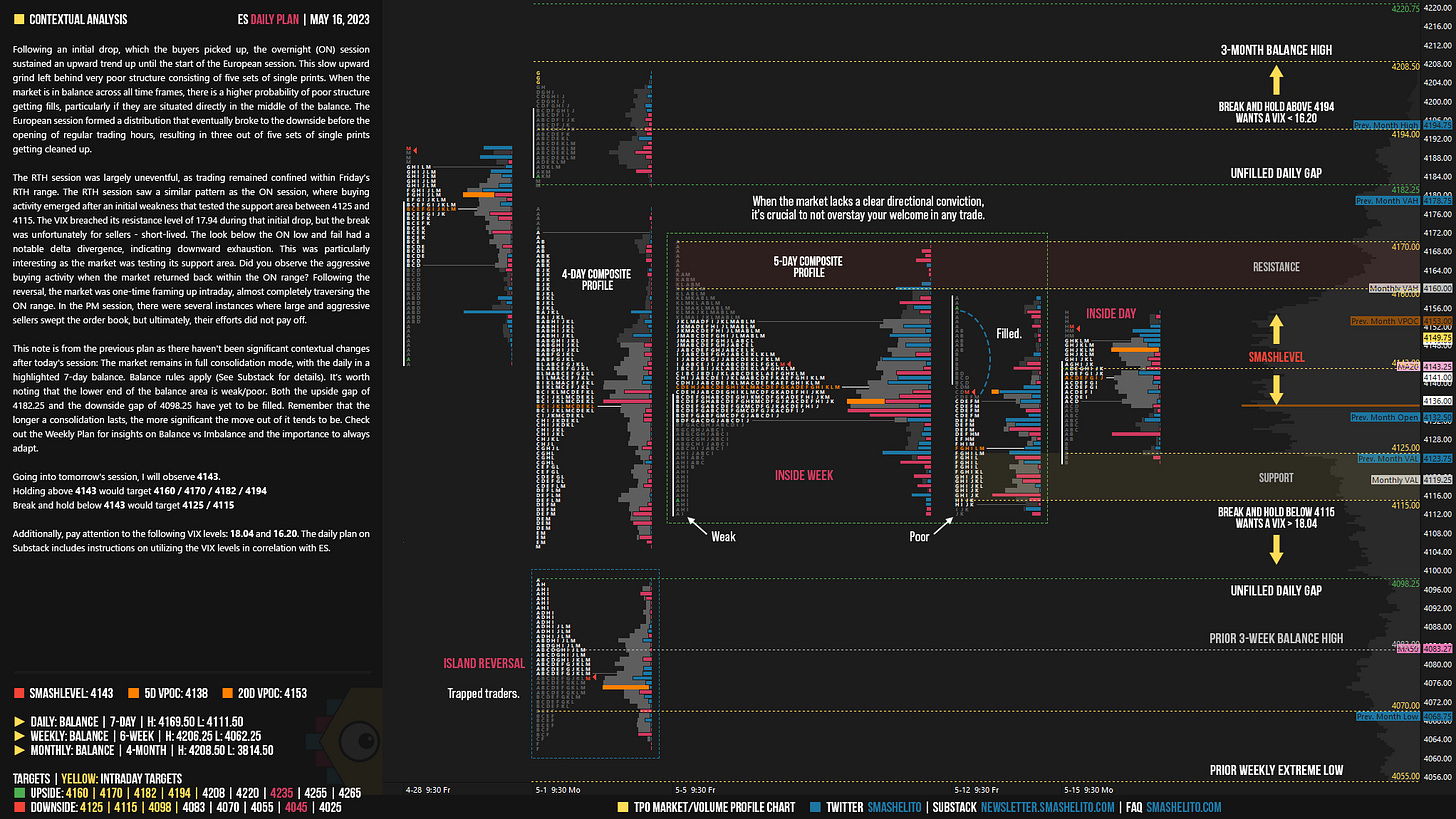

Following an initial drop, which the buyers picked up, the overnight (ON) session sustained an upward trend up until the start of the European session. This slow upward grind left behind very poor structure consisting of five sets of single prints. When the market is in balance across all time frames, there is a higher probability of poor structure getting fills, particularly if they are situated directly in the middle of the balance. The European session formed a distribution that eventually broke to the downside before the opening of regular trading hours, resulting in three out of five sets of single prints getting cleaned up.

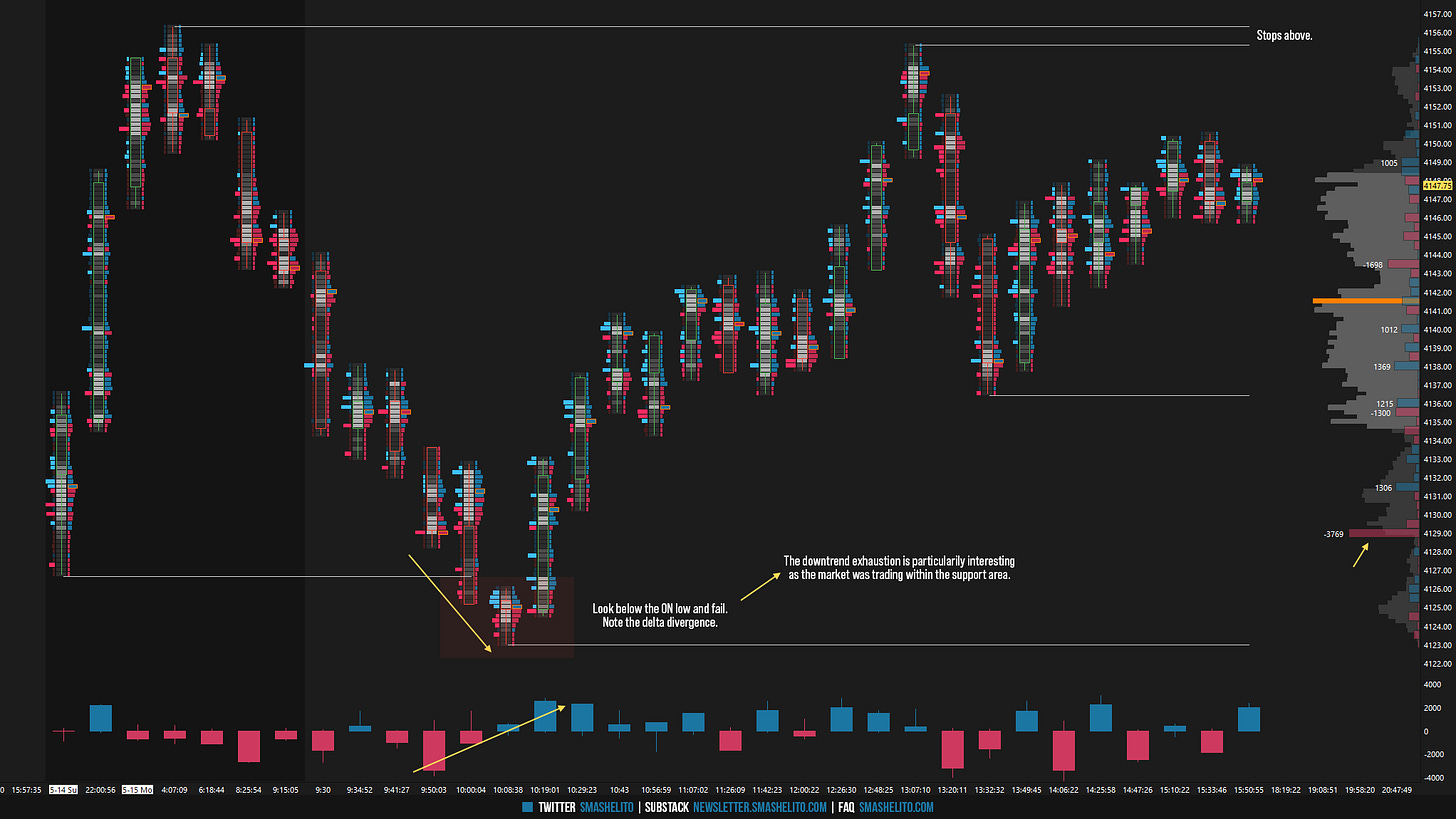

The RTH session was largely uneventful, as trading remained confined within Friday’s RTH range. The RTH session saw a similar pattern as the ON session, where buying activity emerged after an initial weakness that tested the support area between 4125 and 4115. The VIX breached its resistance level of 17.94 during that initial drop, but the break was unfortunately for sellers - short-lived. The look below the ON low and fail had a notable delta divergence, indicating downward exhaustion. This was particularly interesting as the market was testing its support area. Did you observe the aggressive buying activity when the market returned back within the ON range?

Following the reversal, the market was one-time framing up intraday, almost completely traversing the ON range. In the PM session, there were several instances where large and aggressive sellers swept the order book, but ultimately, their efforts did not pay off.

This note is from the previous plan as there haven't been significant contextual changes after today's session: The market remains in full consolidation mode, with the daily in a highlighted 7-day balance. Balance rules apply (See Substack for details).

Balance Rules: The general rule is to go with the break of the balance area. Break to the upside (Look above and go), you want to be a buyer. Break to the downside (Look below and go), you want to be a seller. Monitor for continuation (Acceptance) or lack thereof. Lack of continuation (Failed breakout / Look above/below and fail), you want to fade and target other side of balance.

It’s worth noting that the lower end of the balance area is weak/poor. Both the upside gap of 4182.25 and the downside gap of 4098.25 have yet to be filled. Remember that the longer a consolidation lasts, the more significant the move out of it tends to be. Check out the Weekly Plan for insights on Balance vs Imbalance and the importance to always adapt.

Going into tomorrow's session, I will observe 4143.

Holding above 4143 would target 4160 / 4170 / 4182 / 4194

Break and hold below 4143 would target 4125 / 4115

Additionally, pay attention to the following VIX levels: 18.04 and 16.20. These levels can provide confirmation of strength or weakness.

Break and hold above 4194 with VIX below 16.20 would confirm strength.

Break and hold below 4115 with VIX above 18.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Hi smashelito - once again thanks for sharing your views on the ES - gives me real confidence while cross-checking my TPOs and analysis - and I’m grateful to have the possibility to learn every day from this&you. The infinite Espressos goes on my house 😉 take care

The sellers are poor! need to attract stronger sellers with higher prices.