ES Daily Plan | May 1, 2024

The market is currently in balance across all time frames, highlighting the importance of staying nimble, particularly with tomorrow's FOMC. Downward spike area is of interest in the short term.

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

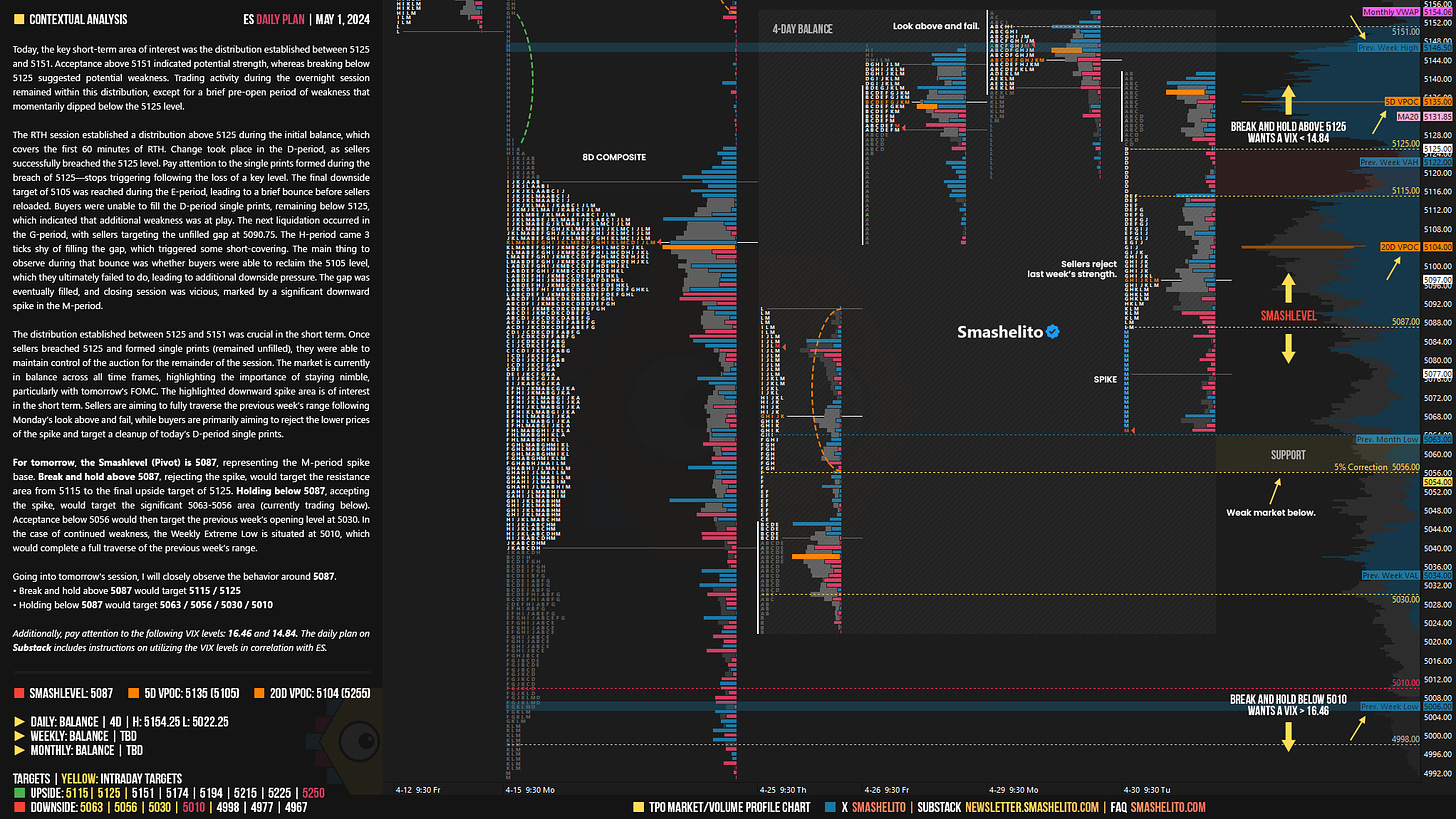

Today, the key short-term area of interest was the distribution established between 5125 and 5151. Acceptance above 5151 indicated potential strength, whereas breaking below 5125 suggested potential weakness. Trading activity during the overnight session remained within this distribution, except for a brief pre-open period of weakness that momentarily dipped below the 5125 level.

The RTH session established a distribution above 5125 during the initial balance, which covers the first 60 minutes of RTH. Change took place in the D-period, as sellers successfully breached the 5125 level. Pay attention to the single prints formed during the breach of 5125—stops triggering following the loss of a key level. The final downside target of 5105 was reached during the E-period, leading to a brief bounce before sellers reloaded. Buyers were unable to fill the D-period single prints, remaining below 5125, which indicated that additional weakness was at play. The next liquidation occurred in the G-period, with sellers targeting the unfilled gap at 5090.75. The H-period came 3 ticks shy of filling the gap, which triggered some short-covering. The main thing to observe during that bounce was whether buyers were able to reclaim the 5105 level, which they ultimately failed to do, leading to additional downside pressure. The gap was eventually filled, and closing session was vicious, marked by a significant downward spike in the M-period.

The distribution established between 5125 and 5151 was crucial in the short term. Once sellers breached 5125 and formed single prints (remained unfilled), they were able to maintain control of the auction for the remainder of the session. The market is currently in balance across all time frames, highlighting the importance of staying nimble, particularly with tomorrow's FOMC. The highlighted downward spike area is of interest in the short term. Sellers are aiming to fully traverse the previous week’s range following Monday’s look above and fail, while buyers are primarily aiming to reject the lower prices of the spike and target a cleanup of today’s D-period single prints.

For tomorrow, the Smashlevel (Pivot) is 5087, representing the M-period spike base. Break and hold above 5087, rejecting the spike, would target the resistance area from 5115 to the final upside target of 5125. Holding below 5087, accepting the spike, would target the significant 5063-5056 area (currently trading below). Acceptance below 5056 would then target the previous week’s opening level at 5030. In the case of continued weakness, the Weekly Extreme Low is situated at 5010, which would complete a full traverse of the previous week’s range.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5087.

Break and hold above 5087 would target 5115 / 5125

Holding below 5087 would target 5063 / 5056 / 5030 / 5010

Additionally, pay attention to the following VIX levels: 16.46 and 14.84. These levels can provide confirmation of strength or weakness.

Break and hold above 5125 with VIX below 14.84 would confirm strength.

Break and hold below 5010 with VIX above 16.46 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

The market fell apart below the weekly 5125 level! Thank you!

Thank you, buddy! Was long at the open after 11 am shorts were in play.