ES Daily Plan | March 8, 2023

Today’s session resulted in a triple distribution trend day down, and we ultimately reached the previous week's VPOC of 3985.

My primary focus for tomorrow will be today's lower distribution, which I've highlighted.

Contextual Analysis

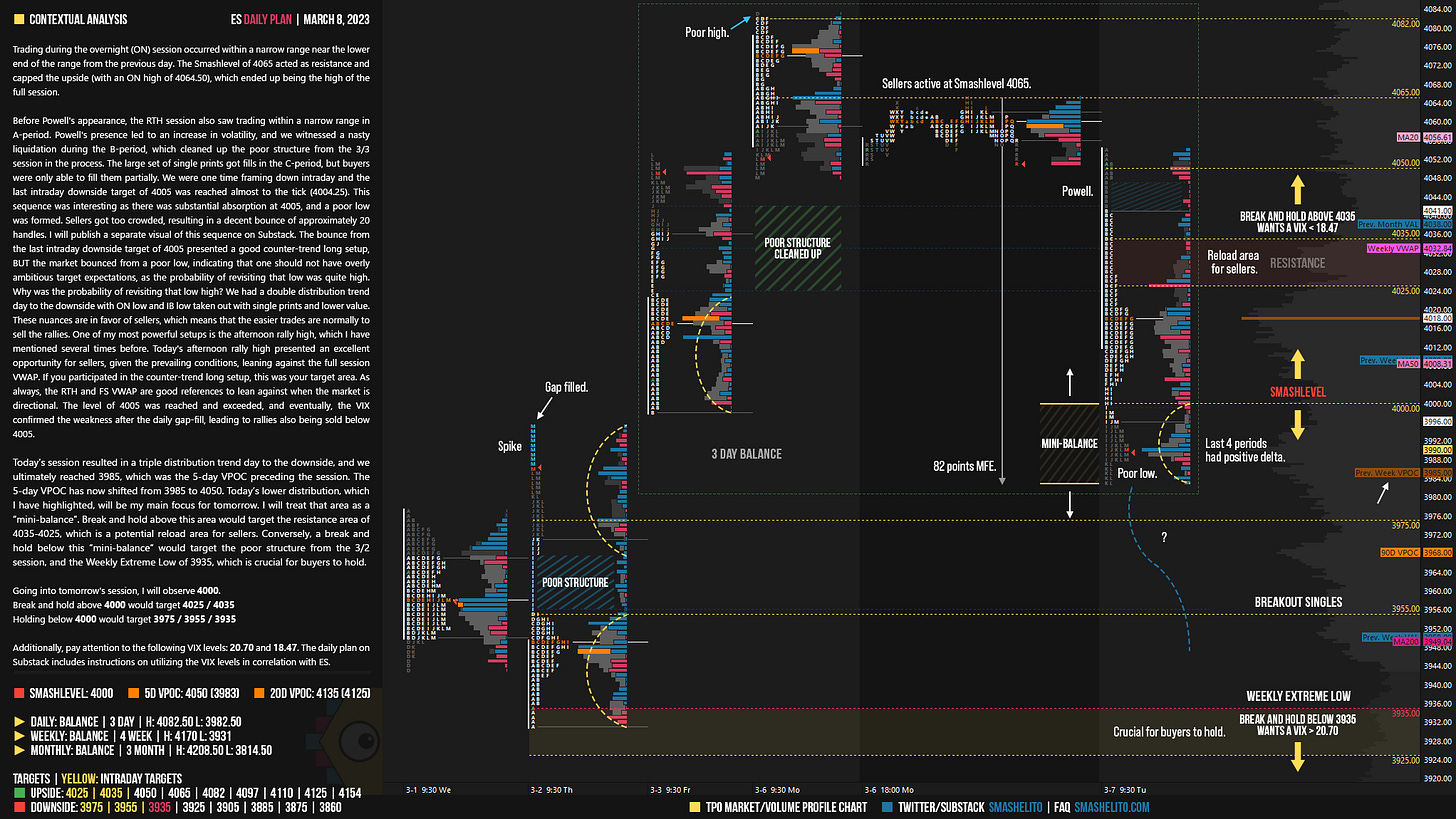

Trading during the overnight (ON) session occurred within a narrow range near the lower end of the range from the previous day. The Smashlevel of 4065 acted as resistance and capped the upside (with an ON high of 4064.50), which ended up being the high of the full session.

Before Powell's appearance, the RTH session also saw trading within a narrow range in A-period. Powell's presence led to an increase in volatility, and we witnessed a nasty liquidation during the B-period, which cleaned up the poor structure from the 3/3 session in the process. The large set of single prints got fills in the C-period, but buyers were only able to fill them partially. We were one time framing down intraday and the last intraday downside target of 4005 was reached almost to the tick (4004.25). This sequence was interesting as there was substantial absorption at 4005, and a poor low was formed. Sellers got too crowded, resulting in a decent bounce of approximately 20 handles. I will publish a separate visual of this sequence on Substack.

The bounce from the last intraday downside target of 4005 presented a good counter-trend long setup, BUT the market bounced from a poor low, indicating that one should not have overly ambitious target expectations, as the probability of revisiting that low was quite high. Why was the probability of revisiting that low high? We had a double distribution trend day to the downside with ON low and IB low taken out with single prints and lower value. These nuances are in favor of sellers, which means that the easier trades are normally to sell the rallies. One of my most powerful setups is the afternoon rally high, which I have mentioned several times before. Today's afternoon rally high presented an excellent opportunity for sellers, given the prevailing conditions, leaning against the full session VWAP. If you participated in the counter-trend long setup, this was your target area. As always, the RTH and FS VWAP are good references to lean against when the market is directional. The level of 4005 was reached and exceeded, and eventually, the VIX confirmed the weakness after the daily gap-fill, leading to rallies also being sold below 4005.

Today’s session resulted in a triple distribution trend day to the downside, and we ultimately reached 3985, which was the 5-day VPOC preceding the session. The 5-day VPOC has now shifted from 3985 to 4050. Today’s lower distribution, which I have highlighted, will be my main focus for tomorrow. I will treat that area as a “mini-balance”. Break and hold above this area would target the resistance area of 4035-4025, which is a potential reload area for sellers. Conversely, a break and hold below this “mini-balance” would target the poor structure from the 3/2 session, and the Weekly Extreme Low of 3935, which is crucial for buyers to hold.

Going into tomorrow's session, I will observe 4000.

Break and hold above 4000 would target 4025 / 4035

Holding below 4000 would target 3975 / 3955 / 3935

Additionally, pay attention to the following VIX levels: 20.70 and 18.47. These levels can provide confirmation of strength or weakness.

Break and hold above 4035 with VIX below 18.47 would confirm strength.

Break and hold below 3935 with VIX above 20.70 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Thank you so much for all the great work you doing! Simply amazing!

Awesome work as usual, silly Ques but do you trade futures or use this information and trade options. Thank you for everything 🙏🏻