ES Daily Plan | March 24, 2023

Despite significant intraday fluctuations in both directions, there was not much overall change.

The weekly profile is still characterized by a double distribution, which I will continue to focus on short-term.

Contextual Analysis

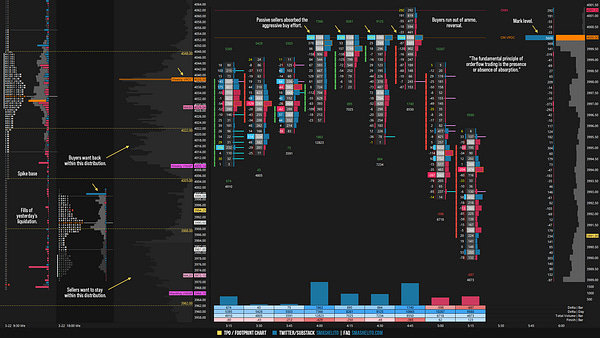

Starting from the beginning of the overnight (ON) session, there was an upward trend, which resulted in the majority of yesterday's emotional M-period being filled. However, passive sellers were waiting at the 4000 level and absorbed buyers who ran out of ammo, leading to a decent reversal. I tweeted a visual of this sequence.

Like I mentioned in previous plan, the fundamental principle of orderflow trading is the presence or absence of absorption. During the ON session, the trading occurred entirely within yesterday's spike area, and the overnight inventory was 100% net long. This means that the entire ON session traded above the prior day's settlement.

Normally, when the inventory is 100% net long (or short), we get an inventory correction at the opening of the RTH session. The absence of an inventory correction is powerful market generated information, indicating that the overnight traders are “correct”. Do you remember the delta from yesterday’s M-period? -18222. There was no interest below the open level when RTH opened, indicating that buyers were not done. The spike base of 4005 was immediately rejected in A-period, which obviously triggered a vicious short-covering rally. The market was one time framing up intraday, forming two sets of single prints after only four periods, and had already reached the last upside target of 4022 in the C-period.

Although I have mentioned it before, it is worth reiterating that conservative traders should book profits at the last upside/downside target and always exercise caution initiating trades outside of the yellow levels, regardless of whether there is confirmation from VIX or not. Making impulsive decisions during emotional market moves is one of the easiest mistakes to make in trading. Yesterday, sellers who acted impulsively during the M-period were punished, and today, late buyers suffered the same fate. The VIX confirmed the market's strength even before the RTH opened by breaking the support level of 21.12, which ultimately helped buyers squeeze another ~20 handles above the last upside target of 4022. The D-period formed an excess high, but the conditions for a reversal were not there yet as VIX held below 21.12. However, the conditions drastically changed when buyers lost control of 4022 and the VIX regained the 21.12 level in the same moment. Did you notice the aggressive selling that followed? I will publish a visual of this on Substack. The reversal that followed was obviously much bigger than one could expect, and it breached prior day’s low, which means that the daily is now one time framing down.

Despite significant intraday fluctuations in both directions, there was not much overall change. The weekly profile is still characterized by a double distribution, which I will continue to focus on short-term. Currently, both the weekly VPOC and the 5-day VPOC are located in the upper distribution, and sellers aim to shift it to the lower distribution.

Going into tomorrow's session, I will observe 3990.

Break and hold above 3990 would target 4005 / 4030

Holding below 3990 would target 3967 / 3940 / 3920

Additionally, pay attention to the following VIX levels: 23.98 and 21.24. These levels can provide confirmation of strength or weakness.

Break and hold above 4030 with VIX below 21.24 would confirm strength.

Break and hold below 3920 with VIX above 23.98 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. Twitter: @smashelito | FAQ: smashelito.com

Smash beast mode

Great writeup as always! Thank you for the guidance 💥