ES Daily Plan | June 7, 2023

The daily has returned to a 3-day balance, indicating that the market is taking a breather following Friday’s significant breakout.

As long as the market stays within this balance range, we can anticipate two-sided activity, emphasizing the need to remain adaptable and responsive.

Contextual Analysis

Note: I posted a video on Twitter showcasing a replay of yesterday's false breakout of the initial balance high. If you haven't watched it yet, you can find the video at the following link. This sequence provided a valuable illustration of what to observe from an order flow perspective. Aggressive buyers attempting a breakout were absorbed by passive sellers, resulting in a price stall. Following that, aggressive sellers entered the market and confirmed the reversal.

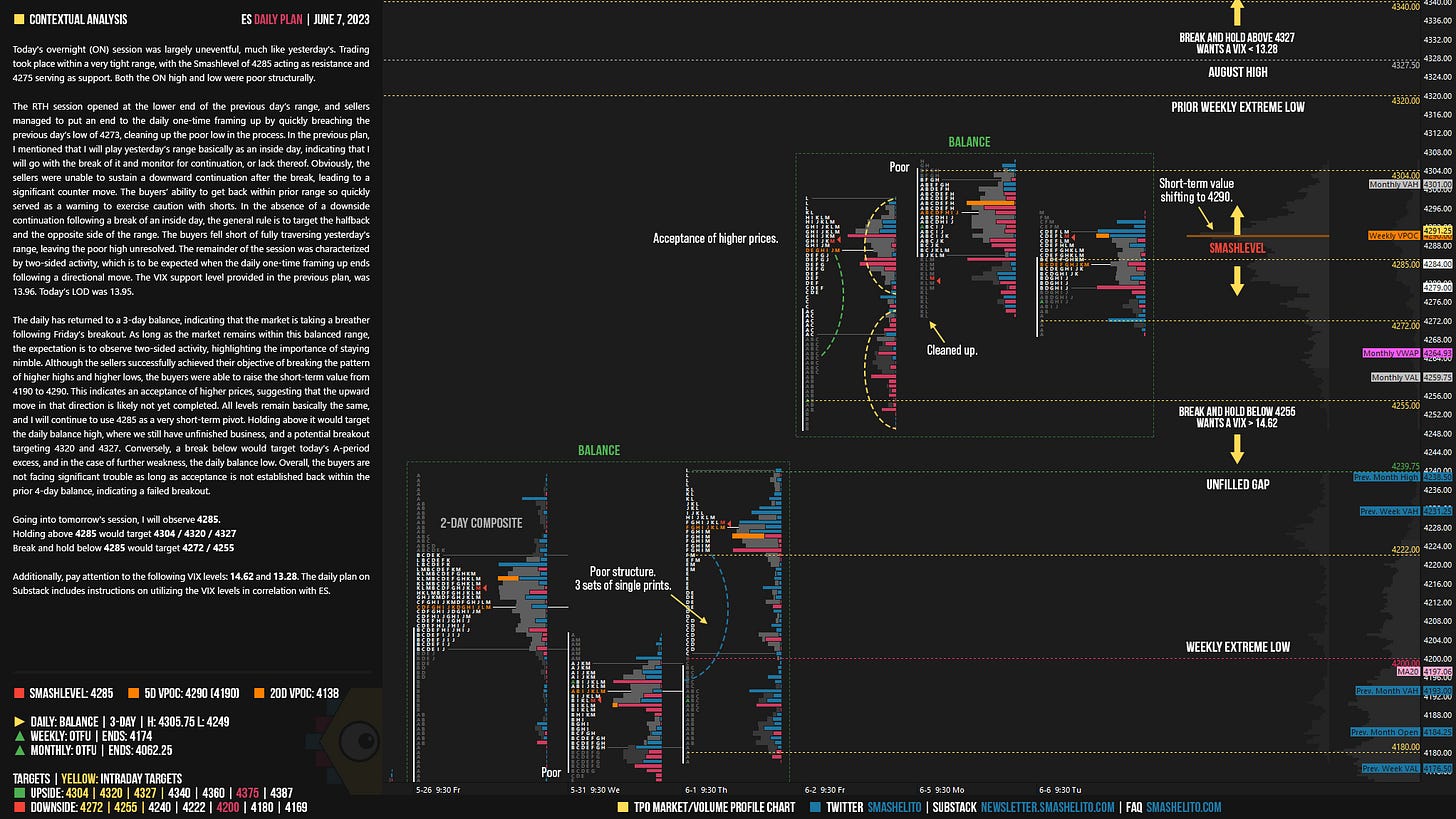

Today's overnight (ON) session was largely uneventful, much like yesterday's. Trading took place within a very tight range, with the Smashlevel of 4285 acting as resistance and 4275 serving as support. Both the ON high and low were poor structurally.

The RTH session opened at the lower end of the previous day’s range, and sellers managed to put an end to the daily one-time framing up by quickly breaching the previous day’s low of 4273, cleaning up the poor low in the process. In the previous plan, I mentioned that I will play yesterday’s range basically as an inside day, indicating that I will go with the break of it and monitor for continuation, or lack thereof. Obviously, the sellers were unable to sustain a downward continuation after the break, leading to a significant counter move. The buyers’ ability to get back within prior range so quickly served as a warning to exercise caution with shorts. In the absence of a downside continuation following a break of an inside day, the general rule is to target the halfback and the opposite side of the range. The buyers fell short of fully traversing yesterday's range, leaving the poor high unresolved. The remainder of the session was characterized by two-sided activity, which is to be expected when the daily one-time framing up ends following a directional move. The VIX support level provided in the previous plan, was 13.96. Today’s LOD was 13.95.

The daily has returned to a 3-day balance, indicating that the market is taking a breather following Friday’s breakout. As long as the market remains within this balance range, the expectation is to observe two-sided activity, highlighting the importance of staying nimble. Although the sellers successfully achieved their objective of breaking the pattern of higher highs and higher lows, the buyers were able to raise the short-term value from 4190 to 4290. This indicates an acceptance of higher prices, suggesting that the upward move in that direction is likely not yet completed. All levels remain basically the same, and I will continue to use 4285 as a very short-term pivot. Holding above it would target the daily balance high, where we still have unfinished business, and a potential breakout targeting 4320 and 4327. Conversely, a break below would target today’s A-period excess, and in the case of further weakness, the daily balance low. Overall, the buyers are not facing significant trouble as long as acceptance is not established back within the prior 4-day balance, indicating a failed breakout.

Going into tomorrow's session, I will observe 4285.

Holding above 4285 would target 4304 / 4320 / 4327

Break and hold below 4285 would target 4272 / 4255

Additionally, pay attention to the following VIX levels: 14.62 and 13.28. These levels can provide confirmation of strength or weakness.

Break and hold above 4327 with VIX below 13.28 would confirm strength.

Break and hold below 4255 with VIX above 14.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

That was a great video!

Hello Smashleto, can you give NQ levels as well?