ES Daily Plan | June 27, 2023

The sellers successfully put an end to the weekly one-time framing up, bringing it back to balance.

Close and a spike below the inside week - can sellers establish acceptance of lower prices or will buyers reject?

Contextual Analysis

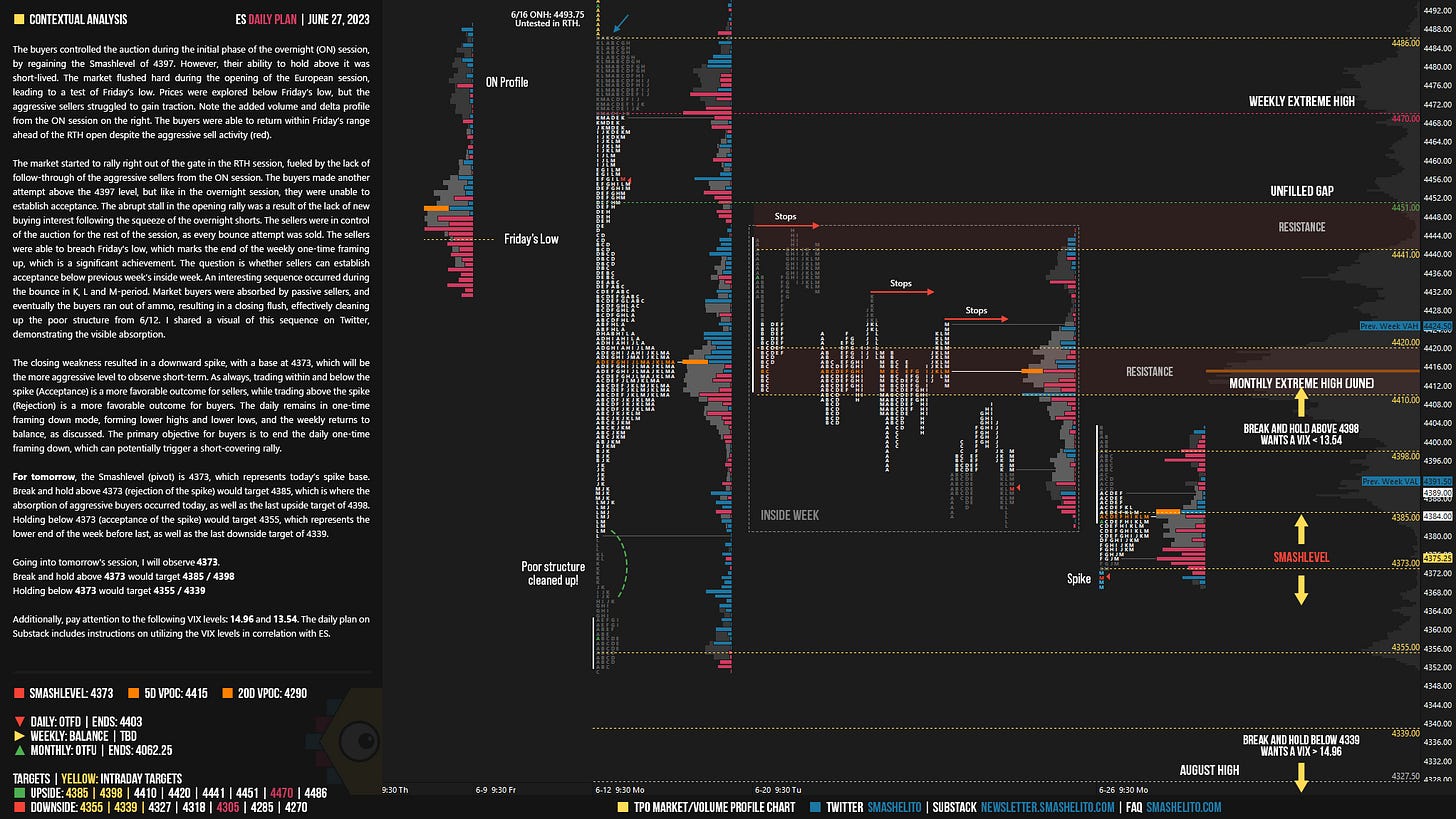

The buyers controlled the auction during the initial phase of the overnight (ON) session, by regaining the Smashlevel of 4397. However, their ability to hold above it was short-lived. The market flushed hard during the opening of the European session, leading to a test of Friday’s low. Prices were explored below Friday’s low, but the aggressive sellers struggled to gain traction. Note the added volume and delta profile from the ON session on the right. The buyers were able to return within Friday’s range ahead of the RTH open despite the aggressive sell activity (red).

The market started to rally right out of the gate in the RTH session, fueled by the lack of follow-through of the aggressive sellers from the ON session. The buyers made another attempt above the 4397 level, but like in the overnight session, they were unable to establish acceptance. The abrupt stall in the opening rally was a result of the lack of new buying interest following the squeeze of the overnight shorts. The sellers were in control of the auction for the rest of the session, as every bounce attempt was sold. The sellers were able to breach Friday's low, which marks the end of the weekly one-time framing up, which is a significant achievement. The question is whether sellers can establish acceptance below previous week’s inside week. An interesting sequence occurred during the bounce in K, L and M-period. Market buyers were absorbed by passive sellers, and eventually the buyers ran out of ammo, resulting in a closing flush, effectively cleaning up the poor structure from 6/12. I shared a visual of this sequence on Twitter, demonstrating the visible absorption.

The closing weakness resulted in a downward spike, with a base at 4373, which will be the more aggressive level to observe short-term. As always, trading within and below the spike (Acceptance) is a more favorable outcome for sellers, while trading above the spike (Rejection) is a more favorable outcome for buyers. The daily remains in one-time framing down mode, forming lower highs and lower lows, and the weekly returns to balance, as discussed. The primary objective for buyers is to end the daily one-time framing down, which can potentially trigger a short-covering rally.

For tomorrow, the Smashlevel (pivot) is 4373, which represents today’s spike base. Break and hold above 4373 (rejection of the spike) would target 4385, which is where the absorption of aggressive buyers occurred today, as well as the last upside target of 4398. Holding below 4373 (acceptance of the spike) would target 4355, which represents the lower end of the week before last, as well as the last downside target of 4339.

Going into tomorrow's session, I will observe 4373.

Break and hold above 4373 would target 4385 / 4398

Holding below 4373 would target 4355 / 4339

Additionally, pay attention to the following VIX levels: 14.96 and 13.54. These levels can provide confirmation of strength or weakness.

Break and hold above 4398 with VIX below 13.54 would confirm strength.

Break and hold below 4339 with VIX above 14.96 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

... and as soon as they broke those passive selling BOOM. Squeeze-o-rama

Amazing commentary as always. That absorption at 4385 (first support yesterday) was also controlled by VWAP, which was sold every time buyers attempted a bounce.