ES Daily Plan | June 16, 2023

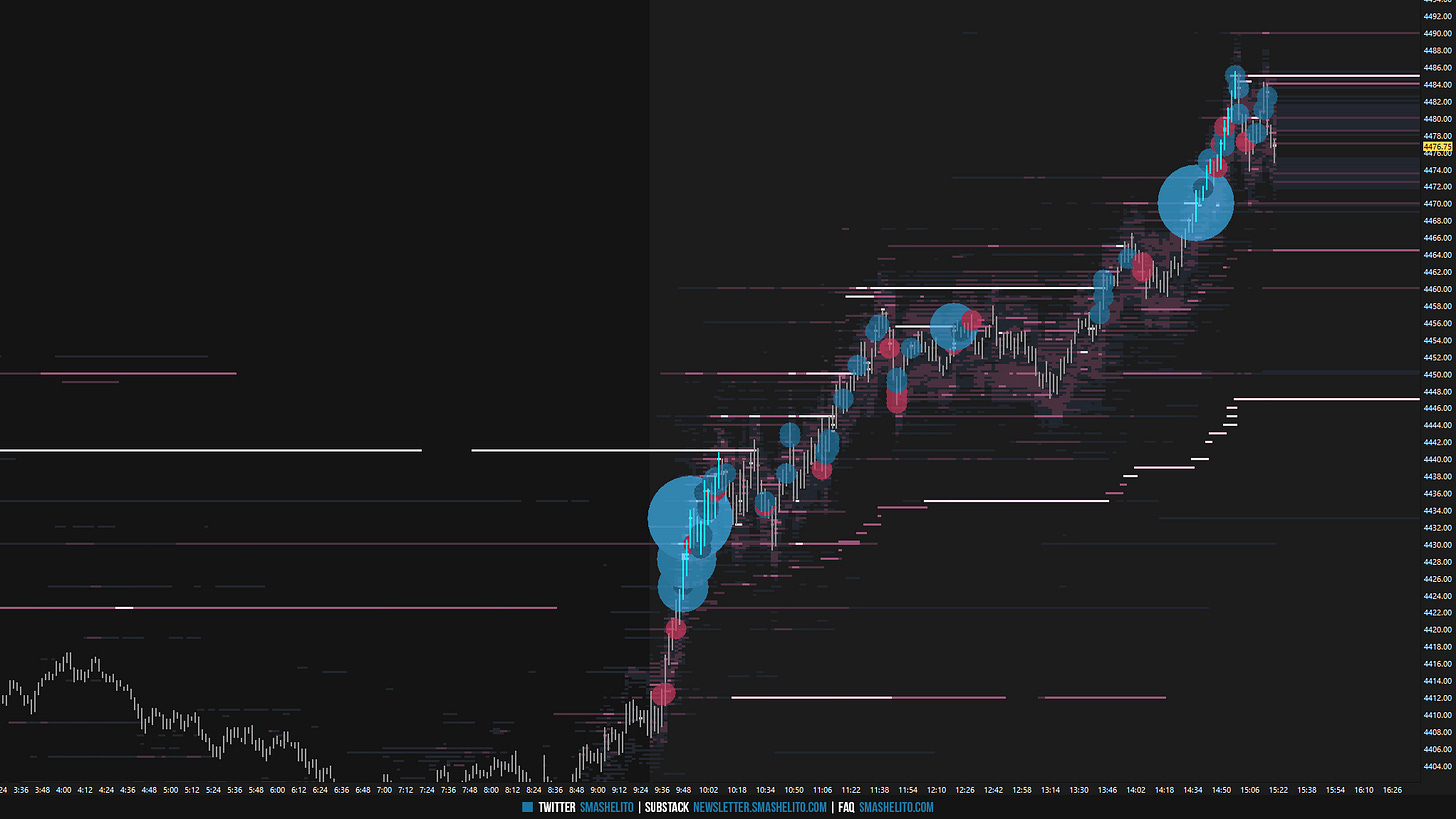

The balance was short-lived as the buyers had completely different plans and formed a multi-distribution trend day.

Immediate level of interest is 4467, followed by today's afternoon pullback low at 4447.

Contextual Analysis

Just a reminder that I have transitioned to the ESU23 (September) contract. Please note that I do not back-adjust my charts. I suggest marking 4304.75 (Friday’s ESM23 settlement) on your chart, as roll gaps often tend to get filled.

Today’s session was wild, to say the least. The overnight (ON) session was rather weak as sellers managed to breach and defend the Smashlevel of 4418 during the Asian hours. The weakness carried over into the European hours, resulting in a test of our next level of interest 4396, where buying activity emerged.

The market started to rally right out of the gate in the RTH session, resulting in a quick trip to the upper end of the 2-day balance during the initial balance (first hour of RTH). As a result, yesterday’s excess high was immediately challenged, which was something the buyers aimed to accomplish quickly, as discussed. Another topic discussed in the previous plan, was the Weekly Extreme High of 4430, which the sellers successfully defended yesterday. Established acceptance above 4430, had potential to trigger a squeeze. Did you observe how the market developed a distribution above 4430 in B and C-period? The consolidation above 4430, located at the upper end of the balance area, provided early indications of a potential breakout attempt underway. On top of that, a poor low formed right at 4430. Following a breakout, the market successfully reached the last upside target of 4452 during the D-period. Subsequently, there was a consolidation phase that lasted for a couple of periods. Note where today’s TPOC is located (4453.75). Days like these are not my favorite, as the lack of confirmation in the VIX regarding the market's strength typically leads me to adopt a defensive approach. Shorting was not an optimal choice given the breakout of the balance, unless it fails, and simultaneously, I tend to refrain from initiating new long positions above 4452 (last target). Today, it was contextually favorable for leaving runners, which unfortunately I did not capitalize on. The market squeezed another 30 handles, but subsequently retraced 20 handles from its highs, highlighting the challenging nature of entering a full FOMO mode. The next session always awaits.

Today’s session was a multi-distribution trend day that effectively cleaned up the poor structure left behind by the trend day on April 21, 2022. Carry forward today’s high as poor. To simplify things for tomorrow, I will closely monitor whether today's trend day, which deviated from the 2-day balance and the short-term value (4417), will be accepted or rejected. As long as the afternoon pullback low of 4447, coinciding with today's halfback, remains intact, the buyers are not facing any significant trouble. Trouble would only arise if the market reestablishes acceptance within the initial balance range, which would put today’s rally into question and target a weekly close below 4430. The immediate level of interest is the lower end of today’s upper distribution at 4467. Tomorrow, I will take the day off and let other traders take the lead in the price discovery process as the market is well above 4430. Stay nimble!

Going into tomorrow's session, I will observe 4467.

Holding above 4467 would target 4485 / 4503

Break and hold below 4467 would target 4447 / 4430

Additionally, pay attention to the following VIX levels: 15.24 and 13.76. These levels can provide confirmation of strength or weakness.

Break and hold above 4503 with VIX below 13.76 would confirm strength.

Break and hold below 4430 with VIX above 15.24 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

What an awesome day!

Incredibly tricky session, and kudos for the honesty in describing an insane squeeze that was not confirmed by anything. Tomorrow's Opex but especially next shorter week will hold the key to the rest of the summer