ES Daily Plan | June 1, 2023

The daily has returned to a 3-day balance after the break of the prior day’s low.

I’m expecting two-sided activity as long as the market stays within this balance range, highlighting the importance of staying nimble.

Contextual Analysis

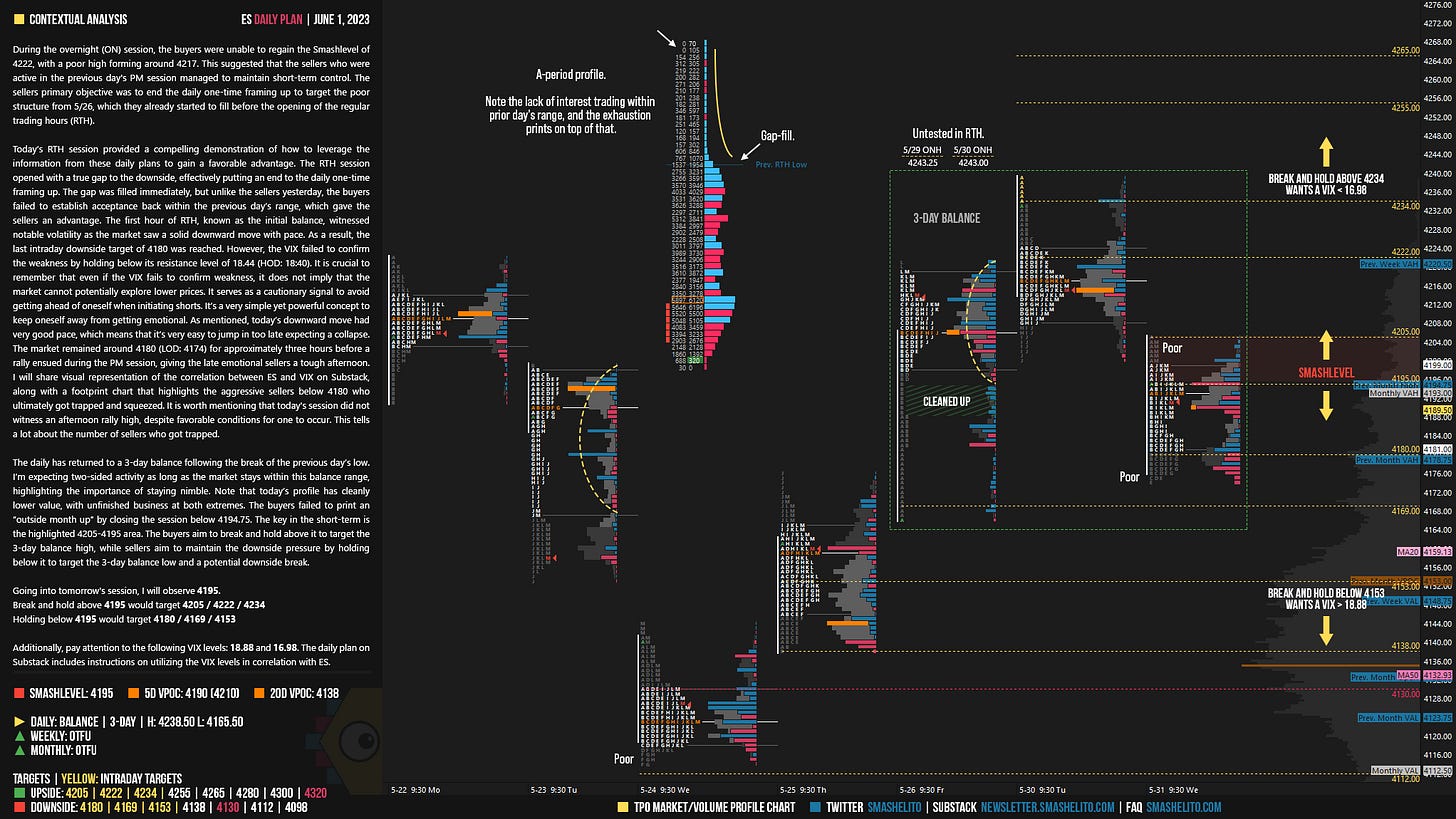

During the overnight (ON) session, the buyers were unable to regain the Smashlevel of 4222, with a poor high forming around 4217. This suggested that the sellers who were active in the previous day's PM session managed to maintain short-term control. The sellers primary objective was to end the daily one-time framing up to target the poor structure from 5/26, which they already started to fill before the opening of the regular trading hours (RTH).

Today’s RTH session provided a compelling demonstration of how to leverage the information from these daily plans to gain a favorable advantage. The RTH session opened with a true gap to the downside, effectively putting an end to the daily one-time framing up. The gap was filled immediately, but unlike the sellers yesterday, the buyers failed to establish acceptance back within the previous day’s range, which gave the sellers an advantage. The first hour of RTH, known as the initial balance, witnessed notable volatility as the market saw a solid downward move with pace. As a result, the last intraday downside target of 4180 was reached. However, the VIX failed to confirm the weakness by holding below its resistance level of 18.44 (HOD: 18:40). It is crucial to remember that even if the VIX fails to confirm weakness, it does not imply that the market cannot potentially explore lower prices. It serves as a cautionary signal to avoid getting ahead of oneself when initiating shorts. It’s a very simple yet powerful concept to keep oneself away from getting emotional. As mentioned, today’s downward move had very good pace, which means that it’s very easy to jump in too late expecting a collapse. The market remained around 4180 (LOD: 4174) for approximately three hours before a rally ensued during the PM session, giving the late emotional sellers a tough afternoon. I will share visual representation of the correlation between ES and VIX on Substack, along with a footprint chart that highlights the aggressive sellers below 4180 who ultimately got trapped and squeezed.

It is worth mentioning that today's session did not witness an afternoon rally high, despite favorable conditions for one to occur. This tells a lot about the number of sellers who got trapped.

The daily has returned to a 3-day balance following the break of the previous day’s low. I’m expecting two-sided activity as long as the market stays within this balance range, highlighting the importance of staying nimble. Note that today’s profile has cleanly lower value, with unfinished business at both extremes. The buyers failed to print an “outside month up” by closing the session below 4194.75. The key in the short-term is the highlighted 4205-4195 area. The buyers aim to break and hold above it to target the 3-day balance high, while sellers aim to maintain the downside pressure by holding below it to target the 3-day balance low and a potential downside break.

Going into tomorrow's session, I will observe 4195.

Break and hold above 4195 would target 4205 / 4222 / 4234

Holding below 4195 would target 4180 / 4169 / 4153

Additionally, pay attention to the following VIX levels: 18.88 and 16.98. These levels can provide confirmation of strength or weakness.

Break and hold above 4234 with VIX below 16.98 would confirm strength.

Break and hold below 4153 with VIX above 18.88 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Your VIX levels was what avoided me to get short once 4180 was breached. There was no confirmation as VIX did not make any higher highs and remained at 18.2

Thank you!