ES Daily Plan | July 6, 2023

The daily has returned to a 3-day balance after breaching the prior day's low. The market is currently accepting the higher prices following Friday's true gap to the upside.

Contextual Analysis

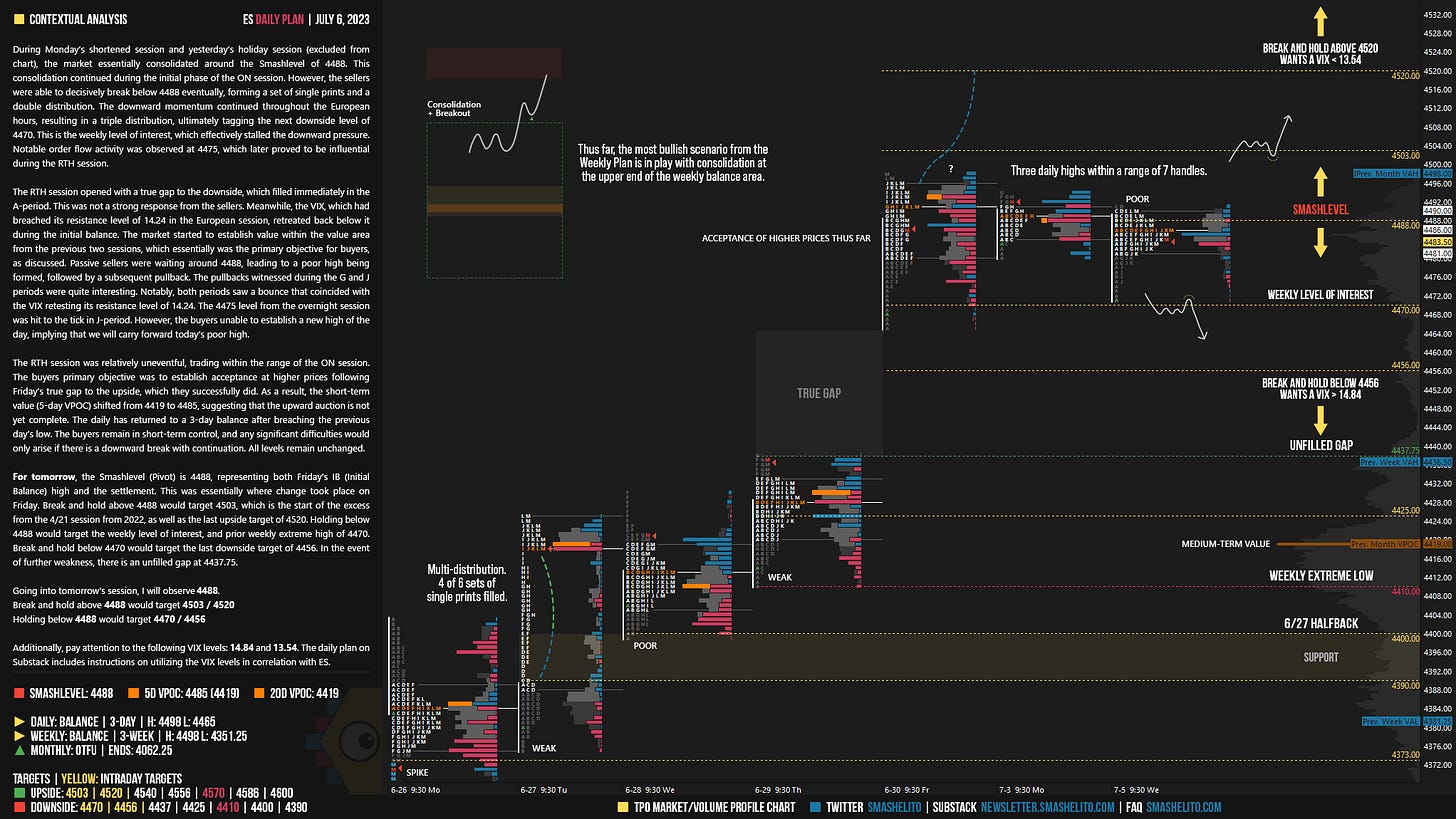

During Monday’s shortened session and yesterday’s holiday session (excluded from chart), the market essentially consolidated around the Smashlevel of 4488. This consolidation continued during the initial phase of the ON session. However, the sellers were able to decisively break below 4488 eventually, forming a set of single prints and a double distribution. The downward momentum continued throughout the European hours, resulting in a triple distribution, ultimately tagging the next downside level of 4470. This is the weekly level of interest, which effectively stalled the downward pressure. Notable order flow activity was observed at 4475, which later proved to be influential during the RTH session.

The RTH session opened with a true gap to the downside, which filled immediately in the A-period. This was not a strong response from the sellers. Meanwhile, the VIX, which had breached its resistance level of 14.24 in the European session, retreated back below it during the initial balance. The market started to establish value within the value area from the previous two sessions, which essentially was the primary objective for buyers, as discussed. Passive sellers were waiting around 4488, leading to a poor high being formed, followed by a subsequent pullback. The pullbacks witnessed during the G and J periods were quite interesting. Notably, both periods saw a bounce that coincided with the VIX retesting its resistance level of 14.24. The 4475 level from the overnight session was hit to the tick in J-period. However, the buyers unable to establish a new high of the day, implying that we will carry forward today’s poor high.

The RTH session was relatively uneventful, trading within the range of the ON session. The buyers primary objective was to establish acceptance at higher prices following Friday’s true gap to the upside, which they successfully did. As a result, the short-term value (5-day VPOC) shifted from 4419 to 4485, suggesting that the upward auction is not yet complete. The daily has returned to a 3-day balance after breaching the previous day’s low. The buyers remain in short-term control, and any significant difficulties would only arise if there is a downward break with continuation. All levels remain unchanged.

For tomorrow, the Smashlevel (Pivot) is 4488, representing both Friday's IB (Initial Balance) high and the settlement. This was essentially where change took place on Friday. Break and hold above 4488 would target 4503, which is the start of the excess from the 4/21 session from 2022, as well as the last upside target of 4520. Holding below 4488 would target the weekly level of interest, and prior weekly extreme high of 4470. Break and hold below 4470 would target the last downside target of 4456. In the event of further weakness, there is an unfilled gap at 4437.75.

Going into tomorrow's session, I will observe 4488.

Break and hold above 4488 would target 4503 / 4520

Holding below 4488 would target 4470 / 4456

Additionally, pay attention to the following VIX levels: 14.84 and 13.54. These levels can provide confirmation of strength or weakness.

Break and hold above 4520 with VIX below 13.54 would confirm strength.

Break and hold below 4456 with VIX above 14.84 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you for what u do sir.

Beautiful VIX level (14.84), aggressive selling activity with the help of VIX smashes the bottom of the 3-day balance.