ES Daily Plan | July 31, 2023

Friday's session quickly reversed Thursday's emotional session.

However, the buyers struggled in gaining acceptance within Thursday's upper distribution, which is what I will continue to observe in the short-term.

Contextual Analysis

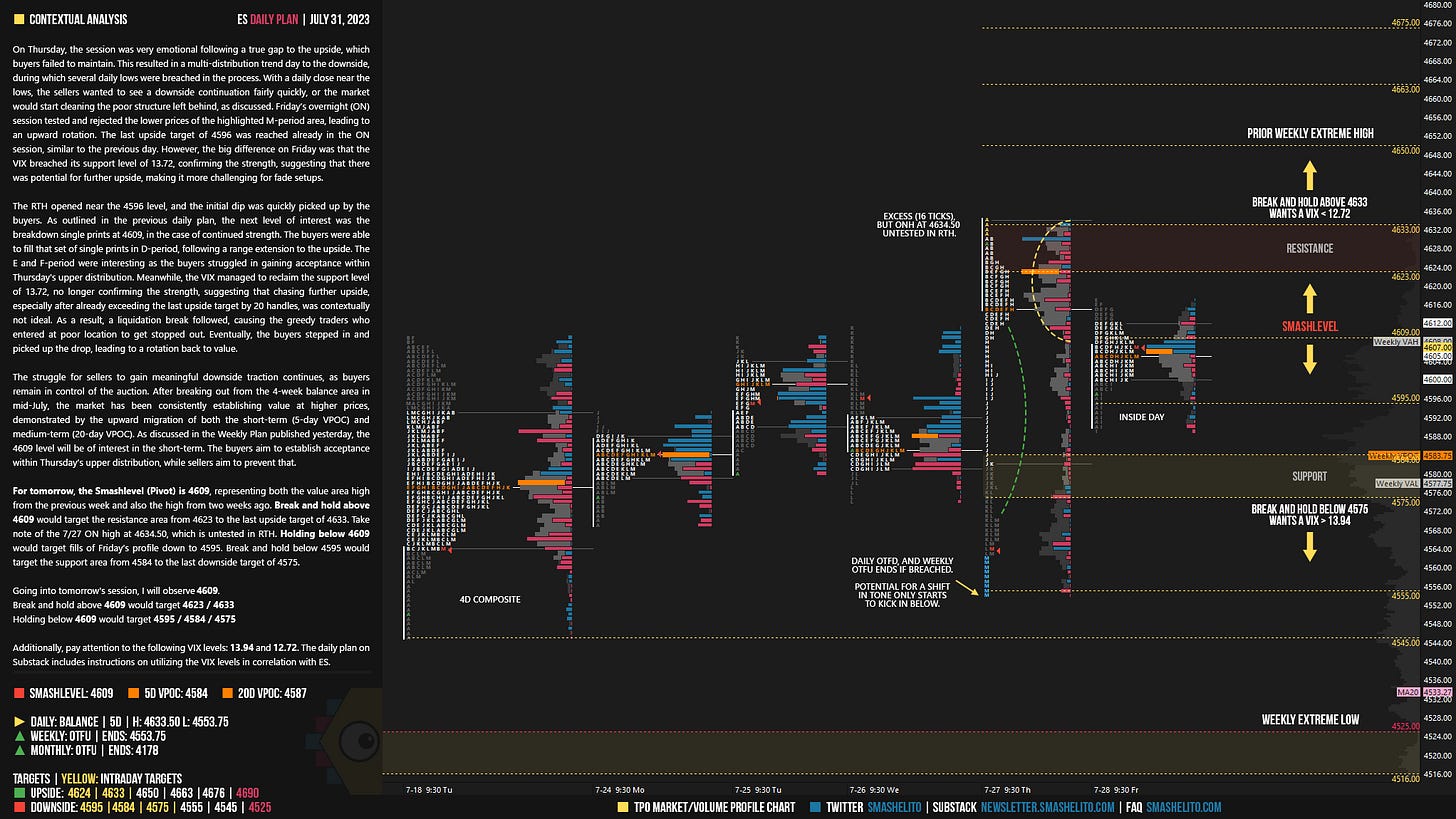

On Thursday, the session was very emotional following a true gap to the upside, which buyers failed to maintain. This resulted in a multi-distribution trend day to the downside, during which several daily lows were breached in the process. With a daily close near the lows, the sellers wanted to see a downside continuation fairly quickly, or the market would start cleaning the poor structure left behind, as discussed. Friday’s overnight (ON) session tested and rejected the lower prices of the highlighted M-period area, leading to an upward rotation. The last upside target of 4596 was reached already in the ON session, similar to the previous day. However, the big difference on Friday was that the VIX breached its support level of 13.72, confirming the strength, suggesting that there was potential for further upside, making it more challenging for fade setups.

The RTH opened near the 4596 level, and the initial dip was quickly picked up by the buyers. As outlined in the previous daily plan, the next level of interest was the breakdown single prints at 4609, in the case of continued strength. The buyers were able to fill that set of single prints in D-period, following a range extension to the upside. The E and F-period were interesting as the buyers struggled in gaining acceptance within Thursday's upper distribution. Meanwhile, the VIX managed to reclaim the support level of 13.72, no longer confirming the strength, suggesting that chasing further upside, especially after already exceeding the last upside target by 20 handles, was contextually not ideal. As a result, a liquidation break followed, causing the greedy traders who entered at poor location to get stopped out. Eventually, the buyers stepped in and picked up the drop, leading to a rotation back to value.

The struggle for sellers to gain meaningful downside traction continues, as buyers remain in control of the auction. After breaking out from the 4-week balance area in mid-July, the market has been consistently establishing value at higher prices, demonstrated by the upward migration of both the short-term (5-day VPOC) and medium-term (20-day VPOC). As discussed in the Weekly Plan published yesterday, the 4609 level will be of interest in the short-term. The buyers aim to establish acceptance within Thursday’s upper distribution, while sellers aim to prevent that.

For tomorrow, the Smashlevel (Pivot) is 4609, representing both the value area high from the previous week and also the high from two weeks ago. Break and hold above 4609 would target the resistance area from 4623 to the last upside target of 4633. Take note of the 7/27 ON high at 4634.50, which is untested in RTH. Holding below 4609 would target fills of Friday’s profile down to 4595. Break and hold below 4595 would target the support area from 4584 to the last downside target of 4575.

Going into tomorrow's session, I will observe 4609.

Break and hold above 4609 would target 4623 / 4633

Holding below 4609 would target 4595 / 4584 / 4575

Additionally, pay attention to the following VIX levels: 13.94 and 12.72. These levels can provide confirmation of strength or weakness.

Break and hold above 4633 with VIX below 12.72 would confirm strength.

Break and hold below 4575 with VIX above 13.94 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Shoutout Smashelito!!!

Thanks!