ES Daily Plan | July 19, 2023

Triple distribution trend day to the upside following the lack of interest below yesterday's afternoon pullback low of 4546.

I will use the lower end of today's upper distribution as a short-term reference point.

Contextual Analysis

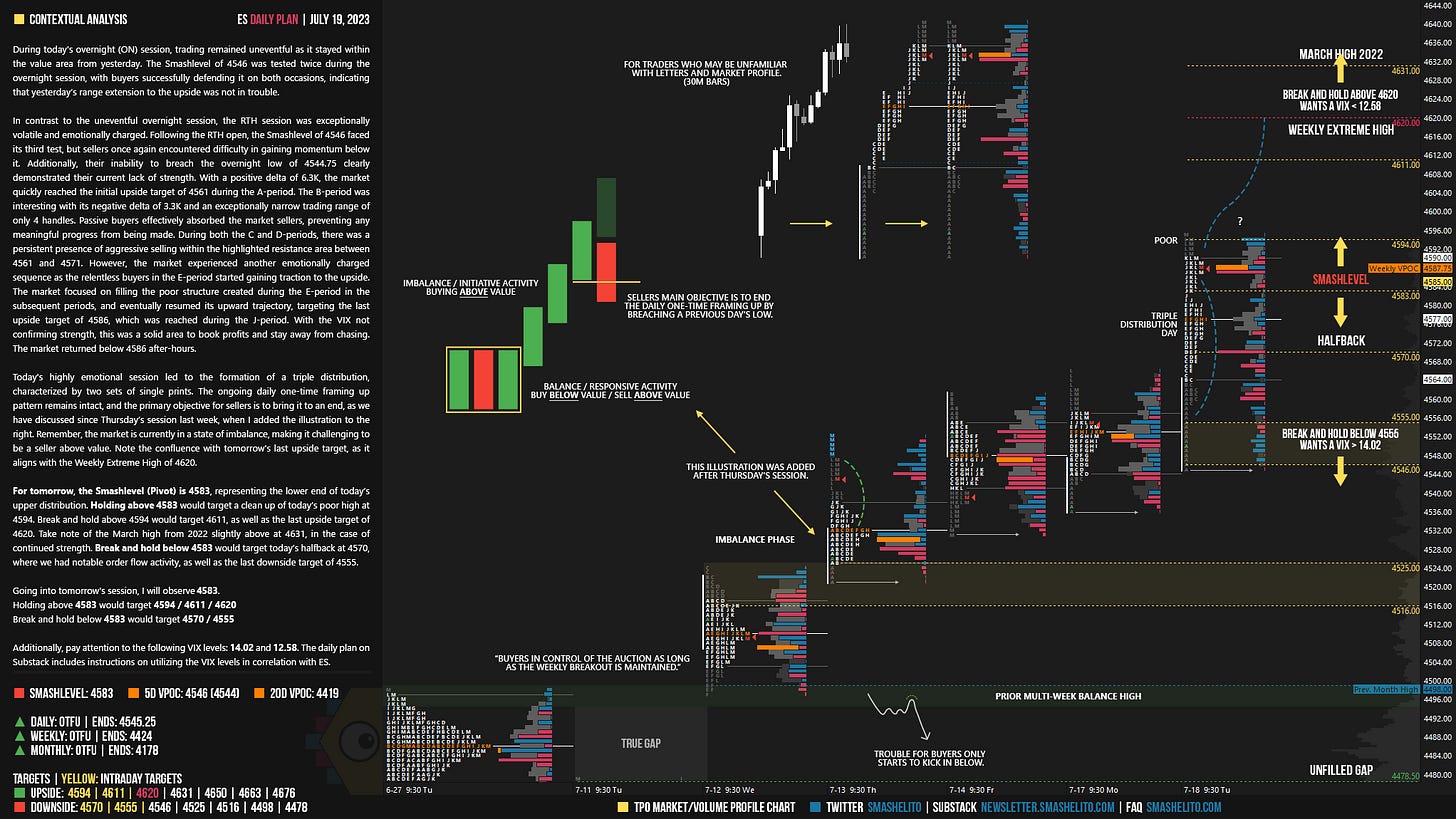

During today's overnight (ON) session, trading remained uneventful as it stayed within the value area from yesterday. The Smashlevel of 4546 was tested twice during the overnight session, with buyers successfully defending it on both occasions, indicating that yesterday’s range extension to the upside was not in trouble.

In contrast to the uneventful overnight session, the RTH session was exceptionally volatile and emotionally charged. Following the RTH open, the Smashlevel of 4546 faced its third test, but sellers once again encountered difficulty in gaining momentum below it. Additionally, their inability to breach the overnight low of 4544.75 clearly demonstrated their current lack of strength. With a positive delta of 6.3K, the market quickly reached the initial upside target of 4561 during the A-period. The B-period was interesting with its negative delta of 3.3K and an exceptionally narrow trading range of only 4 handles. Passive buyers effectively absorbed the market sellers, preventing any meaningful progress from being made. During both the C and D-periods, there was a persistent presence of aggressive selling within the highlighted resistance area between 4561 and 4571. However, the market experienced another emotionally charged sequence as the relentless buyers in the E-period started gaining traction to the upside. The market focused on filling the poor structure created during the E-period in the subsequent periods, and eventually resumed its upward trajectory, targeting the last upside target of 4586, which was reached during the J-period. With the VIX not confirming strength, this was a solid area to book profits and stay away from chasing. The market returned below 4586 after-hours.

Today's highly emotional session led to the formation of a triple distribution, characterized by two sets of single prints. The ongoing daily one-time framing up pattern remains intact, and the primary objective for sellers is to bring it to an end, as we have discussed since Thursday’s session last week, when I added the illustration to the right. Remember, the market is currently in a state of imbalance, making it challenging to be a seller above value. Note the confluence with tomorrow's last upside target, as it aligns with the Weekly Extreme High of 4620.

Note from ES Daily Plan | July 14, 2023:

“The market witnessed a breakout from the multi-week balance yesterday, and today, the imbalance phase continued with a higher high and higher low. Navigating the shift from balance to imbalance in trading is always challenging as it demands a readjustment of your strategy. After four weeks of participants agreeing on value, with responsive activity prevailing, the market has now transitioned to a phase of initiative activity (imbalance). Consequently, the approach of selling above value and buying below value, effective in a balanced market, will prove ineffective during an imbalanced state. It’s crucial to pay attention to the state of the market and adjust your strategy accordingly. Having a trading plan and preparing for the session serve as the core purpose in this context.”

For tomorrow, the Smashlevel (Pivot) is 4583, representing the lower end of today’s upper distribution. Holding above 4583 would target a clean up of today’s poor high at 4594. Break and hold above 4594 would target 4611, as well as the last upside target of 4620. Take note of the March high from 2022 slightly above at 4631, in the case of continued strength. Break and hold below 4583 would target today’s halfback at 4570, where we had notable order flow activity, as well as the last downside target of 4555.

Going into tomorrow's session, I will observe 4583.

Holding above 4583 would target 4594 / 4611 / 4620

Break and hold below 4583 would target 4570 / 4555

Additionally, pay attention to the following VIX levels: 14.02 and 12.58. These levels can provide confirmation of strength or weakness.

Break and hold above 4620 with VIX below 12.58 would confirm strength.

Break and hold below 4555 with VIX above 14.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks the daily guidance Smash!

On NQ it was even worse... they had 50 points of single prints on Microsoft announcement.