ES Daily Plan | July 13, 2023

Multi-week balance breakout following the release of the CPI data. Moving forward, the buyers' ability to sustain this breakout will hold significant importance in the short-term.

Contextual Analysis

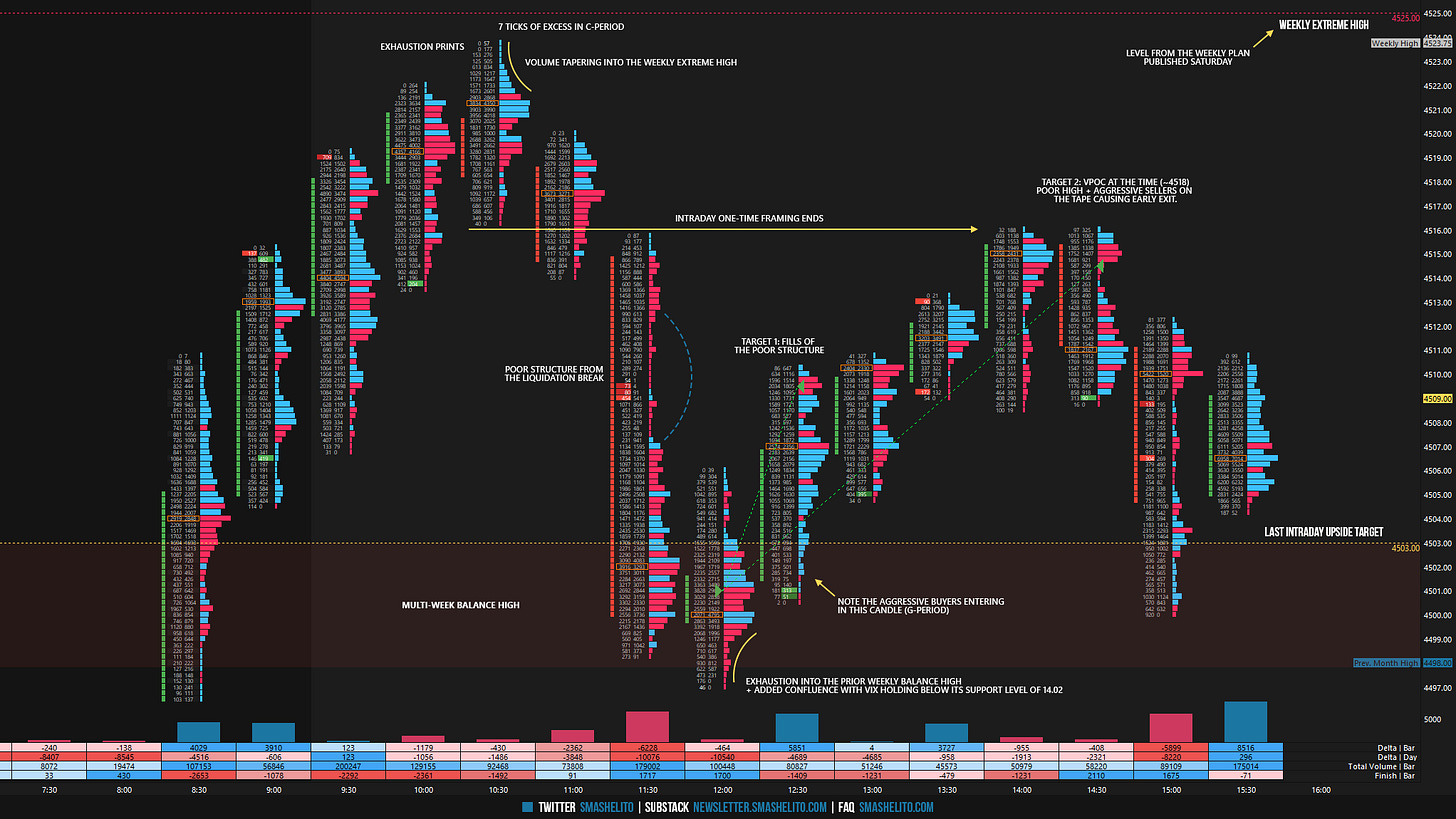

In the Asian hours of the overnight (ON) session, trading remained within the spike area from the previous day. However, during the European session, the market was able to explore prices above the spike area prior to the release of the CPI data, reaching the first upside target of interest at 4485. Following the release of the CPI data, the market demonstrated its typical volatility, resulting in reaching and exceeding the last upside target of 4503. We discussed the increased potential for moves outside of the intraday targets in the previous plan. The VIX actually held its support level of 14.02 during the data release, but eventually gave it up in the RTH session.

The RTH session opened with a true gap to the upside, and a quick look above the ON high and fail prompted an inventory correction. However, this pullback was short-lived (10 handles) as buyers were quick to pick it up. The market was one-time framing up intraday for the first three periods, with the C-period being particularly interesting. The next upside target of interest was the Weekly Extreme High of 4525, and the C-period period reached 4523.75, falling only 4 ticks short of that level from the Weekly Plan. On a weekly time-frame, it is always wise to consider booking profits around the Weekly Extreme levels, regardless of whether the market continues its upward trajectory or not. The interesting part of the C-period was the notable volume tapering, accompanied by exhaustion prints. Obviously, if fading, you know that you are initiating trades against the trend, implying the need to adjust your target expectations accordingly. The D-period ended the intraday one-time framing up, resulting in a liquidation break with pace in E-period. As a result, the multi-week balance high was retested, and this was my only trade for the session (long). I will provide a visual of this trade on Substack, accompanied by a commentary detailing the thought process behind it. The market essentially spent the PM session filling the poor structure from the liquidation break before the buyers got too long, resulting in the formation of a poor high and triggering another round of liquidation.

The buyers are in control of the auction as long as the weekly breakout is maintained, following today’s close above the multi-week balance area. The market is one-time framing up across all time frames. With both extremes of today's profile being exhaustive, it becomes crucial to closely monitor which one gets taken out first. To assess the strength or weakness, I will use today’s afternoon rally high of 4516 as a reference point. Given the multi-week balance breakout, the buyers should have no difficulty breaching it. Inability to break it, or a quick sweep and reversal leaving the excess high intact, is a lot of information. The short and medium-term value are located at 4438 and 4419, respectively. These will act as downside magnets IF the breakout fails.

For tomorrow, the Smashlevel (Pivot) is 4516, representing today’s afternoon rally high, which was also the level that ended today’s intraday one-time framing up. Break and hold above 4516 would target the Weekly Extreme High of 4525, essentially today’s excess high. Break and hold above 4525, indicating a continuation of this imbalance, would target the last upside target of 4540. Holding below 4516 would target the multi-week balance high at 4498. Break and hold below 4498, indicating a failed breakout, would target today’s unfilled gap at 4478.50.

Going into tomorrow's session, I will observe 4516.

Break and hold above 4516 would target 4525 / 4540

Holding below 4516 would target 4498 / 4485 / 4478

Additionally, pay attention to the following VIX levels: 14.30 and 12.82. These levels can provide confirmation of strength or weakness.

Break and hold above 4540 with VIX below 12.82 would confirm strength.

Break and hold below 4478 with VIX above 14.30 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

The quality of this newsletter is incomparable! Thank you!

Thank you for amazing jpb done as always!